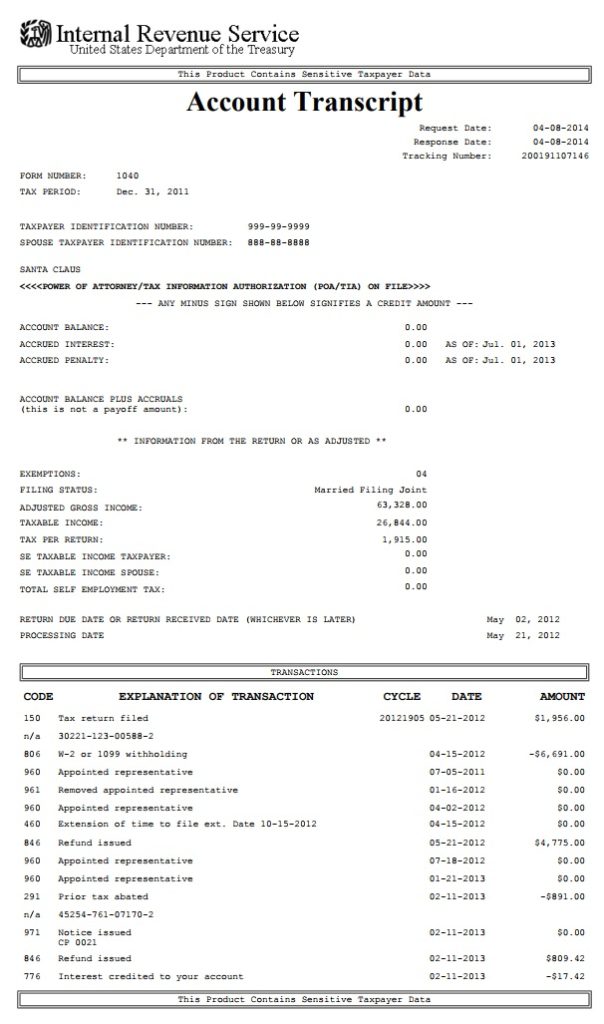

Here’s a breakdown of what everything on your Account Transcripts means.

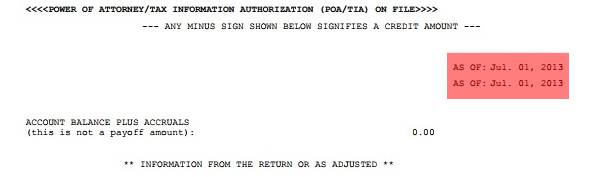

Request and Response Dates

The Request date shows the date you requested your transcripts and the response date shows when they actually responded to send your transcripts via mail, fax, or view online (fax and online will always have the same date as the requested date). In this case, it’s for (April 8th, 2014).

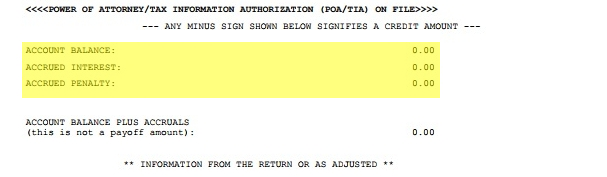

Balance, Interest, and Penalties

The Account Balance: is to show what is due to you (-$x.xx: minus before amount they owe you) or what you’re due to pay ($xxx: no minus you owe the IRS)

The Accrued Interest: is to show any interest that’s built up from a past due return, delinquent payment,

or what is owed to you from the IRS taking longer than 45 days to complete your return (Interest starts to build AFTER April 15th.

The Accrued Penalties show what you owe due to an overdue filing of the return/or delinquent payment.

As of Date on Tax Transcripts

The “As of Date” on a Tax Account Transcript is the date your penalties and interest are estimated to be calculated to determine if you have a balance due or a tax refund. It’s computed to a future date in case someone may owe and want to mail their check-in rather than pay online. The “As of Date” is a computer-generated date set to remind the IRS systems to check your account again by this date. If everything is completed the system will generate an 846 code, if the system sees something that does not look fully completed the system may add further codes to your transcript or resequence the return to a future cycle to give them further time to complete the processing of the tax return. The “as of date” will change each time the tax return gets resequenced.

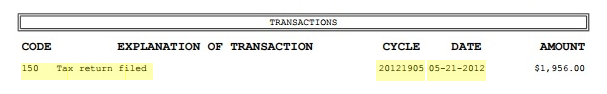

Cycle Code and Processing Date on Transcripts

The Processing Date column beside the cycle code (in the example above is 05-21-12)

Shows the week that your 21 days are estimated to be up from your actual cycle code’s date (shown below how to break it down)

It will always be for a future Monday date and be generated for 3 weeks out (7 days x 3 weeks = 21 days) from the cycle codes date.

