Refundtalk

@admin

-

Refundtalk wrote a new post 1 year ago

Choosing a Reputable Tax Preparer is Vital to Tax Security

As taxpayers gear up for the approaching tax filing season, it’s crucial to choose tax return preparers with the right skills, education, and expertise to ensure accurate preparation of tax forms. Regardless of…

As taxpayers gear up for the approaching tax filing season, it’s crucial to choose tax return preparers with the right skills, education, and expertise to ensure accurate preparation of tax forms. Regardless of… -

Refundtalk wrote a new post 1 year, 2 months ago

October 16, 2023, is the Tax Filing Extension Deadline!

Attention, taxpayers! We want to remind you that the tax filing extension deadline for the year 2023 is fast approaching. If you haven’t filed your taxes yet, mark your calendars and take note: Monday, October 1…

Attention, taxpayers! We want to remind you that the tax filing extension deadline for the year 2023 is fast approaching. If you haven’t filed your taxes yet, mark your calendars and take note: Monday, October 1… -

Refundtalk wrote a new post 1 year, 2 months ago

Government Shutdown Looms: How it Could Impact IRS Operations and Taxpayers

As October approaches, there is growing concern over the possibility of a government shutdown, which could have significant repercussions for the Internal Revenue Service (IRS) and taxpayers across the United…

As October approaches, there is growing concern over the possibility of a government shutdown, which could have significant repercussions for the Internal Revenue Service (IRS) and taxpayers across the United… -

Refundtalk wrote a new post 1 year, 3 months ago

When Can I Expect My Tax Refund?

Tax season can be a stressful time for many, but one question that’s always on the minds of taxpayers is, “When can I expect my refund?” Whether you’re eagerly anticipating a tax refund or you’re simply trying to…

Tax season can be a stressful time for many, but one question that’s always on the minds of taxpayers is, “When can I expect my refund?” Whether you’re eagerly anticipating a tax refund or you’re simply trying to… -

Refundtalk wrote a new post 1 year, 3 months ago

Where's My Refund? A Guide for TaxpayersTax season is a time of anticipation and financial planning for many Americans. Whether you’re expecting a substantial refund or just looking to reconcile your financial records, tracking the status of your tax…

