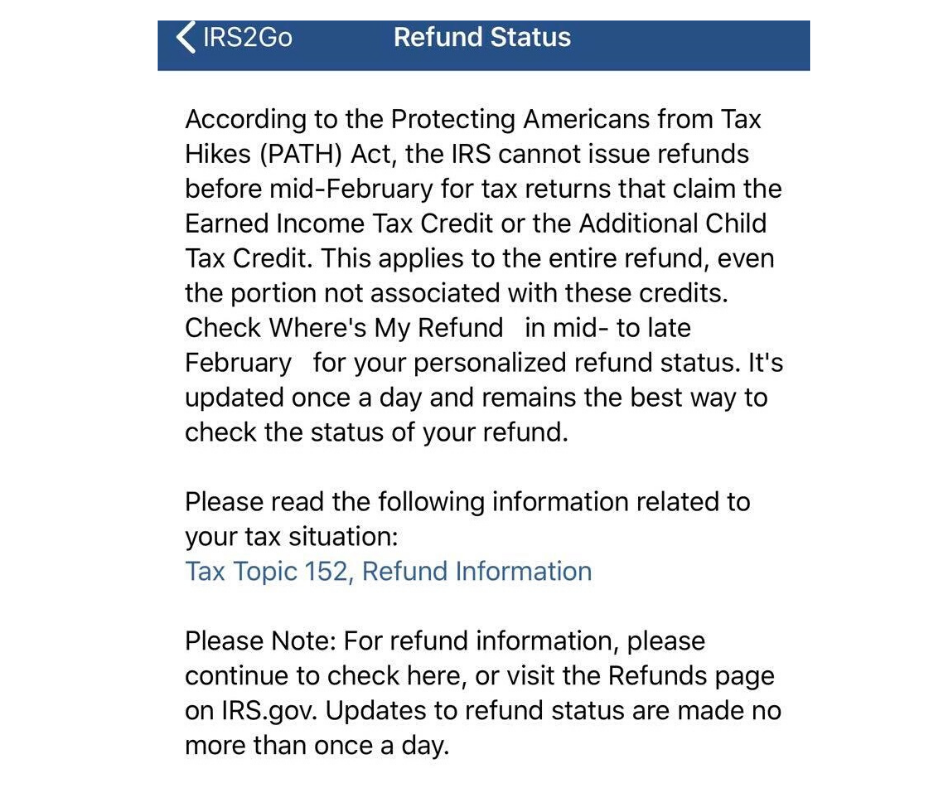

Taxpayers who claimed the Earned Income Tax Credit(EITC) or the Additional Child Tax Credit(ACTC) will update to the PATH Message

Once your tax return status goes from “We have received your tax return and it is being processed” to the PATH ACT message all this means is the system has recognized you have either EITC or ACTC credits that fall under the PATH ACT LAW which places a refund hold(C-Freeze) on your account until February 15th

What days should I check Wheres My Refund? if I have not received the PATH Message yet?

Taxpayers claiming the Earned Income Tax Credit(EITC) or the Additional Child Tax Credit(ACTC) could update to the PATH Message either on Wednesday or Saturday mornings.

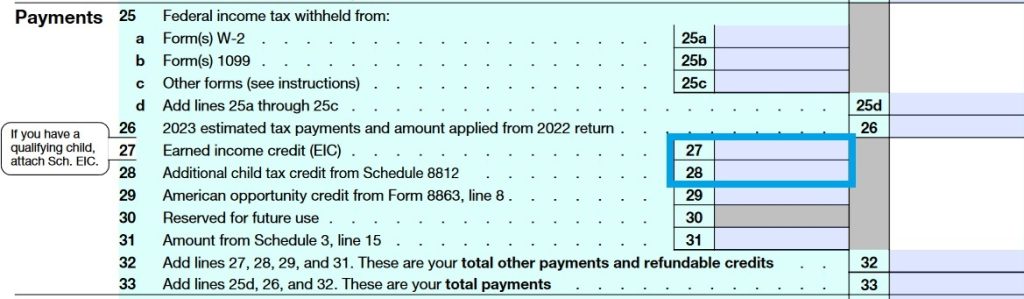

If you file your tax return before February 15 and claim the Earned Income Tax Credit (EIC) and/or Additional Child Tax Credit (ACTC) with amounts on line 27 or 28 of your 1040 form, your entire refund will be held until at least February 15 each year. This delay enables the IRS more time to cross-reference information from individual tax returns with data from W-2 and 1099 forms provided by employers, which are submitted to the IRS by January 31. This precautionary measure helps combat identity theft and fraud.

What if I never received the PATH message but I claimed the credits?

The IRS processes tax returns in batches so some tax returns may stay at one bar and may not get an update to the PATH Message before February 15th. If you never receive the PATH message and you are claiming EITC/ACTC credits. Those refunds will be issued after your return completes processing, provided you owe no other liability.

Does the PATH Message mean my tax refund is done processing and approved?

No, The PATH message does not mean your tax return is done and your tax refund is approved. It simply means the computer system has identified you are claiming the Earned Income Tax Credit(EITC) or the Additional Child Tax Credit(ACTC) on your tax return.

