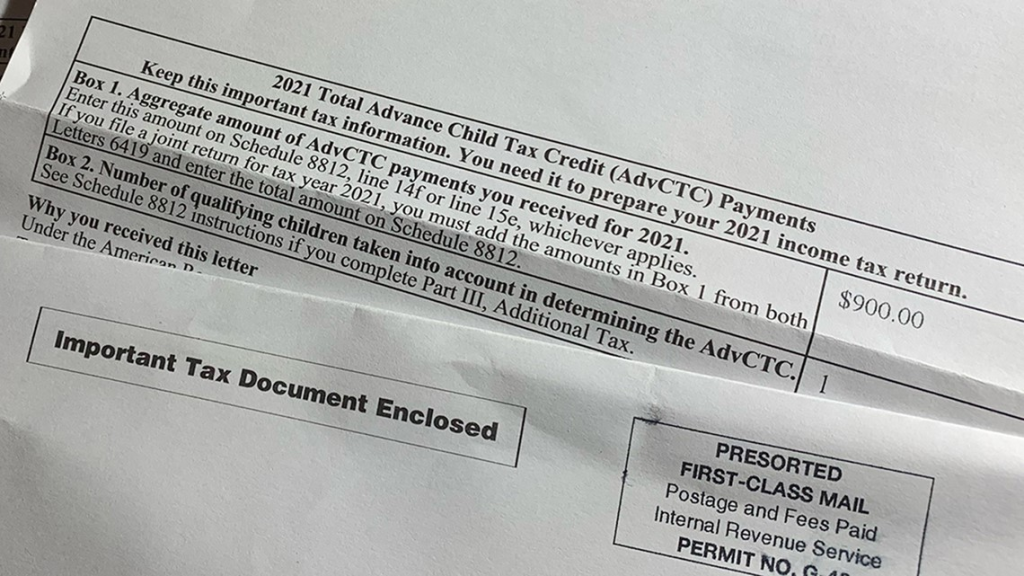

Child tax credit recipients need to be on the lookout for this letter from the IRS, which has started arriving in mailboxes.

In January 2022, the IRS will send out these letters to households. Letter 6419 will serve as a reminder to log into your IRS tax account and make sure the advance Child Tax Credit payments the IRS says you received match up with what was deposited into your account.

Advanced Child Tax Credit Payments

The American Rescue Plan, passed in March 2021, increased the annual child tax credit to $3,600 for children under age 6 and $3,000 for kids aged 6-17. From July through December 2021, eligible Americans were allowed to receive up to $300 per month for kids under 6 and $250 per month for kids 6-17. They were also eligible to opt-out of some or all the payments.

What is the purpose of IRS Letter 6419?

IRS Letter 6419 has information for taxpayers on how much money a taxpayer received from the 2021 monthly advance child tax credit payments. These payments were an advance on the full amount, which is the purpose of the letter.

Letter 6419, which is in English on the front and Spanish on the back, provides the following information, which will go on Schedule 8812.

- How much in advance monthly child tax credit payments the person received, located in Box 1 of the letter.

- The number of qualifying children used to determine that amount, which is located in Box 2.

For parents who are married and file jointly, each parent will receive a letter. The amount in Box 1 of each letter needs to be added together to put on Schedule 8812.

Whatever amount the parents did not receive via monthly payments will be paid out once the tax return is filed. So a couple with one child under the age of 6 who received $900 each, or $1,800 total, will be due to another $1,800 total after taxes are filed.

People who received the monthly payments can also check how much they got through the CTC Update Portal on the IRS website.

What address does the IRS send the letter to?

The IRS will send Letter 6419 to the last address they have on file for you. Usually, this comes from the last tax return that you filed.

If you moved recently, you’ll want to make sure you get mail from the IRS, including this letter. You can do this by updating your address with the IRS. This can be done by mail, phone, or online. You can call the IRS to change your address at 1-800-829-1040.

What if I Don’t Receive Letter 6419? Can I Still File my Tax Return?

You can still file your tax return without Letter 6419. The most important thing is that you make sure you enter the correct total amount for the advance Child Tax Credit payments into your tax return.

If the amount you enter differs from what the IRS has on record, it will delay the processing of your tax return.

- Based on the 2021 tax season we know that many taxpayers saw delays in the processing of their 2020 tax returns when the amount they entered in their 2020 tax return for the stimulus checks (or economic impact payments) did not match IRS records.

