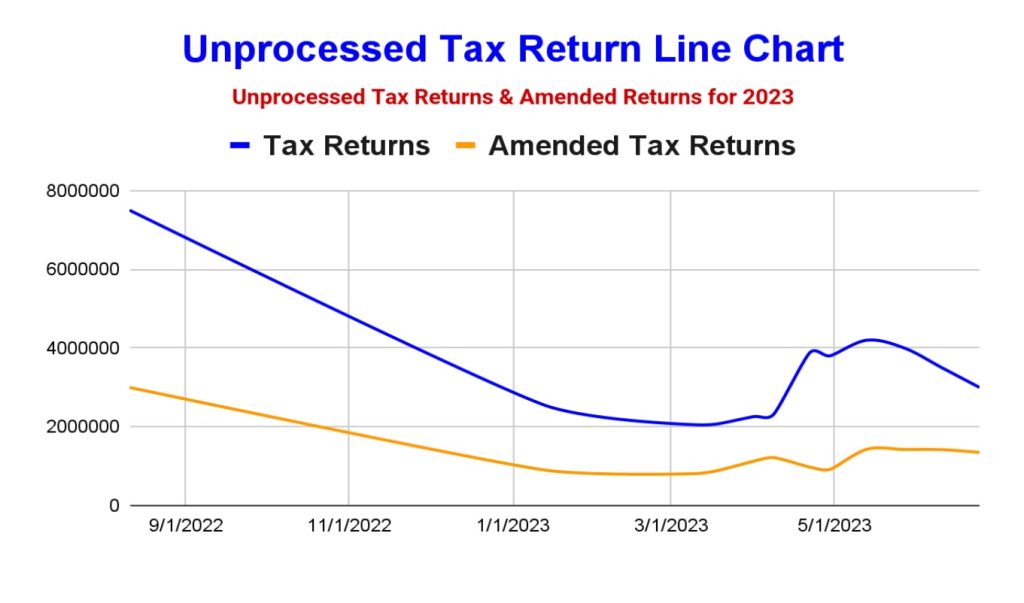

The Internal Revenue Service (IRS) has been working diligently to address the backlog of unprocessed tax returns and amended returns. In this blog post, we will highlight the significant progress made from August 2022 to July 2023, as the IRS has reduced the backlog from 7.5 million returns to 3 million returns. Let’s delve into the efforts made by the IRS to improve processing times and ensure a smoother experience for taxpayers.

- The Challenge of Unprocessed Tax Returns: In 2022, the IRS faced a substantial backlog of unprocessed tax returns, resulting from various factors including the impact of the COVID-19 pandemic and staffing challenges. This backlog created delays in processing times, causing frustration and uncertainty for many taxpayers.

- Dedication and Efforts of the IRS: Recognizing the urgency of the situation, the IRS took proactive measures to tackle the backlog. They implemented strategies such as increasing staffing levels, streamlining processes, and leveraging technology to expedite the processing of tax returns and amended returns.

- Significant Progress Made: The concerted efforts of the IRS have yielded remarkable results. In just under a year, the backlog of unprocessed tax returns has been reduced from 7.5 million returns in August 2022 to 3 million returns in July 2023. This signifies a significant milestone in the IRS’s mission to provide timely and accurate services to taxpayers.

- Improved Processing Times: As the backlog continues to shrink, the IRS is making substantial progress in improving processing times. This means that taxpayers can expect a more efficient and timely turnaround for their tax returns and amended returns. The IRS’s commitment to reducing the backlog demonstrates their dedication to enhancing the overall taxpayer experience.

- Staying Informed: To stay updated on the status of their tax returns, taxpayers are encouraged to utilize the “Where’s My Refund?” tool on the IRS website. This tool provides real-time updates and allows individuals to track the progress of their refunds.

The IRS’s significant reduction in the backlog of unprocessed tax returns and amended returns from 7.5 million in August 2022 to 3 million in July 2023 is a testament to their unwavering commitment to serving taxpayers effectively. The progress made by the IRS in improving processing times brings hope and relief to individuals awaiting their refunds or the resolution of amended returns. As we continue through 2023, the IRS’s dedication to further streamlining processes and enhancing taxpayer services reinforces their commitment to ensuring a smoother tax-filing experience for all.