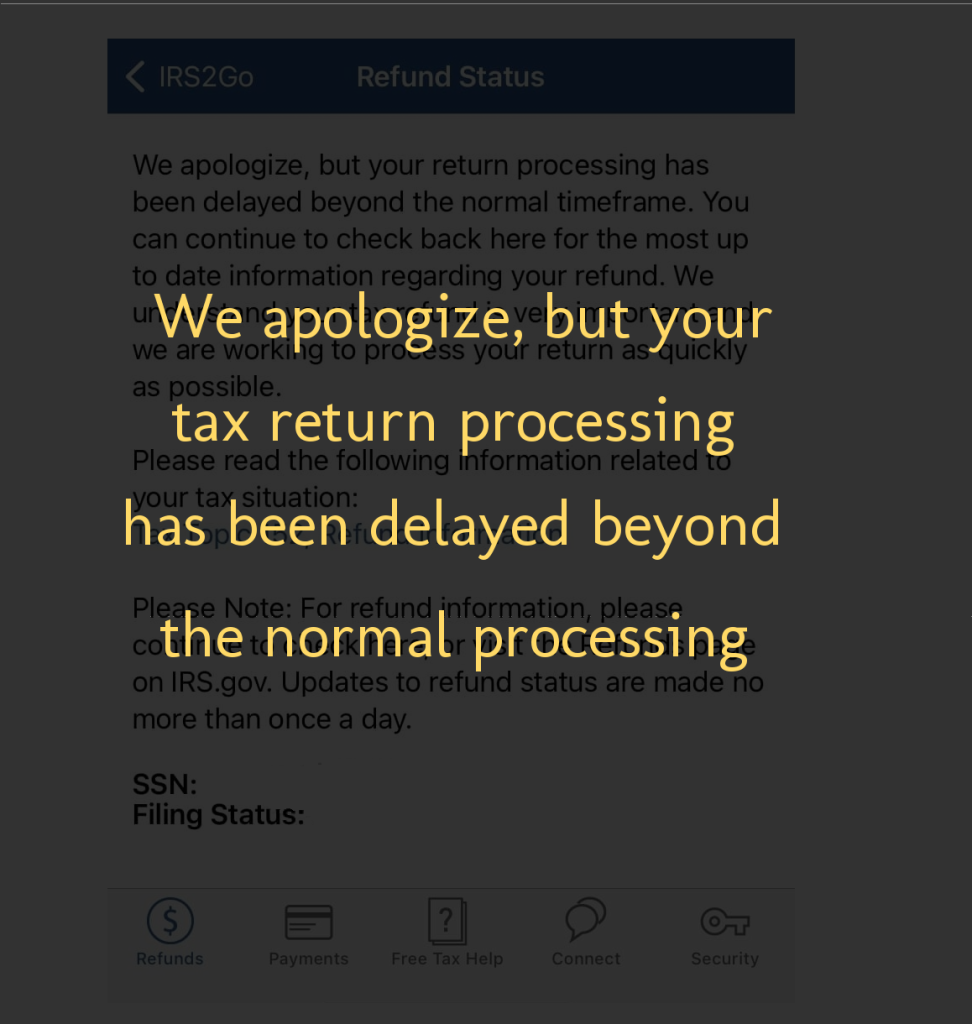

The Where’s My Refund? Status message “We apologize, but your tax return processing has been delayed beyond the normal timeframe” is used to inform the taxpayer of a delay in processing their tax return.

The IRS issue most tax refunds in less than 21 calendar days. However, it’s possible your tax return may require additional review and take longer to process.

What is “We apologize, but your tax return processing has been delayed beyond the normal timeframe” mean?

This refund status is informing you that the IRS has paused/delayed the processing of your tax return. And due to the delay in processing, they can no longer guarantee your tax refund within the 21-day time frame. If you are seeing this refund status “We apologize, but your tax return processing has been delayed beyond the normal timeframe” it means the IRS can no longer guarantee your refund within the 21-day time frame. The reason you are seeing this message is that you have reached your 21-day marker in the system and the IRS is informing you that they are going to need additional time to process your tax return.

What is the IRS timeframe for normal tax return processing?

A typical tax return with no processing issues can go from accepted to approved in as little as 21 days. Tax returns with no processing issues could see tax refunds go out in 21 days or less. Typically, nine out of 10 refunds filed electronically go out in this time frame.

Why is my tax return delayed beyond the normal timeframe?

If the IRS is reviewing your tax returns, you should monitor your transcript for transaction codes. If you have a 570 code, your account is frozen. The IRS may also place a code 971 on your transcript to let you know that it will send a letter about the review and the delay in processing. Processing of the tax refund will be delayed until verification is complete

You may get a letter or notice from the IRS saying there’s a problem with your tax return or your refund will be delayed. There are a number of reasons why the IRS may withhold your refund and take longer to process it:

- You have unfiled or missing tax returns for prior tax years.

- The check was held or returned due to a problem with the name or address.

- You elected to apply the refund toward your estimated tax liability for next year.

- The IRS is reviewing your tax return for an additional 60-120 days.

- Your refund was applied to a debt you owe to the IRS or another federal or state agency.

How long until I will get my tax refund?

The IRS knows this is a desperate time for taxpayers and is committed to continuing to help in any way possible. They will continue to issue tax refunds to the public as quickly as possible, with an average of over one million tax refunds issued to taxpayers across the country each day.

How long will I see this refund status?

For returns received in the current year, the IRS processes individual tax returns for which refunds are due first. Tax returns reflecting tax owed are processed last, but if a payment is mailed with the tax return, the payment is separated upon receipt and deposited to ensure the taxpayer account is credited for the payment. The IRS continues to process tax returns that need to be manually reviewed due to errors in the order received.

As the return is processed, whether it was filed electronically or on paper, it may be delayed because it has a mistake, is missing information, or there is suspected identity theft or fraud. If the IRS can fix it without contacting you, they will. If they need more information or need you to verify you sent the tax return, they will send you a letter. The resolution of these issues could take more than 120 days depending on how quickly and accurately you respond, and how quickly the IRS can complete the processing of your return.

The IRS will mail you a letter if your tax return has issues or errors

If there is an issue with a tax return that requires additional review, that can add time for some taxpayers, but it varies depending on the issue. Many factors can affect the timing of a refund. Tax returns with an error, incomplete information, or those affected by identity theft or fraud may take longer to process. If more information is needed to process the tax return, the IRS will send the taxpayer a letter with a request for information.

What you should do

In most instances, no further action is needed. The IRS will contact you by mail if we need more information or if we made a change to your return. If you filed electronically and received an acknowledgment, you do not need to take any further action other than promptly responding to any requests for information.

However, if you are due a refund, filed on paper more than six months ago, and Where’s My Refund? does not indicate the IRS received your tax return, you should resubmit your tax return, electronically if possible. Make sure it includes an original signature, and include all documents submitted with the original return.

Online tools help avoid delays

The IRS urges people to visit IRS.gov and use tools like “Where’s My Refund” and “Get My Transcripts” for the quickest assistance. Filing electronically with direct deposit is the quickest way to receive a refund; it’s even more important to avoid filing a paper return if at all possible.

mines and im trying to see whats going on because i never had a issused like this before this the first time my refund ever said something like this