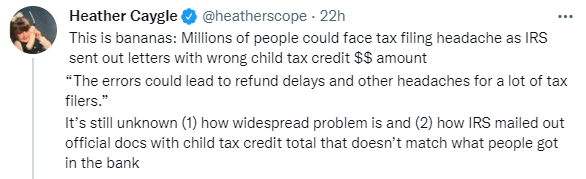

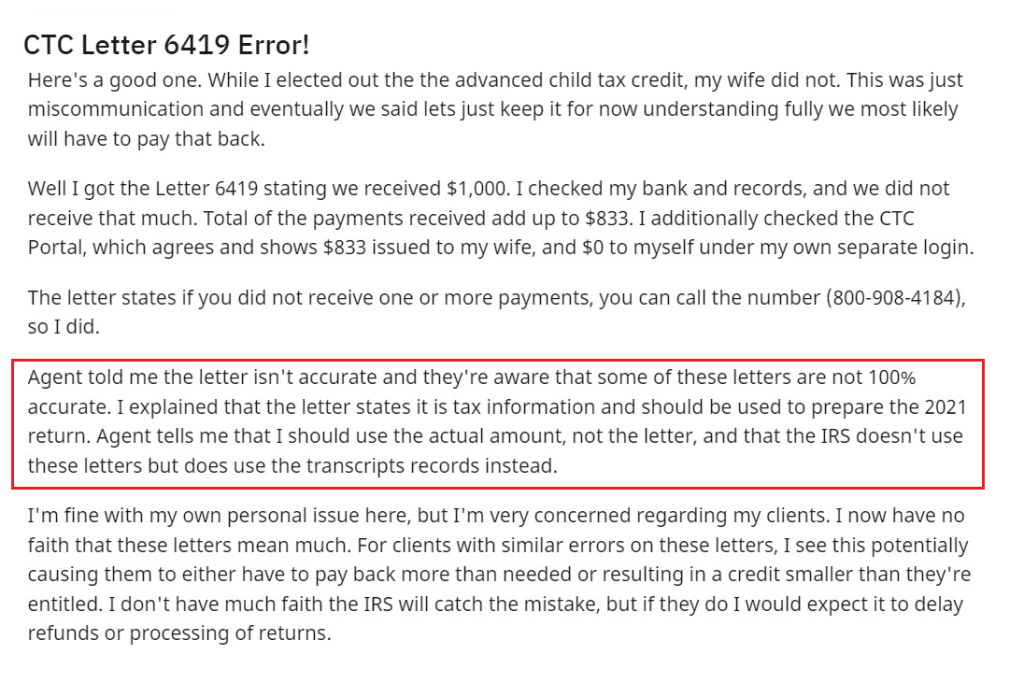

Please compare the amount from Letter 6419 to the amount on your IRS online account before you file your tax return, the amount on some Letter 6419 could be wrong?

There may be discrepancies in the 6419 letters indicating that some parents are receiving incorrect Child Tax Credit information.

Double Check your amount before you rely upon, the IRS Advanced Child Tax Credit Letter 6419. To verify, check your IRS Account Transcript. This will help you ensure your 2021 tax return is complete and accurate.

If the amount you enter differs from what the IRS has on record, it will delay the processing of your tax return.

Here are some ways to get the correct total of Advanced Child Tax Credit Payments:

- Check your history of payments in your IRS Child Tax Credit Update portal. Please remember if you file jointly that both spouses will need to check each of their portals.

- Open or create your Tax Account at irs.gov. You will be able to find a record of the history of payments there.

- View your Account Transcript

- Check your bank records. If you had direct deposit it should show as IRS TREAS 310 CHILDCTC.

What if I Don’t Agree with IRS Letter 6419 or IRS Records of Payments?

You can still file your tax return with what you believe is the correct amount, but make sure that you have documentation (ex: bank statements, etc.).

You may need that documentation later. As was mentioned above, if the number you enter for total payments differs from what the IRS has on file, your tax return – and tax refund – may be delayed.

If the IRS makes an adjustment to your tax return, you can expect to receive a letter from the IRS explaining the adjustment. If at that point you still believe the IRS is wrong, the letter should explain what further actions you can take.

If you aren’t comfortable navigating this situation on your own, you can consider engaging a tax professional or inquiring with the Taxpayer Advocate Service about whether or not they can help.

You may need to compare the payment dates and amounts the IRS says you received to what you actually received. The IRS does offer payment traces upon request, and you may request your bank do some tracing. Although, if money was sent to another account they cannot give you the information about that other account. If you suspect you may be a victim of identity theft, you may need to take some actions. The IRS provides identity theft guidance here and the FTC provides guidance here.

If you and the IRS don’t agree on the amount of Advance Child Tax Credit Payments received, it may take months to resolve.