Refundtalk

@admin

-

Refundtalk wrote a new post 2 years, 10 months ago

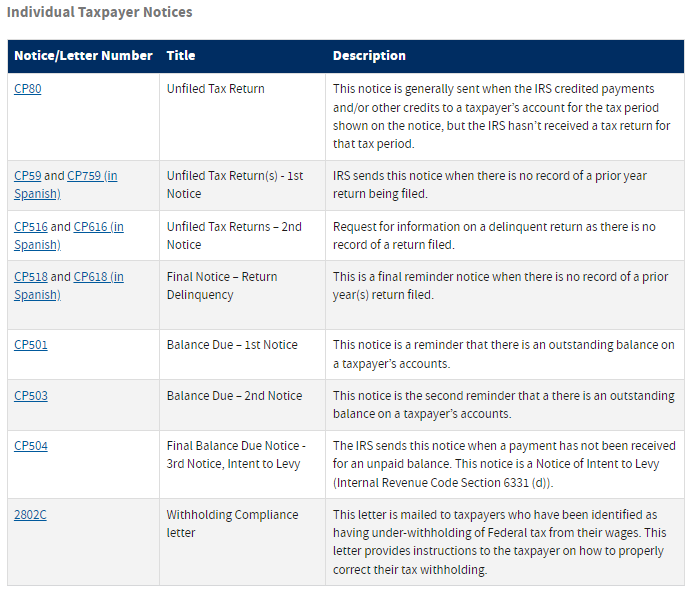

The IRS has announced the suspension of over a dozen additional letters including the mailing of automated collection notices. These mailings include balance due notices and unfiled tax return notices. Several…

-

Refundtalk wrote a new post 2 years, 10 months ago

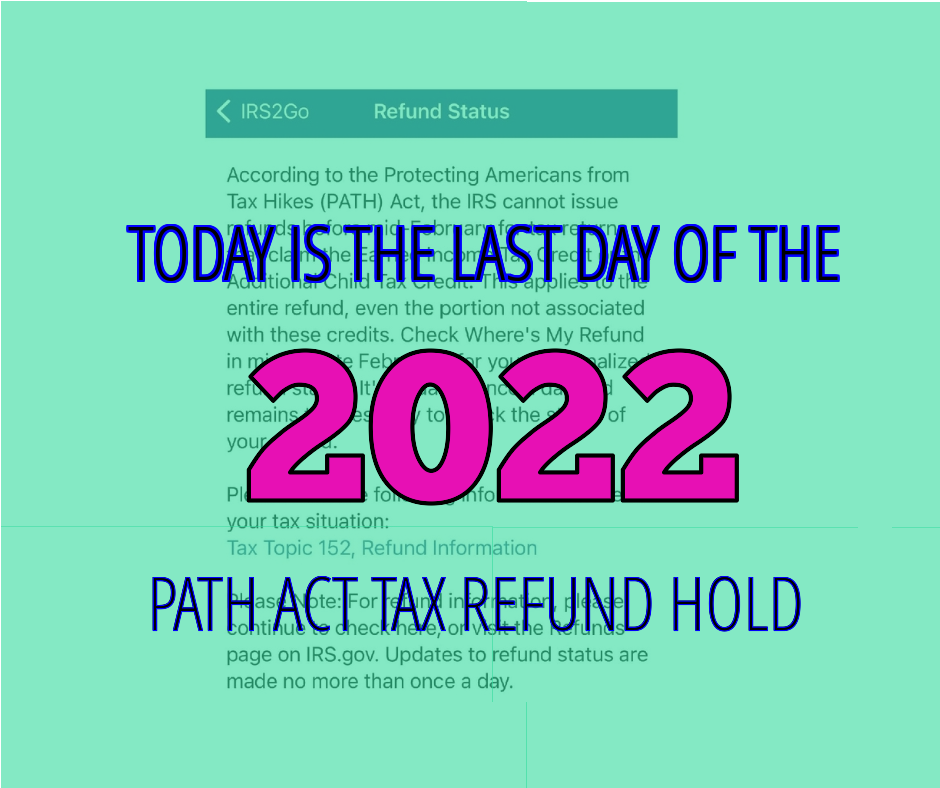

The Protecting Americans from Tax Hikes (PATH) Act was created in order to protect taxpayers and their families against fraud and permanently extend many expiring tax laws. The law, which was enacted…

-

Refundtalk wrote a new post 2 years, 10 months ago

Senate Finance Committee Chair Ron Wyden, D-Ore., today released the following statement after the Treasury Department informed his office it is in the process of transitioning away from using the private facial…