-

Refundtalk wrote a new post 1 year, 3 months ago

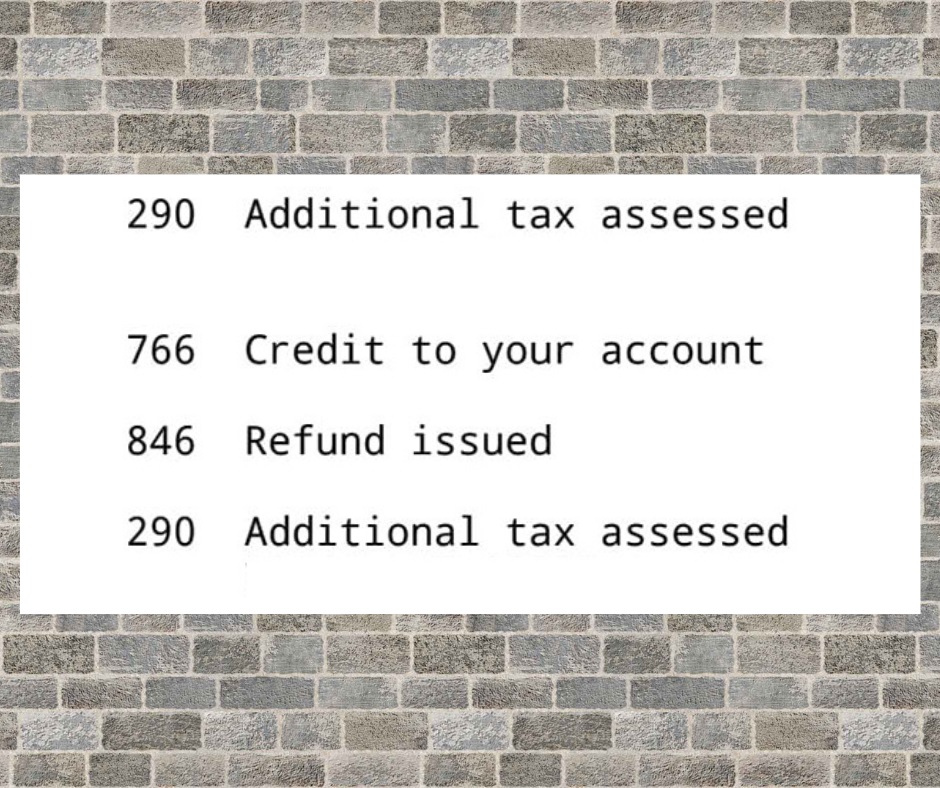

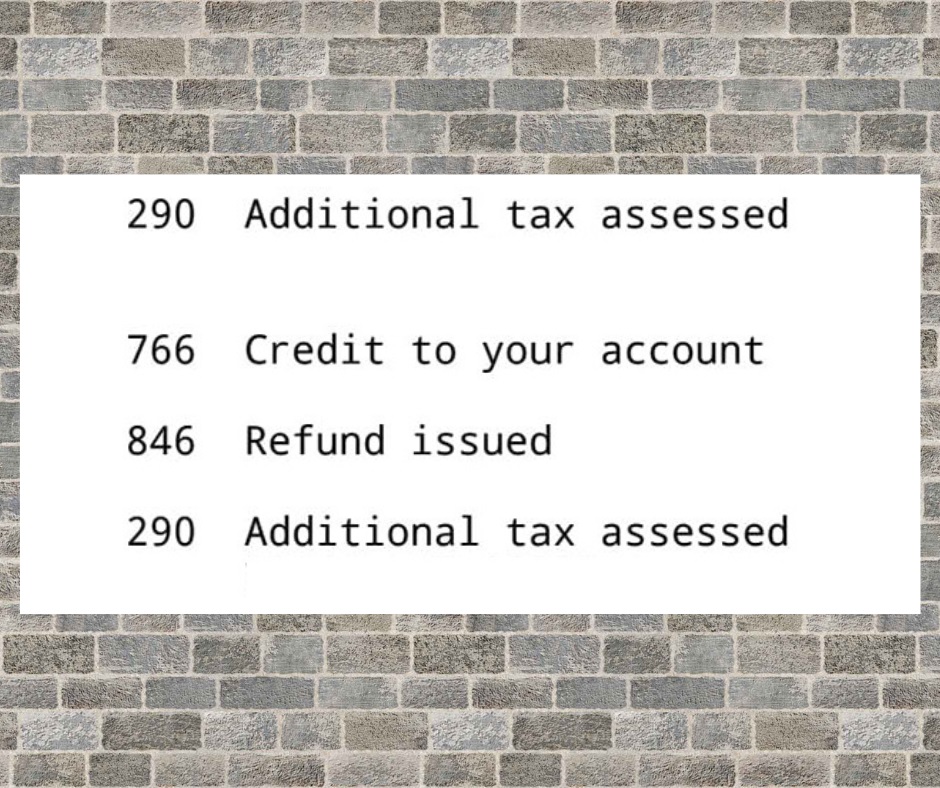

IRS Transcript Code 290: Additional Tax Assessed

Tax season can be a confusing time for many individuals, especially when you receive notifications and transcripts from the Internal Revenue Service (IRS). One such code that often leaves taxpayers puzzled is…

Tax season can be a confusing time for many individuals, especially when you receive notifications and transcripts from the Internal Revenue Service (IRS). One such code that often leaves taxpayers puzzled is… -

Refundtalk wrote a new post 1 year, 3 months ago

IRS Transcript Code 280: Understanding Account Resolution PendingTax season can be a confusing and stressful time for many individuals and businesses. One of the tools the Internal Revenue Service (IRS) uses to communicate with taxpayers is the IRS transcript, a detailed record…

-

Refundtalk wrote a new post 1 year, 3 months ago

IRS Transcript Code 340: Understanding the Failure to Pay PenaltyTax season can be a stressful time for many Americans, and dealing with the Internal Revenue Service (IRS) can sometimes feel like navigating a maze of complex codes and regulations. One of these codes, Transcript…

