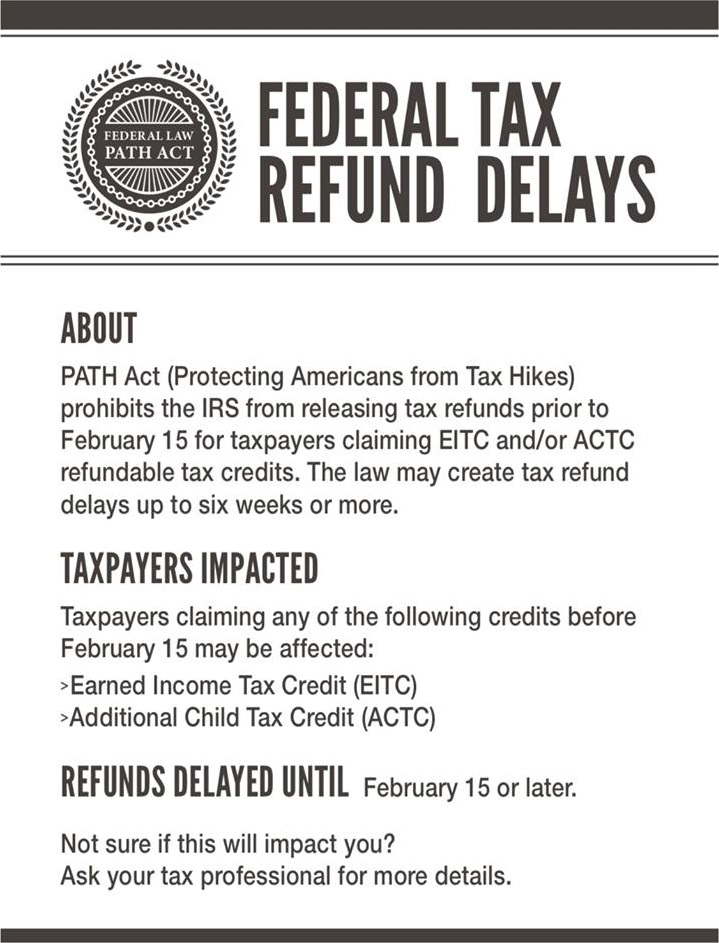

The Protecting Americans from Tax Hikes (PATH) Act was created in order to protect taxpayers and their families against fraud and permanently extend many expiring tax laws. The law, which was enacted December 18, 2015, first impacted tax returns filed in 2017 and will continue to impact returns until the law is overturned or changed.

The PATH Act mandates that the IRS can not issue any refund on tax returns claiming credits such as EIC (Earned Income Tax Credit) and/or ACTC (Additional Child Tax Credit) until After February 15th each year.

All current year tax returns that claim EIC and/or ACTC filed before February 15, 2019, will contain a C- Freeze on the account, to hold the refund.

Prior to February 15th, the refund cannot be released for any reason:

- Not even by inputting any type of adjustment to the account

- Not even due to hardship (hardships will not be considered as long as the C- freeze is on the account). This includes the part of the refund that is not associated with the EITC or ACTC.

What if I never got the PATH Message?

Those refunds will be issued after your return completes processing, provided you owe no other liability.

What if I file after February 15th?

If you file taxes after February 15, the new tax law does not affect the timing of your tax refund. Those refunds will be issued after your return completes processing, provided you owe no other liability.

What happen after the PATH Message?

Based off of previous year’s tax Filing Season the PATH message lifted at 11:59:59 pm Feb. 15th and at 12:00 am

Some taxpayers that did not get a deposit date in the first batch seen this message until the following weeks updates.

Why did I change back to processing message?

Everybodys Where’s My Refund? statuses changed back to bars or a Processing message because the PATH hold came to an end at 11:59:59 on February 15th.

During the 2018 tax season, some taxpayer that had access to view transcripts could see their 846 Refund Issued dates on their account transcripts as early as Friday, February 16, 2018. The first Direct Deposit Dates started pouring in at 3:30 am early Saturday, February 17, 2018, with an update for the majority of early filers with daily and weekly accounts with 2/22 Direct Deposit Dates. The majority of early filer accounts that were approved and held under the PATH Hold updated Saturday, February 17, 2018, with Direct Deposit Dates of 2/22. Affective starting in 2018 all major tax refund updates for both daily and weekly accounts seen most updates on Saturday mornings because of the c-freeze hold on their accounts. The hold forces both daily & weekly accounts claiming EIC and/ or ACTC credits to get their final Direct Deposit Date updates on Saturdays. Starting the following week Saturday, February 24, 2018, the IRS returned to normal processing of daily and weekly accounts, but if you claimed either EIC and/or ACTC those refunds only saw the final updates with direct deposit dates updated on Saturday Mornings.

In 2018 the IRS said that the majority of the early filers would see an update by Feb. 24, 2018. It took three batches of updates Friday, Feb. 16, Saturday, Feb. 17, and Saturday, Feb. 24 to push out the large number of early filers returns that were approved and held by the PATH ACT Hold.

The PATH message this year reads that the majority of early filers held under the PATH hold should see an update By Feb. 23, 2019. So if the IRS follow the same schedule they did in 2018. There is a good chance this Saturday morning is going to be big days for updates.

Transcripts should start updating throughout the day Friday and some should start to see 846 Refund issued codes showing up on their transcripts.