-

Refundtalk wrote a new post 2 years, 10 months ago

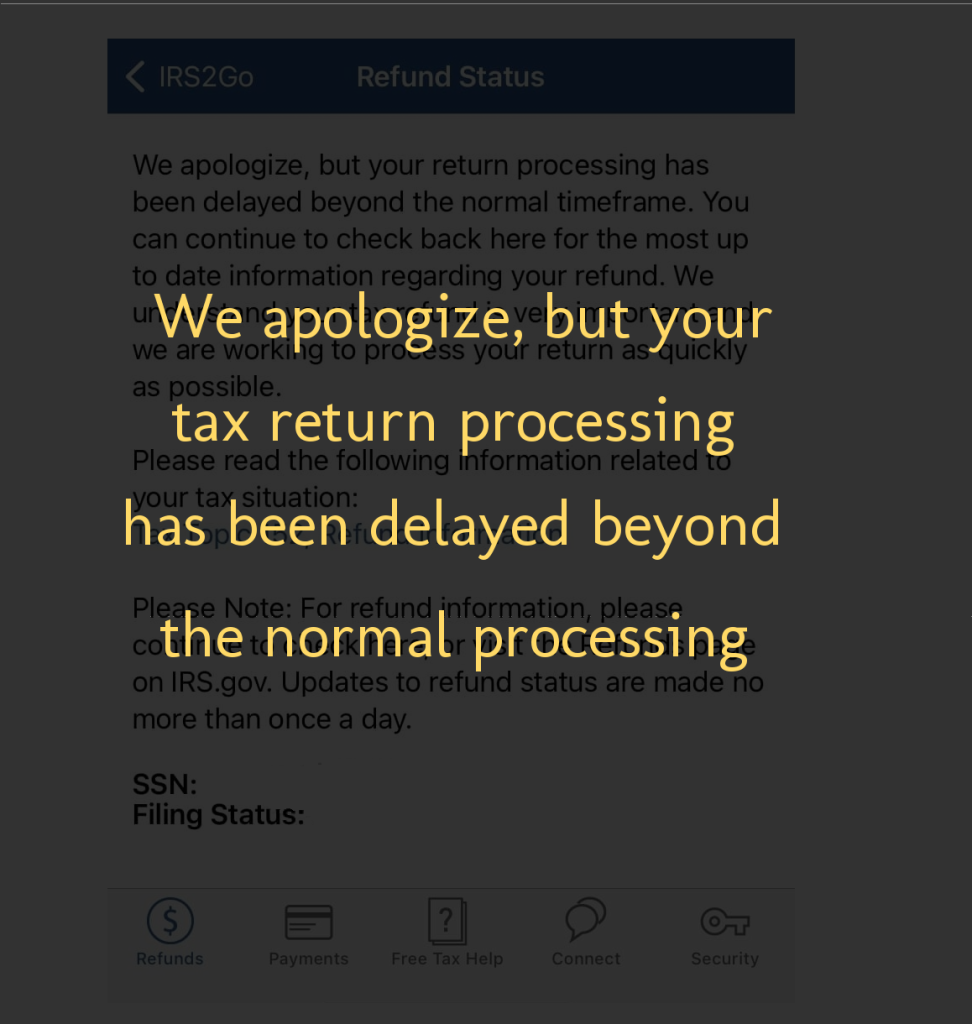

Tax Return processing has been delayed beyond the normal timeframe

The Where’s My Refund? Status message “We apologize, but your tax return processing has been delayed beyond the normal timeframe” is used to inform the taxpayer of a delay in processing their tax return. The…

The Where’s My Refund? Status message “We apologize, but your tax return processing has been delayed beyond the normal timeframe” is used to inform the taxpayer of a delay in processing their tax return. The… -

Refundtalk wrote a new post 2 years, 10 months ago

It’s a new tax season. While some things are different, one thing that remains the same is, taxpayers can have their taxes prepared for free through one of two long-standing IRS programs. People with low to m…

-

Refundtalk started the topic Tax Transcript Code 898 in the forum IRS Transcript Codes 2 years, 10 months ago

What does IRS Tax Transcript Code 898 on your tax transcript mean?

Share your experience with filing your tax return and seeing “IRS Tax Transcript Code 898” on your transcripts.You can find these codes on your tax account transcript under the explanation of transactions column. Connect with other taxpayers that have an “IRS Tax Transcript…[Read more]

-

Refundtalk started the topic Tax Transcript Code 840 in the forum IRS Transcript Codes 2 years, 10 months ago

What does IRS Tax Transcript Code 840 on your tax transcript mean?

Share your experience with filing your tax return and seeing “IRS Tax Transcript Code 840” on your transcripts.You can find these codes on your tax account transcript under the explanation of transactions column. Connect with other taxpayers that have an “IRS Tax Transcript…[Read more]

-

Refundtalk started the topic Tax Transcript Code 820 in the forum IRS Transcript Codes 2 years, 10 months ago

What does IRS Tax Transcript Code 820 on your tax transcript mean?