-

Refundtalk wrote a new post 1 year, 3 months ago

Understanding IRS Transcript Code 380: Balance Due on ReturnTax season can be a stressful time for many, and understanding the various codes and forms the Internal Revenue Service (IRS) uses can be daunting. IRS Transcript Code 380, which refers to a “Balance Due on Return,”…

-

Refundtalk wrote a new post 1 year, 3 months ago

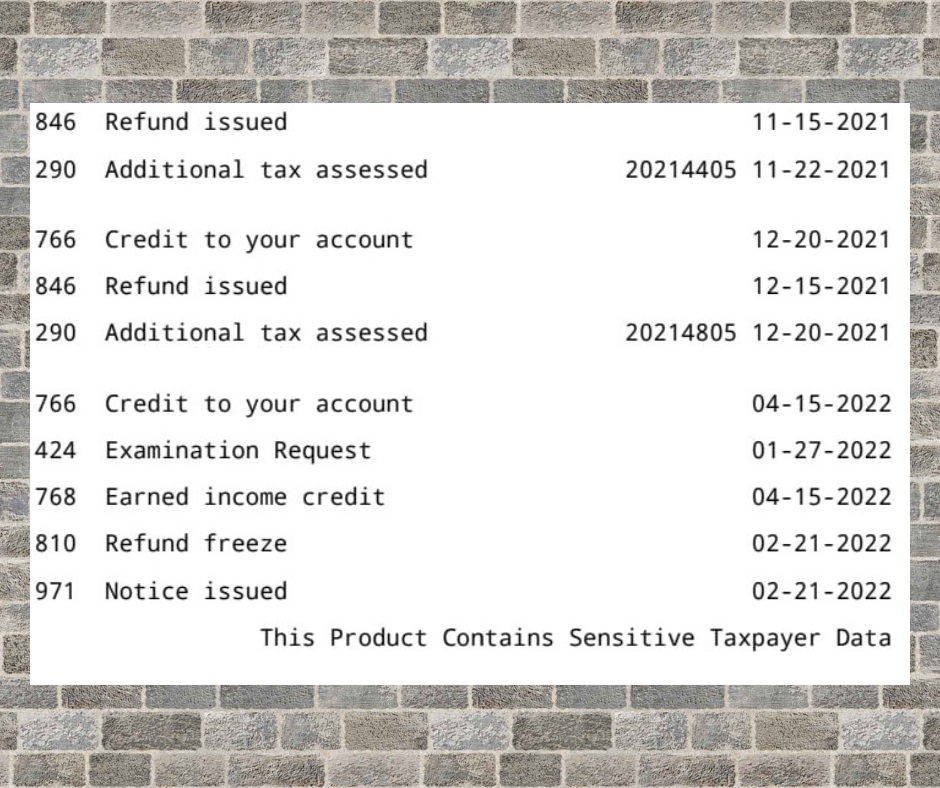

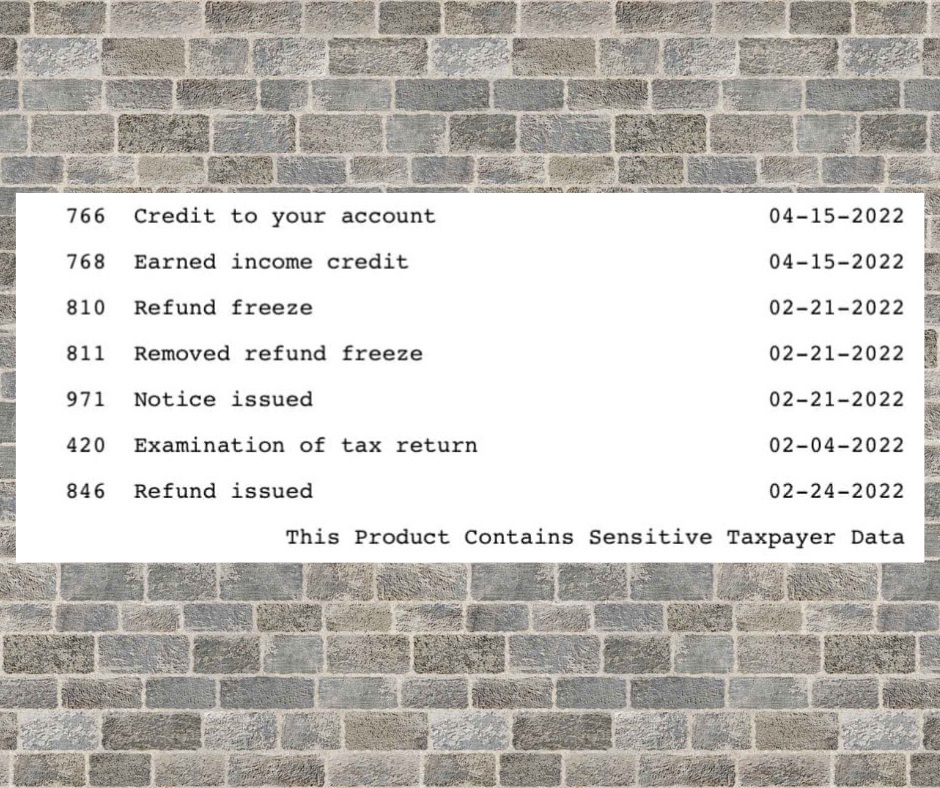

IRS Transcript Code 424: Understanding Examination Request

Taxpayers often find themselves perplexed by the cryptic codes and terminology used by the Internal Revenue Service (IRS). One such code that frequently appears is IRS transcript code 424, which signifies…

Taxpayers often find themselves perplexed by the cryptic codes and terminology used by the Internal Revenue Service (IRS). One such code that frequently appears is IRS transcript code 424, which signifies… -

Refundtalk wrote a new post 1 year, 3 months ago

IRS Transcript Code 972: Reconsideration of Your Tax ReturnTax season can be a stressful time for many individuals and businesses. If you’ve ever received a notice or transcript from the Internal Revenue Service (IRS), you might have come across various codes and terms that…

-

Refundtalk wrote a new post 1 year, 3 months ago

IRS Transcript Code 420: Understanding Examination of Tax Return

Tax season can be a stressful time for many individuals and businesses. It’s not just about filing your taxes; it’s also about understanding the various codes and messages that the IRS sends you. One such code…

Tax season can be a stressful time for many individuals and businesses. It’s not just about filing your taxes; it’s also about understanding the various codes and messages that the IRS sends you. One such code… -

Refundtalk wrote a new post 1 year, 3 months ago

IRS Transcript Code 290: Understanding Additional Tax Assessed

Tax season can be a stressful time for many Americans, and receiving a notice from the Internal Revenue Service (IRS) with unfamiliar codes and jargon can be intimidating. One such code you might encounter is…

Tax season can be a stressful time for many Americans, and receiving a notice from the Internal Revenue Service (IRS) with unfamiliar codes and jargon can be intimidating. One such code you might encounter is… -

Refundtalk wrote a new post 1 year, 3 months ago

IRS Transcript Code 971: Injured Spouse AllocationTax season can be a stressful time, especially for couples who file joint tax returns. If one spouse has outstanding debts or obligations, it can impact the entire tax refund. Fortunately, the Internal Revenue…

