Several tax changes are effective in 2022. Some of the more significant changes are:

Child Tax Credits

- Child tax credit reverts back to $2,000 per child under the age of 17 and is only refundable up to $1,500 for low-income parents, and

- Child and dependent care credit for working parents revert back to $1,050 (was $4,000 in 2021) if one child and $2,100 (was $8,000) if two or more children.

Charitable Contribution Limitations

- Taxpayers who do not itemize are no longer able to deduct up to $300 in cash donations to a charity,

- 60% of AGI limitation on charitable gifts of cash is back, effective in 2022, and

- C corporation’s charitable deductions are again limited to 10% taxable income.

Health Savings Accounts

- Deduction increased to $3,650 for single and $7,300 for family coverage plus $1,000 for people born before 1968.

Expired Tax Benefits

- Itemized deduction for mortgage insurance premiums,

- Credit for energy-efficient doors and windows,

- Tax incentives for qualified fuel-cell motor vehicles and two-wheel plug-ins, and

- Shorter depreciable lives for racehorses and business property located on Native American reservations.

Standard Deduction and Capital Gains Adjustments

- Standard deduction increases:

- Joint return of $25,900 plus $1,400 for each if 65 or older,

- Single $12,950 plus $1,750 if 65 or older, and

- Head of household $19,500 plus $1,750 if 65 or older.

- Capital gains thresholds increase:

- 0% rate if taxable income is less than:

- Single tax returns of $41,675,

- Head of household $55,800, and

- Joint return $83,350.

- 15% rate if taxable income is over the 0% limit but less than the relevant taxable income for the 20% rate,

- 20% rate starts at taxable income in excess of:

- Single $459,751,

- Head of household $488,501, and

- Joint return $517,201.

- 3.8% surtax on net investment income is applicable if modified AGI is in excess of:

- Single $200,000, and

- Joint $250,000.

- 0% rate if taxable income is less than:

Retirement Matters

- Social Security’s annual wage base increases to $147,000,

- Dollar limits for contributions to retirement plans:

- 401(k), 403(b), and 457 plans $20,500 plus $6,500 if born before 1973,

- IRAs and Roth IRAs $6,000 plus $1,000 for “catch up” contributions for individuals 50 or older

- Phase out of IRA and Roth IRA benefits:

- IRA deduction phases out for AGI between:

- $109,000 – $129,000 couples, and

- $68,000 – $78,000 singles.

- Roth contributions phase out:

- $204,000 – $214,000 couples, and

- $129,000 – $144,000 singles.

- Required minimum distributions of IRAs:

- Based on newly revised life expectancies that reduce the annual RMD.

- Estate tax:

- Exemption increased to $12,060,000 in 2022,

- As much as $1,230,000 of farm or business real estate is eligible for a discount valuation based on its current use rather than fair market value, and

- If more than 35% of the estate value consists of closely held businesses, as much as $656,000 of the tax can be deferred with only a 2% interest rate on the amount of the deferral.

- Gift tax:

- Annual exclusion increased to $16,000 per donee.

- $204,000 – $214,000 couples, and

- IRA deduction phases out for AGI between:

Business Matters

- Research and development expenses are no longer fully deductible – must be amortized over five years (15 years if accomplished outside the U.S.),

- 20% deduction for income from self-employment and owners of pass-through entities:

- Limitations applicable if taxable income exceeds $340,100 joint or $170,050 single,

- Expensing assets:

- Increased to $1,080,000 but phased out if more than $2,700,000 acquired,

- Cash method availability increased:

- C corporations and partnerships and LLCs that have C corporations as owners can use the cash method in 2022 if their average gross receipts are no more than $27 million, and

- Employees can deduct up to $280/month for reimbursements their employer provides for parking, mass transit passes, and commuter vans.