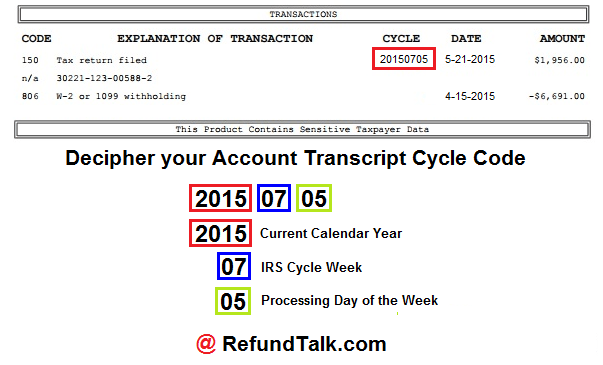

IRS Transaction Code 150 – Tax return filed with cycle code beside it shows when the return is posted to the Master File to start processing (not necessarily the day you filed) to get the date your return actually filed you will need to break down the cycle code.

Current Calendar Year

The first four numbers of the cycle code represent the calendar year the tax return is being processed.

IRS Cycle Week

The fifth and sixth numbers represent the IRS Cycle week of the year

The IRS Processing Day of the Week

The seventh and eighth numbers represent the IRS processing day of the week.

- Cycle Code Ending in 01=Friday(Daily)

- Cycle Code Ending in 02=Monday(Daily)

- Cycle Code Ending in 03=Tuesday(Daily)

- Cycle Code Ending in 04=Wednesday(Daily)

- Cycle Code Ending in 05=Thursday(Weekly)

Tax Transcript Processing Date Column

The Processing Date is the same as the date beside the cycle code. They both also show when the IRS has to either give an 846 refund issued code, or post any other code(s), or resequence the return (send it back through the system) when this happens it’ll be pushed back to a future cycle week. THESE DATES DO NOT CHANGE. As they’re the “original” dates and dates beside any code don’t change they’ll just add new codes with new dates.

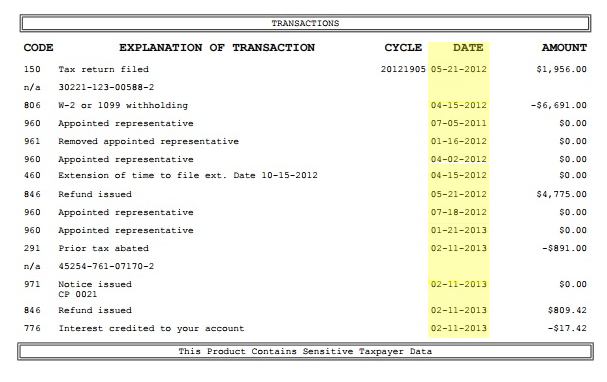

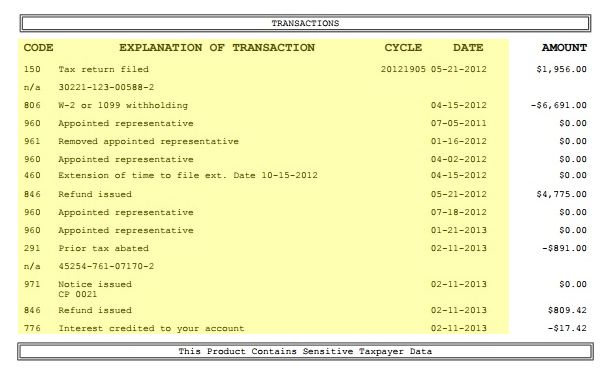

Tax Transcript Explanation of Transaction

You will need to watch your tax account transcript frequently and follow the EXPLANATION OF TRANSACTION section on your tax account transcript and wait until you see the 846 Refund issued Transaction code posted on your transcript, indicating that you will be getting a refund and your direct deposit date has already been determined. The date next to the 846 Refund Issued is when the IRS should send your tax refund to your financial institution.

806 – W-2 or 1099 withholdings this shows the amount of Federal that was held out the whole year the amount beside it should show (- $x.xx) amount because that’s what is owed to you.

766 Credit to your Account (If this applies to you) is for the child tax credit (CTC, ACTC) the amount beside it should be (-$x.xx) as well because this is what is owed to you. If it is just ($x.xx) that means they reduced/removed your credits and you now owe that amount.

768 Earned Income Credit (EIC) (If applies to you) is exactly what it says. Again the amount should be (-$x.xx) because that is what is owed to you. If it is ($x.xx) they have reduced/removed the EIC from your return and you now owe that amount.

The 04-15-2019 date that’s beside all 3 of them (again if it all applies to you) is just for the end of tax season. If you filed after 04-15-2019 it may be a different date.

570 Additional Account Action Pending is a Freeze Code the IRS uses that will hold/stop a refund from being issued until the impact of the action being taken on the account and the refund is determined and processed. The date listed on the line of the transaction is a computer-generated date set to remind the IRS systems to check your account again by this date to see if the tax return is ready to proceed or if it needs to be resequenced out to a future date.

971 notice issued means a letter or notice is being sent out the date beside it means that’s when the notice/letter is due to be sent out (you can receive it before or after) It is basically going to tell you what they’re doing, going to do, or what they have done, and what they did to resolve it.

The dates DO NOT reflect when it was added to the transcripts.