-

Refundtalk wrote a new post 1 year, 3 months ago

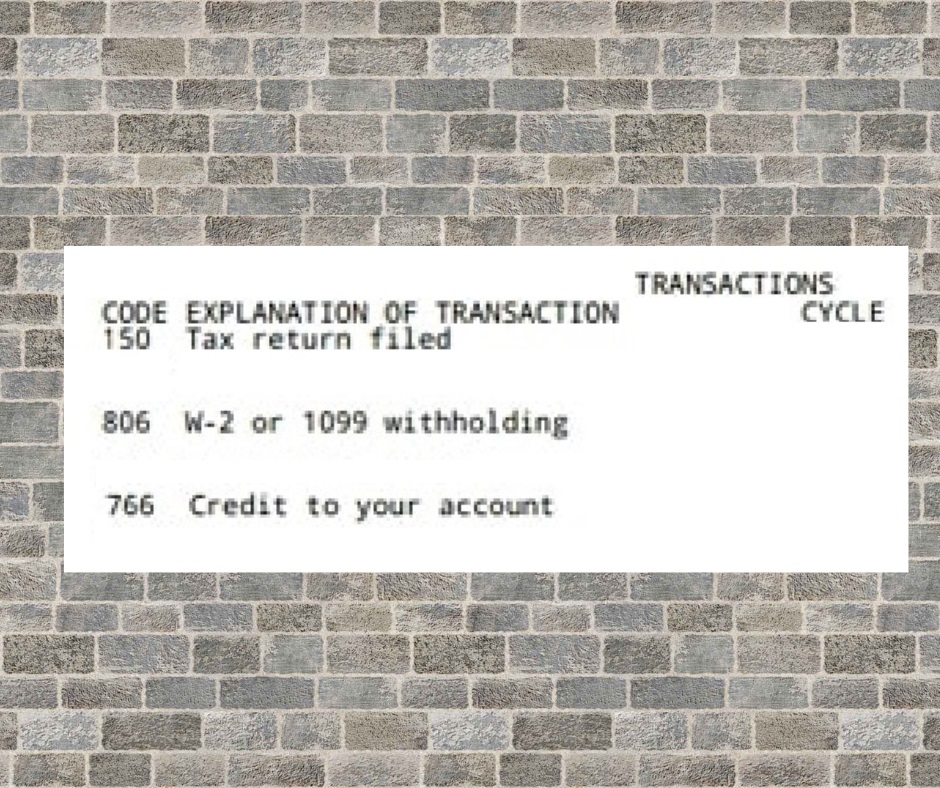

IRS Transcript Code 766: Understanding the Credit to Your Account

Tax season can be a stressful time, filled with complicated forms, calculations, and endless paperwork. If you’ve recently requested an IRS transcript or have received one, you might have come across various…

Tax season can be a stressful time, filled with complicated forms, calculations, and endless paperwork. If you’ve recently requested an IRS transcript or have received one, you might have come across various… -

Refundtalk wrote a new post 1 year, 5 months ago

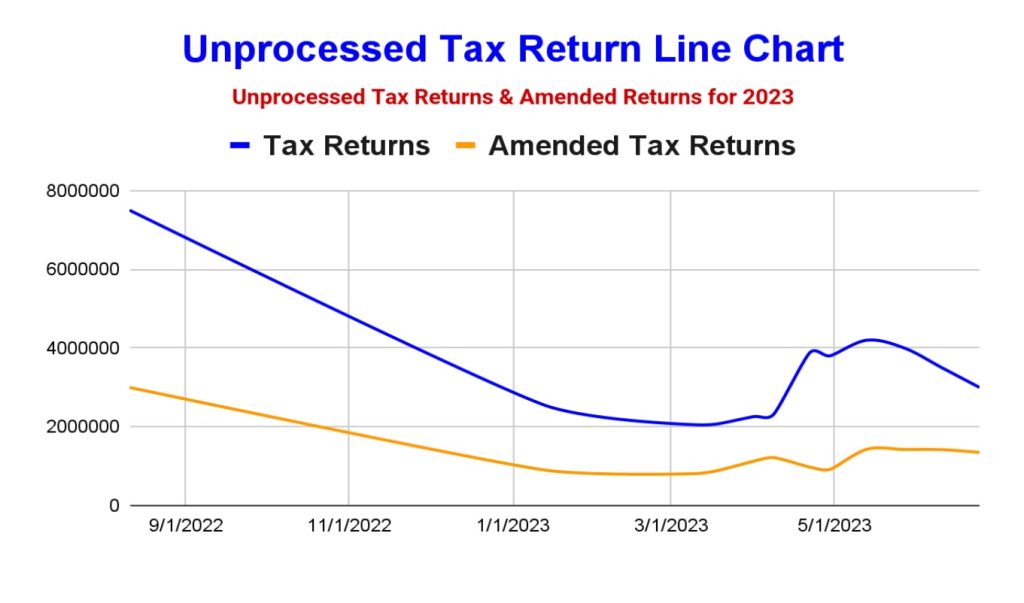

Reducing Unprocessed Tax Returns and Amended Returns in 2023

The Internal Revenue Service (IRS) has been working diligently to address the backlog of unprocessed tax returns and amended returns. In this blog post, we will highlight the significant progress made from…

The Internal Revenue Service (IRS) has been working diligently to address the backlog of unprocessed tax returns and amended returns. In this blog post, we will highlight the significant progress made from… -

