You can start using the Where’s My Refund? website or IRS2Go app to start checking on the status of your return 24 Hours after the IRS receives your e-filed return or 6 Months after you mail a paper return.

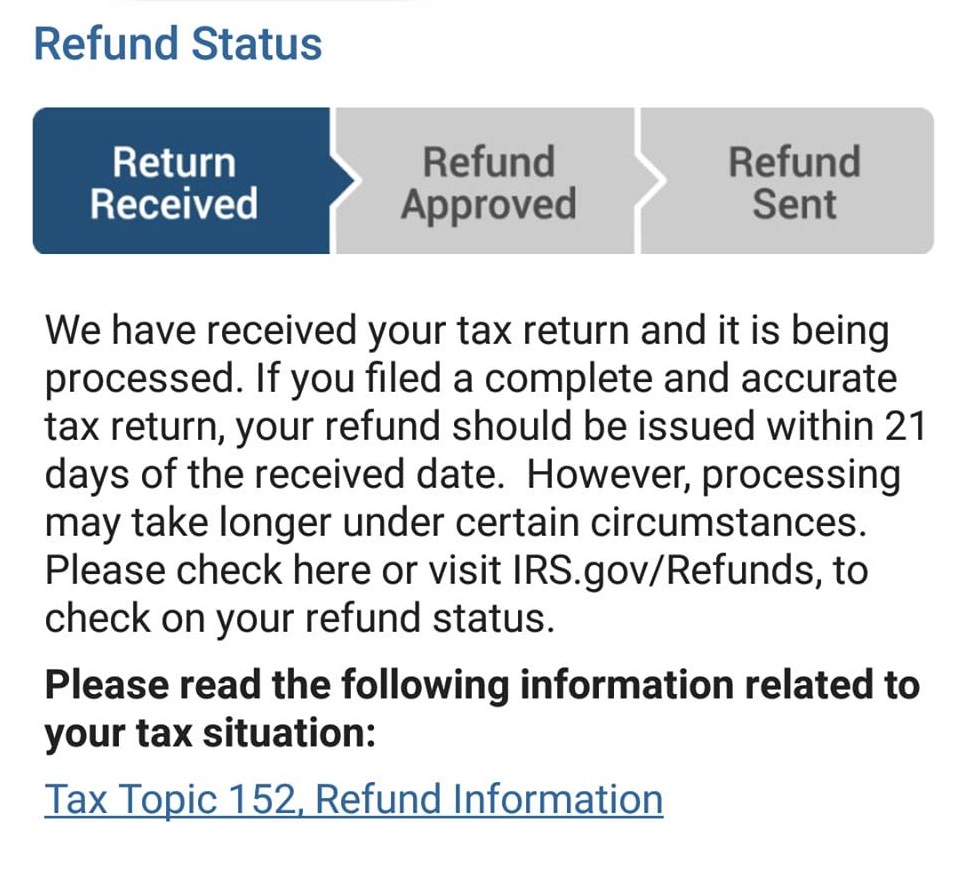

As the IRS processes your return it will progress through the 3 stages: (1) Return Received, (2) Refund Approved, and (3) Refund Sent.

Here are more details on each status and what each one means:

Refund Status Results: Return Received

Tax Return Received is the same as “Return Accepted by the IRS.”This means that your tax return has passed the IRS’s initial review. This includes rudimentary fraud checks, social security number verification, and ensuring that your tax returns do not contain obvious red flags. Your tax return will remain in this status while the IRS processes your tax return in more detail to ensure that your return is compliant and your refund amount is correct.

If the WMR tool shows the status of the return as received, there is no need to follow up with the IRS. If this status is displayed, your return is being processed by the IRS and further calls will not expedite the processing of the tax return.

Your refund can remain in the status for a while if it is complex or the IRS feels further information is needed. However, the IRS says it processes most returns within 21 days if your return is not flagged for further review.

