Refundtalk

@admin

-

Refundtalk wrote a new post 2 years, 8 months ago

You might receive an IRS Notice CP2000 (“CP2000”) in the mail. The IRS issues these particular notices to taxpayers based on discrepancies between tax return reporting and third-party reporting. Taxpayers must pay…

-

Refundtalk wrote a new post 2 years, 8 months ago

To help people during this year’s filing season, many IRS Taxpayer Assistance Centers across the country will have special Saturday hours.

These centers provide taxpayers with in-person help. The TACs are…

-

Refundtalk wrote a new post 2 years, 8 months ago

IRS Letter 5071C – Potential Identity Theft During Original Processing

The IRS is requesting additional information to validate your identity before they will continue to process your tax return.

What d…

-

Refundtalk wrote a new post 2 years, 8 months ago

Faced with a class-action suit filed on behalf of customers who claim they were tricked into paying to file their taxes, TurboTax-maker Intuit knocked the case down. The company insisted its customers had agreed…

-

Refundtalk wrote a new post 2 years, 9 months ago

Most people think of the IRS as the agency that collects taxes, but you may not know that every year, our agency distributes billions of dollars in tax credits to eligible individuals, families and businesses. The…

-

Refundtalk wrote a new post 2 years, 9 months ago

Have you received a Direct Deposit Date yet?

Please take part in the poll below if you have received your tax refund in 2024 How many early filers have already received a Direct Deposit Date? If you filed your taxes before February 15, 2024, have you…

Please take part in the poll below if you have received your tax refund in 2024 How many early filers have already received a Direct Deposit Date? If you filed your taxes before February 15, 2024, have you… -