Refundtalk wrote a new post 1 year, 5 months ago

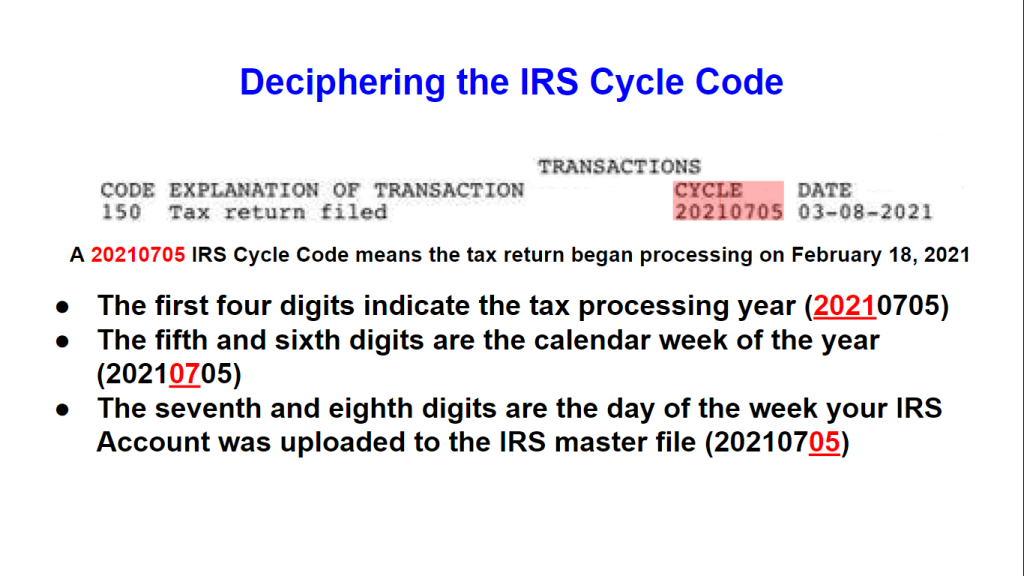

IRS Cycle Code: Understanding and Locating Your Processing Cycle Code

When it comes to deciphering the inner workings of the Internal Revenue Service (IRS), understanding the cycle code can be quite beneficial. This unique code provides valuable information about the processing…

When it comes to deciphering the inner workings of the Internal Revenue Service (IRS), understanding the cycle code can be quite beneficial. This unique code provides valuable information about the processing… -

Refundtalk wrote a new post 1 year, 5 months ago

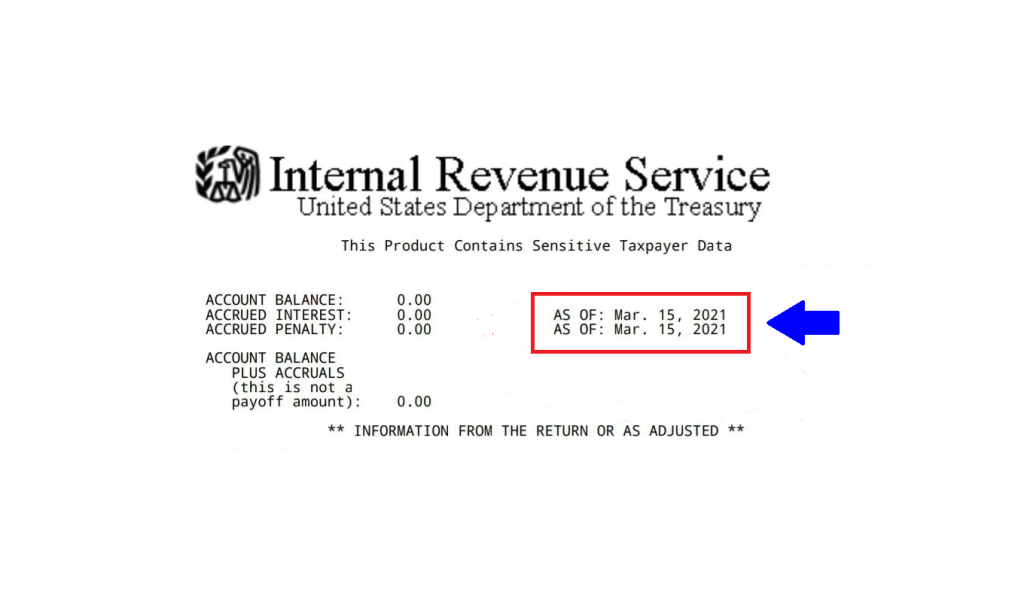

The As Of Date on IRS Tax Transcripts: Understanding its Significance

When obtaining IRS Tax Transcripts, you may come across an As Of Date mentioned on the document. This date holds significance and provides valuable information regarding the status of your tax account. In this…

