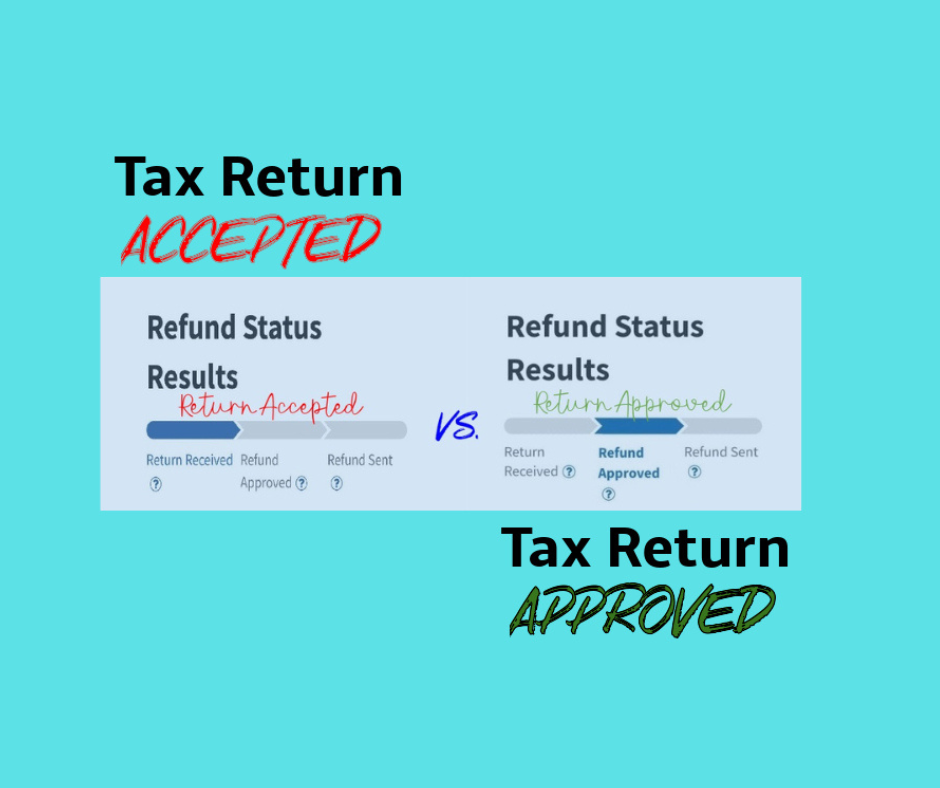

When tracking your tax refund using the IRS Where’s My Refund? tool, you’ll likely encounter two important terms: Accepted and Approved. While they may sound similar, these terms refer to different stages in the refund process. Let’s break down what each means and how they impact the timeline for receiving your refund.

What Does “Accepted” Mean?

Once you file your tax return, the IRS reviews it to ensure it was received successfully and meets the basic filing requirements.

- What Happens at This Stage?

- The IRS verifies basic information, such as your Social Security number, filing status, and dependent details.

- It confirms your return passes initial checks, such as formatting and digital signatures (for e-filed returns).

- What It Doesn’t Mean

- Accepted does not mean the IRS has approved your refund. The IRS hasn’t yet reviewed the accuracy of your reported income, credits, deductions, or refund amount.

- What’s Next?

- After your return is accepted, it moves to the processing stage, where the IRS begins reviewing your return in detail.

What Does “Approved” Mean?

“Approved” is the next milestone after the IRS completes its review of your tax return.

- What Happens at This Stage?

- The IRS has verified your return for accuracy, confirmed your refund amount, and scheduled the refund for disbursement.

- At this point, you’ll typically receive an estimated refund issue date.

- What’s Next?

- Once your refund is approved, it will move to the Refund Sent stage, where the IRS issues the payment via direct deposit or mail.

Key Differences Between “Accepted” and “Approved”

| Stage | Accepted | Approved |

|---|---|---|

| Timing | Happens shortly after filing. | Happens after detailed IRS review. |

| What It Means | The IRS acknowledges receipt of your return. | The IRS has completed its review and approved your refund. |

| Refund Status | Refund is not yet finalized or scheduled. | Refund is finalized and a payment date is provided. |

How Long Does It Take to Move from Accepted to Approved?

- E-Filed Returns

- Most refunds are approved within 21 days of acceptance.

- Paper Returns

- Approval can take up to 6-8 weeks due to mailing and manual processing times.

However, delays can occur for various reasons, such as:

- Errors or missing information on your return.

- Additional reviews for certain credits (e.g., Earned Income Tax Credit or Child Tax Credit).

- Identity verification requirements.

What Should You Do While Waiting?

- Check Your Status Daily

- Use the Where’s My Refund? tool or IRS2Go app. Updates are made once every 24 hours, usually overnight.

- Request an Account Transcript

- If you’re experiencing delays, requesting an IRS account transcript can provide detailed insight into where your return is in the process.

- Stay Patient

- While most refunds are issued promptly, factors like high filing volume or manual reviews can extend timelines.

Understanding the difference between Accepted and Approved is crucial for managing your expectations during tax season. “Accepted” is the first step in the process, ensuring your return is in the system, while “Approved” means your refund is finalized and on its way. By staying informed and monitoring your refund status regularly, you can better anticipate when to expect your refund.