…individual can update their email address using Online Account. However, to change their mailing address, a taxpayer must submit to the IRS a paper Form 8822, Change of Address. Account…

Search Results for: 100% Pass Quiz Professional Fortinet - FCP_FCT_AD-7.2 Pdf Dumps 🌇 Search for ✔ FCP_FCT_AD-7.2 ️✔️ and easily obtain a free download on 「 www.pdfvce.com 」 🕘Examcollection FCP_FCT_AD-7.2 Dumps Torrent

…online for free using brand-name software. Free File is sponsored by the Free File Alliance, a partnership between the IRS and the tax-software industry. People can also visit ChildTaxCredit.gov/file to…

…IRS payment plan. While it may be compelling to pay as little as possible each month, it’s ill-advised. The longer it takes you to pay off your tax debt, the…

Identity Protection

…a thorough authentication check. Once authentication is complete, an IP PIN will be provided online immediately. A new IP PIN is generated every year for added security. Once an individual…

…Reference Number 9001, usually indicates the IRS requires additional information or processing time to complete your refund. Here’s what you need to know and how to resolve the situation. Why…

…impatience. Waiting a few extra days or even a week to make sure you have all the forms needed to file a complete tax return could save you long delays…

IRS waives penalty for many whose tax withholding and estimated tax payments fell short in 2018

…at least 100 percent of the prior year’s tax liability, in this case from 2017. However, the 100 percent threshold is increased to 110 percent if a taxpayer’s adjusted gross…

…to your address of record within 21 days. Additional Information Visit FAQs about the IP PIN for more information. Visit the IRS Identity Protection page if you don’t meet any…

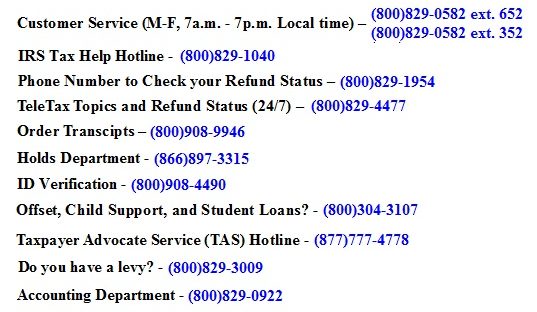

…Priority Hotline – 1-866-860-4259 Taxpayer Advocate Service – 1-877-777-4778 Taxpayer Advocate Offices – 1-404-338-8099 Taxpayer Advocate Supervisor – 1-877-275-8271 Tax Fax Service – 1-703-368-9694 Tax Fraud Referal Hotline – 1-800-829-0433 Tax Help for…

…in 2018) Individuals who are blind and/or age 65 or over are allowed standard deduction add-ons. These add-ons are for the taxpayer and spouse but not for dependents. The add-on…