When obtaining IRS Tax Transcripts, you may come across an As Of Date mentioned on the document. This date holds significance and provides valuable information regarding the status of your tax account. In this… -

Refundtalk wrote a new post 1 year, 5 months ago

How Tax Refund Checks Are Distributed and Delivered

As taxpayers, we eagerly anticipate the arrival of our tax refund checks. But have you ever wondered how the IRS handles the distribution process? In this blog post, we’ll take a closer look at how the IRS…

As taxpayers, we eagerly anticipate the arrival of our tax refund checks. But have you ever wondered how the IRS handles the distribution process? In this blog post, we’ll take a closer look at how the IRS… -

Refundtalk wrote a new post 1 year, 5 months ago

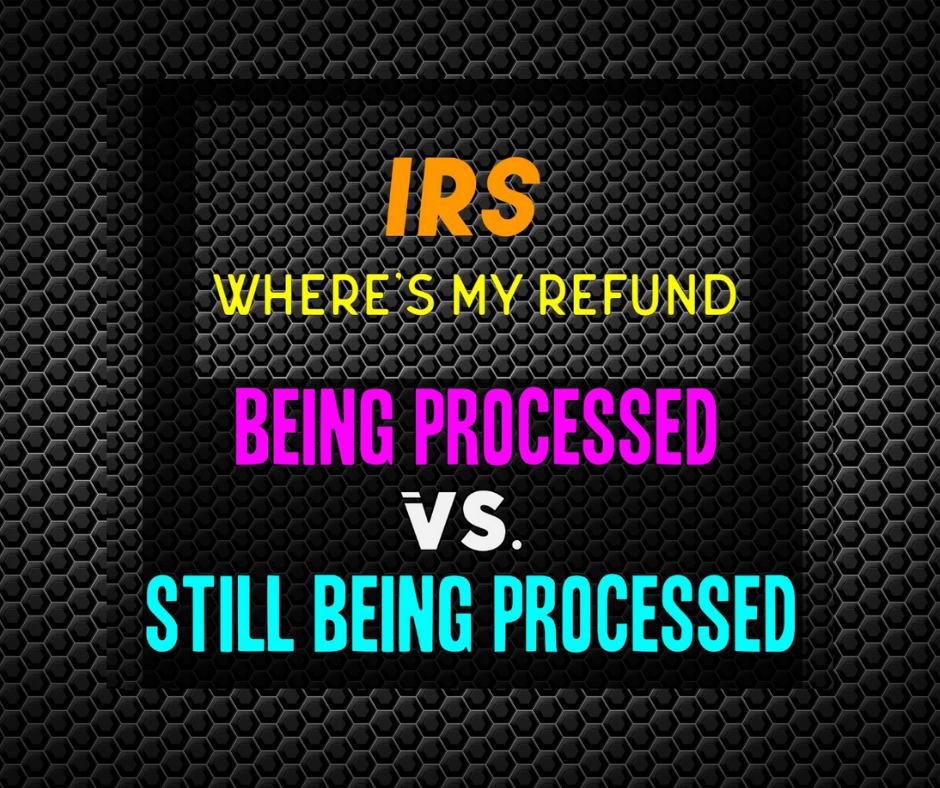

Tax Refund Status: "We Have Received Your Tax Return and It Is Being Processed" vs. "Your Tax Return Is Still Being Processed"

Filing taxes can be an anxious time, and waiting for your tax refund can add to the anticipation. When checking your refund status on the IRS “Where’s My Refund?” tool, you may come across different messages…

Filing taxes can be an anxious time, and waiting for your tax refund can add to the anticipation. When checking your refund status on the IRS “Where’s My Refund?” tool, you may come across different messages… - Load More