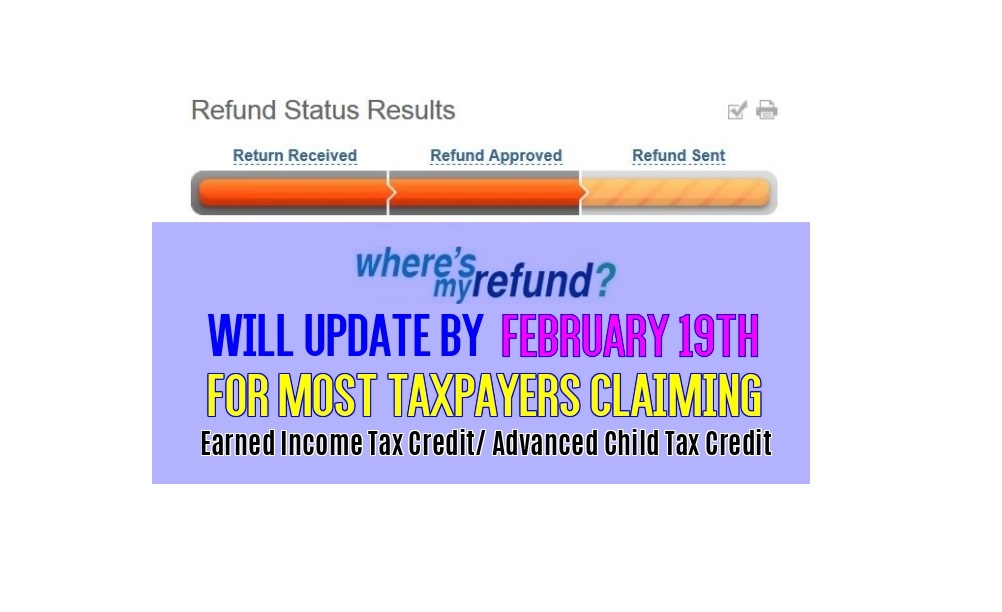

The IRS’s “Where’s My Refund?” tool will be updated by February 19, 2022, for many taxpayers who claimed the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC). Before February 15, some taxpayers may see a PATH ACT Disclaimer message or an intermittent message (Being Processed) informing you that the IRS is processing your return. Early filers claiming the EITC/ACTC may experience delayed refunds because of the Protecting Americans from Tax Hikes Act of 2015 (PATH) Act.

The PATH Act generally requires that no credit or refund for an overpayment for a tax year will be made to a taxpayer before the 15th day of the second month following the close of that tax year, if the taxpayer claimed the EITC or ACTC on the return. This provision in the PATH Act applies to credits or refunds made after December 31, 2016.

Many taxpayers claiming these credits traditionally file during the opening weeks of tax season and seek early refunds, the IRS has reported. However, the IRS has cautioned that the affected refunds likely will not arrive in the bank accounts or debit cards of taxpayers until the week of March 2, 2022, if there are no processing issues with the return and the taxpayer selected direct deposit.

IRS put this message in a special email yesterday to tax professionals:

According to the Protecting Americans from Tax Hikes (PATH) Act, the IRS cannot issue EITC and ACTC refunds before mid-February. The IRS expects most EITC/Additional CTC-related refunds to be available in taxpayer bank accounts or on debit cards by March 1, 2022, if they chose direct deposit and there are no other issues with their tax return. However, some taxpayers may see their refunds a few days earlier. Check Where’s My Refund for your personalized tax refund date.

Where’s My Refund? on IRS.gov and the IRS2Go mobile app remains the best way to check the status of a refund. WMR on IRS.gov and the IRS2Go app will be updated with projected deposit dates for most early EITC/ACTC refund filers by February 19.

By law, the IRS is required to hold all EITC and ACTC refunds until Feb. 15. However, taxpayers may not see those refunds until the week of Mar. 1. Due to differing timeframes with financial institutions, weekends and the Presidents Day holiday, these refunds likely will not start arriving in bank accounts or on debit cards until the week of Mar. 1 — if there are no processing issues with the tax return and the taxpayer chose direct deposit.

When should I check Where’s my Refund for tax refund status updates?

IRS suggests that you check “Where’s My Refund?” for any tax refund status updates After Feb. 19, 2022, for most EITC/Additional CTC-related refunds.

Will calling you help me get my tax refund any faster?

No. unless Where’s My Refund? directs you to call the IRS, call-center representatives will not be able to provide any additional information.

The IRS phone representatives do not have any additional information on tax refund dates beyond what taxpayers have access to on “Where’s My Refund?” and Tax Transcripts. So please don’t call the general helpline unless you’re directed to do so by the Where’s my Refund tool.

We are entering the busiest time of the year for the IRS, which means their free telephone assistance hotline is very busy with taxpayers seeking help with their tax returns. If Where’s My Refund? says that they are still processing your tax return, they are still working on your tax return and will need more time to approve your tax refund, IRS representatives won’t be able to give you a specific refund date.