The Where’s My Refund? tool uses the PATH refund status as a placeholder for all tax returns that have claimed Earned Income Tax Credit(EITC) or the Additional Child Tax Credit(ACTC) until February 15. Once the PATH LAW lifts on February 22, 2025 your personalized refund status will return to the Where’s My Refund? tool and will update accordingly.

Anybody that files an early tax return, claiming either the Earned Income Tax Credit or the Additional Child Tax Credit, those tax returns will be processed as soon as you file them, but any refund that would be due for those returns claiming those two credits will be delayed, the IRS will not release those refunds until after February 15th.

Does PATH mean my tax refund is approved?

The IRS is legally prohibited from approving or distributing any tax refunds claiming EITC/ACTC credits before February 15th each year. Therefore, receiving the PATH Refund Status Result does not signify approval for a tax refund. Rather, it indicates that you are progressing toward receiving your tax refund.

Once the PATH Message is lifted and processing resumes, when can I expect to see an update or receive a direct deposit date?

If you are claiming EITC or ACTC Credits and will be affected by the PATH LAW. All returns claiming the two mentioned credits above will be held under a C-Freeze. When your return is held under a C-Freeze this forces the tax return to update only on a weekly cycle. Everyone with the PATH message whether they follow Daily or Weekly cycles and have a cycle code ending in 01, 02, 03, 04, or 05 will see WMR updates only on Saturdays. When a Refund Freeze is placed on the account the computer forces the account to post updates on Where’s My Refund(WMR) only on Saturday mornings.

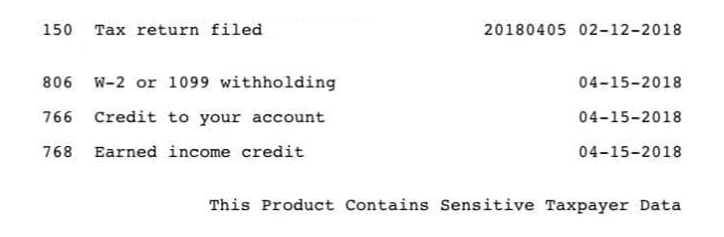

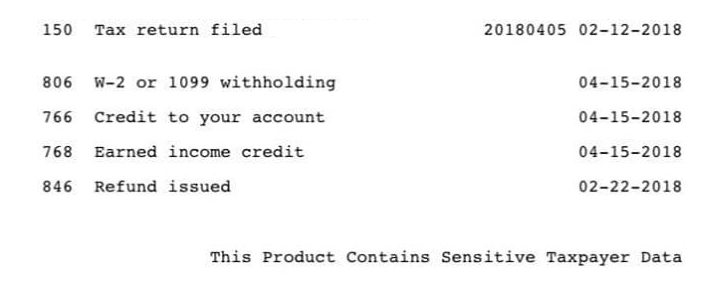

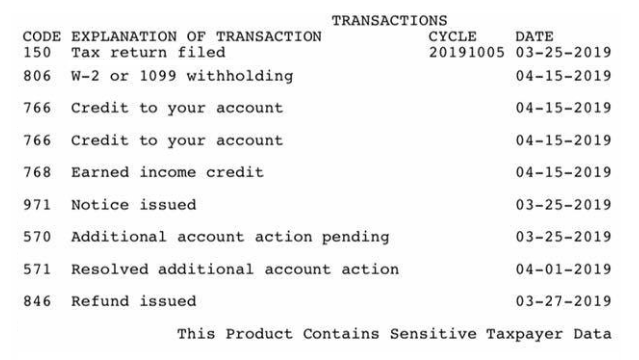

This is an example of an Account Transcript waiting for an 846 code to post after February 15, with the PATH ACT message

This account transcript verifies that you have been accepted and are processing and you will not have a confirmation of your status until after February 15th. If more information is needed the IRS will send you a letter or you can view your transcript online to see further codes after February 15th.

If your transcripts look like this you should not have anything to worry about!

Remember: Until your Explanation of Transaction list shows an 846 Refund Issued code you are not approved or guaranteed your refund on any certain date.

Keep in mind that certain taxpayers who receive the PATH message may also have additional codes appearing on their account transcript, potentially resulting in further delays in receiving your refund.

Does the PATH Refund Status Result signify approval of my tax refund?

While most taxpayers will likely proceed to a refund date smoothly, there remains a possibility that certain taxpayers’ account transcripts may receive additional codes. It’s advisable to monitor your account transcripts regularly until you observe the 846 refund-issued code.

As far as transcripts are concerned:

Accessing and receiving Account transcripts with information signifies the initiation of processing for your tax returns. However, until your Account Transcript displays “846 Refund Issued” on the bottom left corner, your refund has not been officially approved. Your Account Transcript provides a detailed summary of the information submitted in your tax return. Meanwhile, the Account Transcript contains records of actions taken on your account, subject to periodic updates throughout the year.

Don’t forget to mark your calendars for the weekend—February 22nd will be a significant day for PATH HELD Refund dates!

Changes will begin to appear by this Friday(transcripts) or Saturday(Where’s My Refund?), so there’s no need to panic if you don’t see immediate updates! According to the IRS, the Where’s My Refund (WMR) tool will commence updates for PATH Held Early Filed Refunds starting February 22, 2025. It’s important to note that some tax refunds may not reflect in taxpayers’ accounts until February 26, 2025.