Share your experience with filing your tax return and seeing “IRS Tax Transcript Code 820” on your transcripts.You can find these codes on your tax account transcript under the explanation of transactions column. Connect with other taxpayers that have an “IRS Tax Transcript…[Read more]

-

Refundtalk started the topic Tax Transcript Code 811 in the forum IRS Transcript Codes 2 years, 10 months ago

What does IRS Tax Transcript Code 811 on your tax transcript mean?

IRS tax transcript code 811 typically refers to a refund offset. This means that the IRS has used all or part of your tax refund to pay for a debt that you owe, such as unpaid taxes, child support, or student loans. The code may also indicate that your refund was applied to…[Read more] -

Refundtalk started the topic Tax Transcript Code 810 in the forum IRS Transcript Codes 2 years, 10 months ago

What does IRS Tax Transcript Code 810 on your tax transcript mean?

Tax transcript code 810 on your IRS tax transcript refers to a “Refund Freeze.” This code indicates that the IRS has frozen or placed a hold on your tax refund for a specific reason. The freeze may be due to various factors, such as an ongoing audit, a claim of identity theft or…[Read more] -

Refundtalk started the topic Tax Transcript Code 768 in the forum IRS Transcript Codes 2 years, 10 months ago

What does IRS Tax Transcript Code 768 on your tax transcript mean?

Share your experience with filing your tax return and seeing “IRS Tax Transcript Code 768” on your transcripts.You can find these codes on your tax account transcript under the explanation of transactions column. Connect with other taxpayers that have an “IRS Tax Transcript…[Read more]

-

Refundtalk started the topic Tax Transcript Code 766 in the forum IRS Transcript Codes 2 years, 10 months ago

What does IRS Tax Transcript Code 766 on your tax transcript mean?

Tax transcript code 766 on an IRS tax transcript refers to a “Credit to Your Account.” This code indicates that the IRS has made a payment or issued a refund that has been credited to your tax account. It could be a result of various reasons, such as an overpayment of taxes, a…[Read more] -

Refundtalk started the topic Tax Transcript Code 971 in the forum IRS Transcript Codes 2 years, 10 months ago

What does IRS Tax Transcript Code 971 on your tax transcript mean?

Share your experience with filing your tax return and seeing “IRS Tax Transcript Code 971” on your transcripts.You can find these codes on your tax account transcript under the explanation of transactions column. Connect with other taxpayers that have an “IRS Tax Transcript…[Read more]

-

Refundtalk started the topic Tax Transcript Code 846 in the forum IRS Transcript Codes 2 years, 10 months ago

What does IRS Tax Transcript Code 846 on your tax transcript mean?

Tax transcript code 846 on your IRS tax transcript is a transaction code that indicates the refund issued or applied to your tax account. It means that the IRS has processed your tax return and approved your refund. Code 846 indicates the date that the refund was issued and the…[Read more] -

Refundtalk started the topic Tax Transcript Code 571 in the forum IRS Transcript Codes 2 years, 10 months ago

What does IRS Tax Transcript Code 571 on your tax transcript mean?

Share your experience with filing your tax return and seeing “IRS Tax Transcript Code 571” on your transcripts.You can find these codes on your tax account transcript under the explanation of transactions column. Connect with other taxpayers that have an “IRS Tax Transcript…[Read more]

-

Refundtalk started the topic Tax Transcript Code 570 in the forum IRS Transcript Codes 2 years, 10 months ago

What does IRS Tax Transcript Code 570 on your tax transcript mean?

IRS transcript code 570 on your tax transcript generally indicates that there has been a freeze placed on your refund. This could be due to a number of reasons, such as a review of your tax return, an adjustment to your account, or an unresolved issue with your…[Read more] -

Refundtalk wrote a new post 2 years, 11 months ago

On January 28, 2022, the federal government launched a new website to help families claim the second half of their Child Tax Credit, for those who chose to receive monthly payments. (It also helps you figure…

-

Refundtalk started the topic Tax Transcript Code 150 in the forum IRS Transcript Codes 2 years, 11 months ago

What does IRS Tax Transcript Code 150 on your tax transcript mean?

IRS tax transcript code 150 generally indicates that a tax return has been filed and that the IRS has acknowledged receipt of the return.

Transaction Code 150 indicates that the return has been received and is in the IRS system. Code 150 does not provide any information about the…[Read more] -

Refundtalk wrote a new post 2 years, 11 months ago

Join us for Awareness Day on Friday, January 28, 2022

Join us in making the 16th annual Awareness Day as successful as last year’s. We partnered with more than 1,500 supporters with a combined social rea…

-

Refundtalk wrote a new post 2 years, 11 months ago

The IRS encourages taxpayers to file electronically when they are ready and choose direct deposit to get their refund. Direct deposit is the safest and most convenient way to receive a tax refund.

Here are so…

- Load More