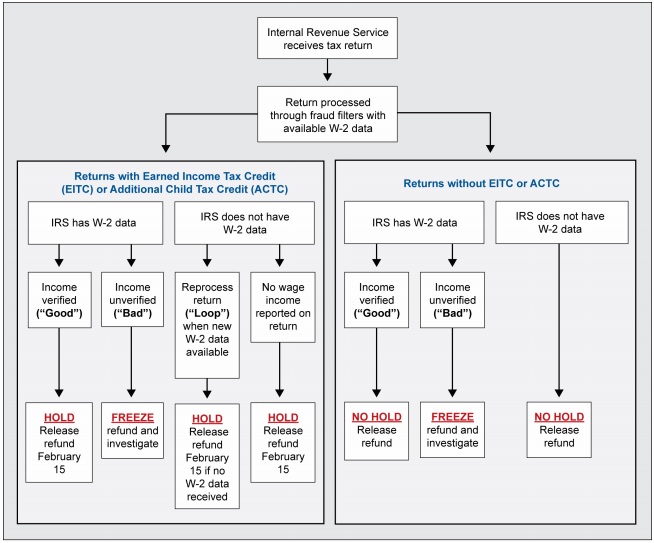

Systemic verification is one element of the IRS’s Return Review Program (RRP), its primary system to detect fraud and noncompliance. The Return Review Program is a platform that runs individual tax returns through a set of rules and models to detect potential taxpayer fraud and other noncompliance. During systemic verification, IRS checks information that taxpayers report on their returns against W-2 data in order to verify wage and withholding information and identify discrepancies.

In years prior to 2017 before PATH ACT wage information that employers report on the W-2 had not been available to IRS until after it issued most refunds. In an effort to address issues such as refund fraud and improper EITC payments, Congress enacted the Protecting Americans from Tax Hikes Act of 2015, which included provisions that took effect in 2017. The act required employers to submit W-2s to the Social Security Administration (SSA) by January 31, which is about 1 to 2 months earlier than in prior years. SSA then provides W-2 data to IRS for verifying employee wage and withholding data on tax returns. The act also required the IRS to hold refunds for all taxpayers claiming the EITC or ACTC until February 15. Now that IRS has earlier access to W-2 information, IRS is using it to conduct additional verification checks before issuing billions of dollars in potentially fraudulent refunds.

Systemic Verification has detected a growing number of fraudulent tax returns

IRS identified more potential fraud and noncompliance through February 15, 2018, than it had by the same time in 2017. In its second year of receiving earlier W-2 data from SSA to match against returns, IRS identified a larger number of potentially fraudulent or noncompliant returns claiming the EITC or ACTC prior to issuing refunds—340,000 compared to 162,000 at the same point in 2017. IRS also reduced the percentage of returns for which it was unable to verify wage information to 13 percent, compared to 58 percent in 2017. IRS has officially stated this was, in part, a result of receiving 224 million W-2s by February 15 compared to 214 million by the same time in 2017. Having more W-2 data available earlier also allowed the IRS to better target its selection of returns for review, helping to reduce taxpayer burden and IRS workload. For example, IRS had excluded 10,000 returns from review as of February 15, 2018, compared to 3,000 during the same time in 2017.

Tax Returns claiming EITC and/or ACTC Credits

The IRS has improved its ability to identify potentially false and fraudulent returns for returns with EITC or ACTC—including those for which it did not have W-2 data at the time of identification—by developing two new filters that automated some aspects of the manual review process used in 2017. IRS developed the new filters based on cases of confirmed fraud identified through systemic verification in 2017 and selected returns with characteristics that are more likely to be fraudulent or noncompliant. The filters select returns for review among those reporting information that does not match corresponding W-2 data and that IRS could not verify because it did not have W-2 data at the time of selection. Last year, IRS identified 12,000 cases of confirmed fraud from the 162,000 cases it selected for review. IRS officials have stated that they anticipate they will continue confirming more cases of fraud and noncompliance in upcoming tax filing seasons as a result of these filters.

Tax Returns with refunds not claiming EITC and/or ACTC Credits

Returns with refunds not claiming EITC or ACTC benefits are also subject to systemic verification as well as additional fraud filters. However, for returns not claiming these benefits,

IRS does not have the data available early in the filing season that would help it better identify which returns are potentially fraudulent or noncompliant. As a result, IRS issues refunds for a large percentage of returns without the EITC or ACTC that cannot be verified against W-2 data prior to February 15.

For example, among 2017 returns without EITC or ACTC, IRS was unable to verify

- 91 percent of returns submitted before January 25, 2018—representing $4.27 billion in refunds; and

- 60 percent of returns submitted prior to February 15—representing $29.27 billion in refunds.

IRS has the authority to hold refunds for these returns (as it does for returns that do claim the EITC or ACTC) until any date deemed necessary to make inquiries, determinations, and assessments in conjunction with those determinations.

IRS Verified Wages and Withholding for Some Returns but Did Not Receive All W-2 Data before Releasing Refunds

While IRS conducts quality and enforcement checks throughout return processing, preliminary data suggest that by using its W-2 systemic verification, including allowing time to input the data for matching, are important steps in IRS’s ability to determine whether the refund amount claimed and taxpayer

- For returns where the taxpayer claimed the EITC or ACTC, preliminary data show that IRS verified the wage information for over 35 percent of these returns before February 15. Moreover, the refund hold allowed IRS time to check returns using its systemic verification when it received more W-2 data. For example, the IRS reported it reprocessed about 1 million returns during the hold period as more data became available. As a result, the IRS said it identified approximately 162,000 returns claiming about $863 million in refunds as potentially fraudulent. According to IRS, those refunds were not allowed to be released on February 15, and the returns were directed for follow up. However, IRS was unable to verify wage information for over 58 percent (7.7 million) of tax returns with refunds claiming the EITC or ACTC—for a total of $38.1 billion—before February 15. This was in part due to the timing of when W-2 information was available, as discussed later in this statement.

- IRS did not hold returns that did not claim the EITC or ACTC unless the return was selected by its other filters (such as for potential IDT refund fraud). On such returns, while IRS also used available W-2 information, it did not hold refunds solely because W-2 information was not available. Preliminary data show that using systemic verification, IRS verified wages of 8.6 million (41 percent) of returns that did not claim the EITC or ACTC before February 15. However, IRS was unable to verify wage information reported on over 58 percent (12.3 million) of these tax returns for a total of $28.1 billion, as not all W-2 data were available and IRS was not required to hold these returns.

The IRS is continuing to study systemic verification’s potential, and is working to identify additional fraud and noncompliance by beginning to match non-wage income reported by taxpayers against data reported on Forms 1099-MISC by companies or individuals that paid the taxpayer miscellaneous income.