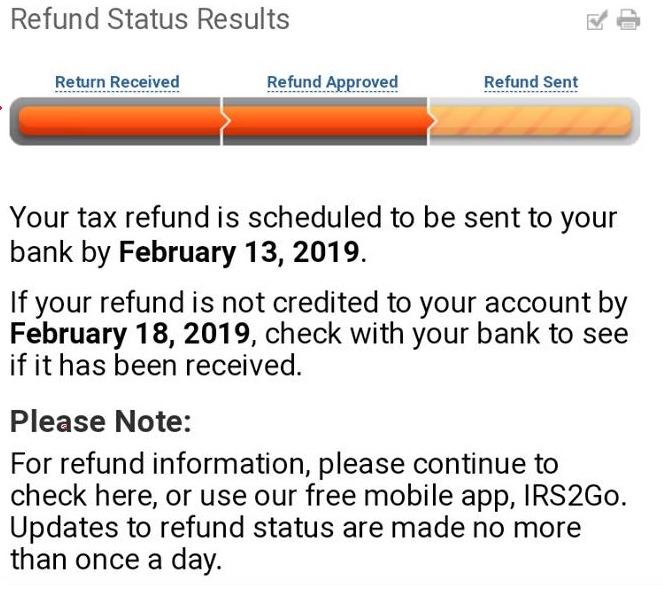

Refund Status Results: Refund Approved

Refund Approved status will appear if your tax return checks out and your return has been approved for payout by direct deposit or check. A personalized refund date will be provided and the WMR status will now be Refund Approved. If you elected the direct deposit (DD) option for your refund, you will get a date by which it should be credited to your account.

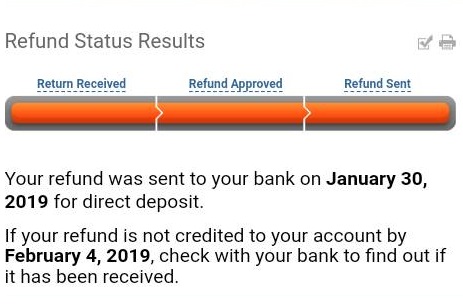

Refund Status Results: Refund Sent

Refund Sent as the name implies means the IRS has sent your refund to your nominated bank account(s). It will give you a specific date the refund was sent. Direct Deposit payments are generally processed within 5 days. I.e. the money will be in your bank available for withdrawal within 5 days of the refund sent date. Contact your bank or financial institution only if you have not received your return after 5 days of the IRS refund sent date. If you requested a paper check this means your check has been mailed and could take 7+ days for you to receive this via mail. It could take weeks if your mailing address is outside the US.

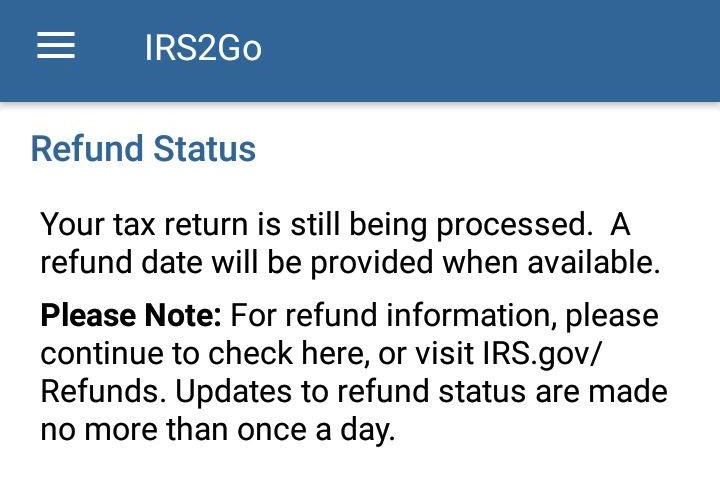

Where’s My Refund? the status bar has disappeared

Refund Status Results: Your tax return is Still Being Processed

While the IRS promises to process most returns in less than 21 days, it can take longer if complex issues arise. Your tax refund status may change to “still being processed” if the system detects a problem. This delay is what frustrates most taxpayers, as the IRS sometimes provides limited information if it finds errors in your return. While some information is provided on WMR and IRS2Go, the IRS will generally mail you further detailed information. It can take weeks or even months to process your return depending on the amount of additional information required.

Additional information is needed to complete processing your tax return after it was received, the WMR tracking bar will disappear and your refund status may show as “still being processed” until the issue is resolved.

Refund Status: Still Being Processed Additional information is required to fully process your tax return. Depending on the circumstances, the IRS will send you an explanation or guidance by mail. This can happen even if you previously checked WMR and it showed the status as “Return Received.” The IRS still has your return but things are essentially on hold until the IRS gets the additional information from you to continue processing your tax return. You will either get directions on WMR or IRS2Go or the IRS will contact you by mail. Please return any additional information as soon as possible following the instructions provided to obtain a possible refund and minimize any further delay. If you are unsure of the IRS requirements, please consult your accountant, tax advocate, or tax professional.