Refundtalk wrote a new post 2 years, 9 months ago

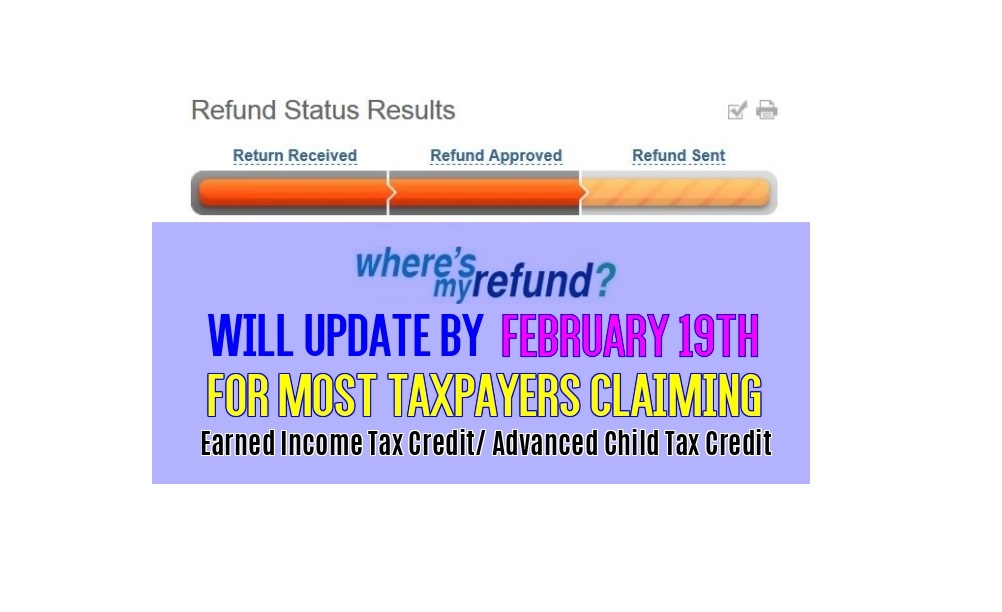

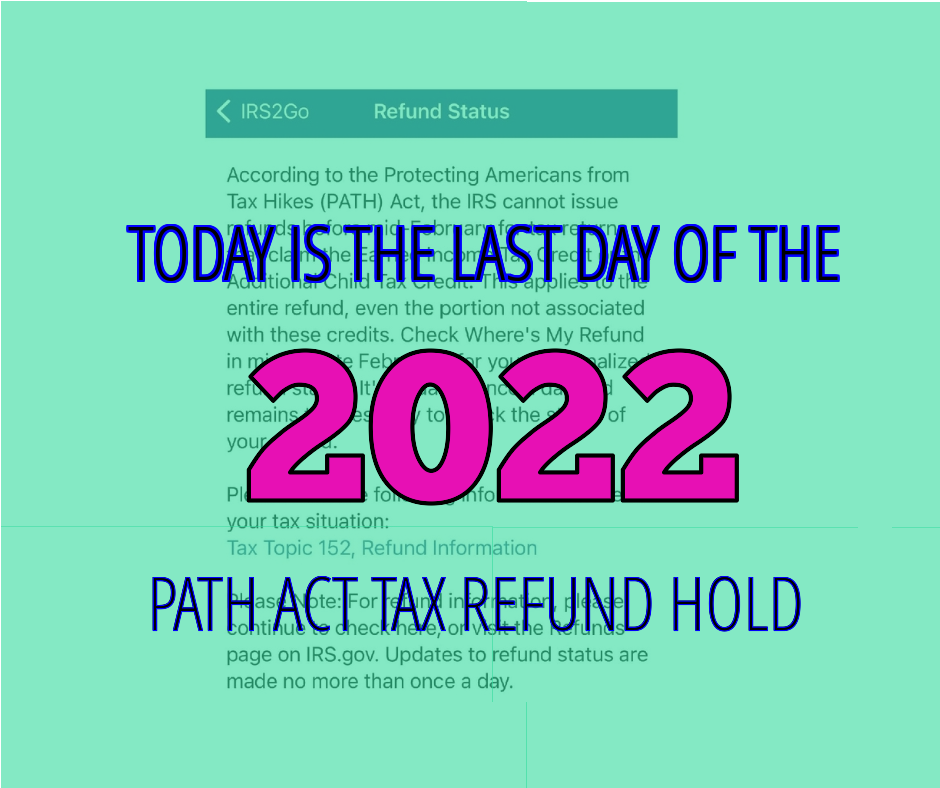

The IRS’s “Where’s My Refund?” tool will be updated by February 19, 2022, for many taxpayers who claimed the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC). Before February 15, some ta…

-

Refundtalk wrote a new post 2 years, 9 months ago

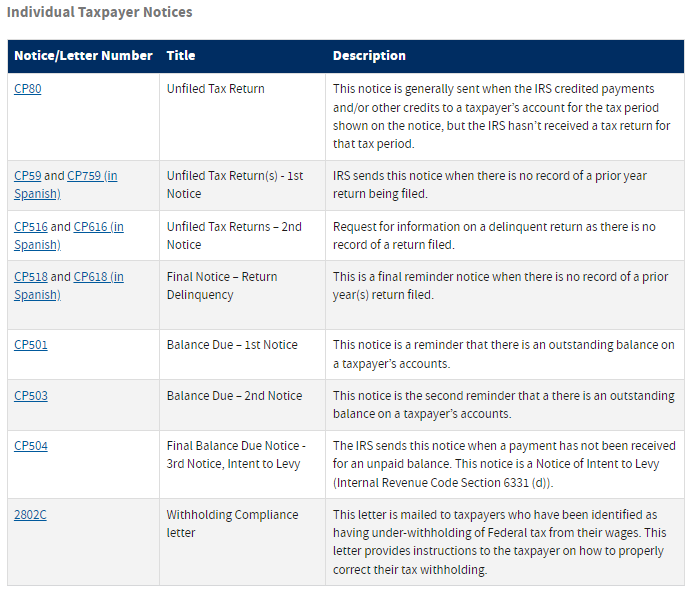

About Your Notice

If you receive a letter or notice from the IRS, they will explain the reason for sending the letter and provide instructions. Many of these messages and notices can be handled simply without…

-

Refundtalk wrote a new post 2 years, 9 months ago

The IRS has announced the suspension of over a dozen additional letters including the mailing of automated collection notices. These mailings include balance due notices and unfiled tax return notices. Several…

-

Refundtalk wrote a new post 2 years, 9 months ago

The Protecting Americans from Tax Hikes (PATH) Act was created in order to protect taxpayers and their families against fraud and permanently extend many expiring tax laws. The law, which was enacted…

-

Refundtalk wrote a new post 2 years, 9 months ago

Senate Finance Committee Chair Ron Wyden, D-Ore., today released the following statement after the Treasury Department informed his office it is in the process of transitioning away from using the private facial…

-

Refundtalk wrote a new post 2 years, 9 months ago

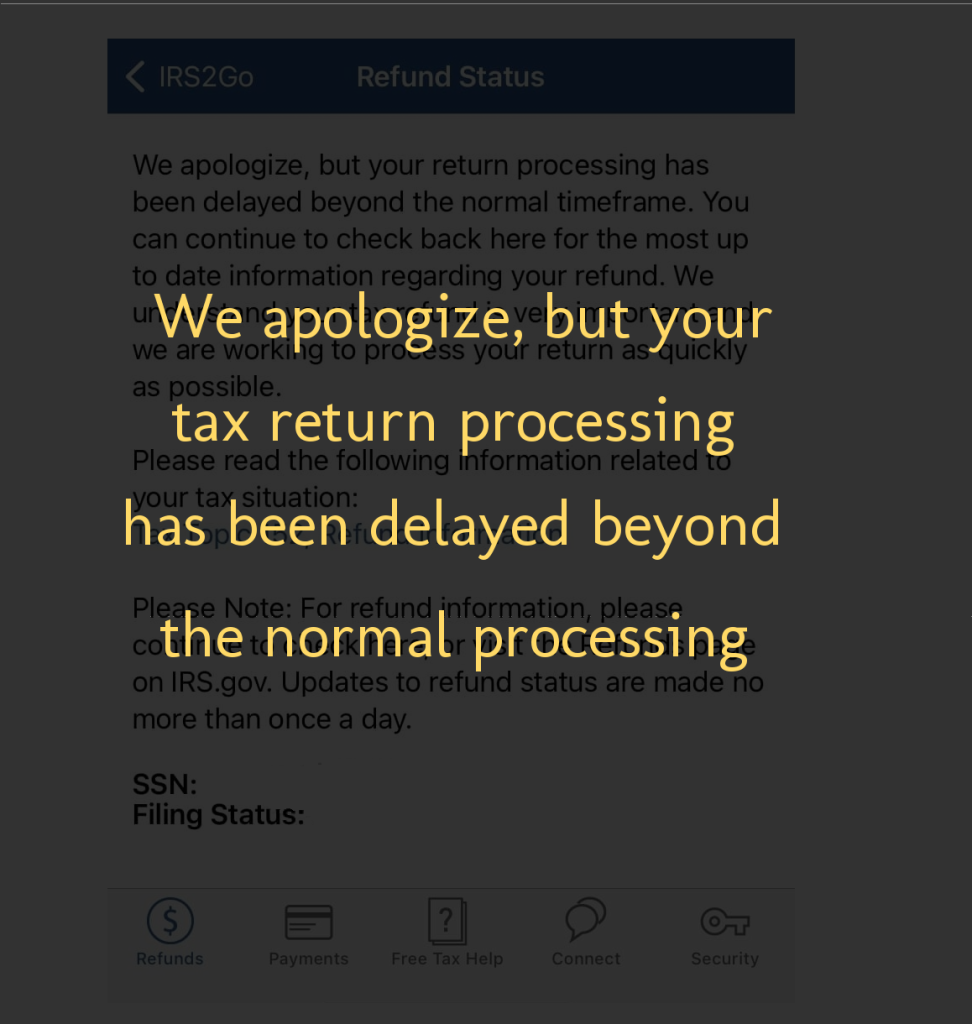

Tax Return processing has been delayed beyond the normal timeframe

The Where’s My Refund? Status message “We apologize, but your tax return processing has been delayed beyond the normal timeframe” is used to inform the taxpayer of a delay in processing their tax return. The…

The Where’s My Refund? Status message “We apologize, but your tax return processing has been delayed beyond the normal timeframe” is used to inform the taxpayer of a delay in processing their tax return. The… -

Refundtalk wrote a new post 2 years, 9 months ago

It’s a new tax season. While some things are different, one thing that remains the same is, taxpayers can have their taxes prepared for free through one of two long-standing IRS programs. People with low to m…

-

Refundtalk started the topic Tax Transcript Code 898 in the forum IRS Transcript Codes 2 years, 9 months ago

What does IRS Tax Transcript Code 898 on your tax transcript mean?

Share your experience with filing your tax return and seeing “IRS Tax Transcript Code 898” on your transcripts.You can find these codes on your tax account transcript under the explanation of transactions column. Connect with other taxpayers that have an “IRS Tax Transcript…[Read more]

-

Refundtalk started the topic Tax Transcript Code 840 in the forum IRS Transcript Codes 2 years, 9 months ago

What does IRS Tax Transcript Code 840 on your tax transcript mean?

Share your experience with filing your tax return and seeing “IRS Tax Transcript Code 840” on your transcripts.You can find these codes on your tax account transcript under the explanation of transactions column. Connect with other taxpayers that have an “IRS Tax Transcript…[Read more]

-

Refundtalk started the topic Tax Transcript Code 820 in the forum IRS Transcript Codes 2 years, 9 months ago

What does IRS Tax Transcript Code 820 on your tax transcript mean?

Share your experience with filing your tax return and seeing “IRS Tax Transcript Code 820” on your transcripts.You can find these codes on your tax account transcript under the explanation of transactions column. Connect with other taxpayers that have an “IRS Tax Transcript…[Read more]

-

Refundtalk started the topic Tax Transcript Code 811 in the forum IRS Transcript Codes 2 years, 9 months ago

What does IRS Tax Transcript Code 811 on your tax transcript mean?

IRS tax transcript code 811 typically refers to a refund offset. This means that the IRS has used all or part of your tax refund to pay for a debt that you owe, such as unpaid taxes, child support, or student loans. The code may also indicate that your refund was applied to…[Read more] -

Refundtalk started the topic Tax Transcript Code 810 in the forum IRS Transcript Codes 2 years, 9 months ago

What does IRS Tax Transcript Code 810 on your tax transcript mean?

Tax transcript code 810 on your IRS tax transcript refers to a “Refund Freeze.” This code indicates that the IRS has frozen or placed a hold on your tax refund for a specific reason. The freeze may be due to various factors, such as an ongoing audit, a claim of identity theft or…[Read more] -

Refundtalk started the topic Tax Transcript Code 768 in the forum IRS Transcript Codes 2 years, 9 months ago

What does IRS Tax Transcript Code 768 on your tax transcript mean?

Share your experience with filing your tax return and seeing “IRS Tax Transcript Code 768” on your transcripts.You can find these codes on your tax account transcript under the explanation of transactions column. Connect with other taxpayers that have an “IRS Tax Transcript…[Read more]

-

Refundtalk started the topic Tax Transcript Code 766 in the forum IRS Transcript Codes 2 years, 9 months ago

What does IRS Tax Transcript Code 766 on your tax transcript mean?

Tax transcript code 766 on an IRS tax transcript refers to a “Credit to Your Account.” This code indicates that the IRS has made a payment or issued a refund that has been credited to your tax account. It could be a result of various reasons, such as an overpayment of taxes, a…[Read more] - Load More