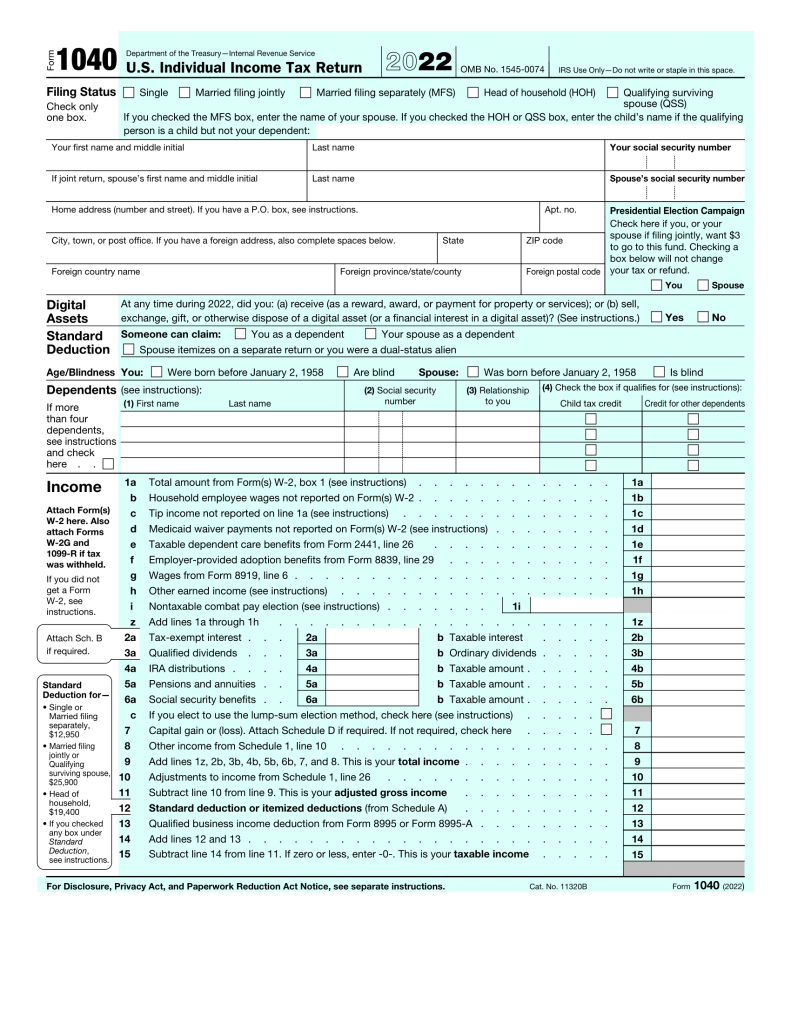

New 1040 Form for 2022

For information about any additional changes to the 2022 tax law or any other developments affecting Form 1040 or 1040-SR or the instructions, go to IRS.gov/Form1040.

Due date of return.

File Form 1040 or 1040-SR by April 18, 2023. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia – even if you don’t live in the District of Columbia.

The filing status name changed to a qualifying surviving spouse.

The filing status qualifying widow(er) is now called qualifying surviving spouse. The rules for the filing status have not changed. The same rules that applied for qualifying widow(er) apply to qualifying surviving spouse. See Qualifying surviving spouse, later.

The standard deduction amount increased.

For 2022, the standard deduction amount has been increased for all filers. The amounts are:

- Single or Married filing separately—$12,950.

- Married filing jointly or Qualifying surviving spouse—$25,900.

- Head of household—$19,400.

New lines 1a through 1z on Form 1040 and 1040-SR.

This year line 1 is expanded and there are new lines 1a through 1z. Some amounts that in prior years were reported on Form 1040 and Form 1040-SR are now reported on Schedule 1.

- Scholarship and fellowship grants that were not reported to you on Form W-2 are now reported on Schedule 1, line 8r.

- Pension or annuity from a nonqualified deferred compensation plan or a nongovernmental section 457 plan is now reported on Schedule 1, line 8t.

- Wages earned while incarcerated are now reported on Schedule 1, line 8u.

New line 6c on Form 1040 and 1040-SR.

A checkbox was added on line 6c. Taxpayers who elect to use the lump-sum election method for their benefits will check this box. See Line 6c, later.

Nontaxable Medicaid waiver payments on Schedule 1.

For 2021, nontaxable amounts of Medicaid waiver payments reported on Form 1040, line 1, were excluded from income on Schedule 1, line 8z. For 2022, nontaxable amounts will be excluded on Schedule 1, line 8s.

Nontaxable combat pay election.

For 2021, individuals elected to include their nontaxable combat pay in their earned income when figuring the earned income credit (EIC) by reporting it on Form 1040 or 1040-SR, line 27b. For 2022, they will make this election by reporting nontaxable combat pay on Form 1040 or 1040-SR, line 1i.

Credits for sick and family leave for certain self-employed individuals are not available.

Self-employed individuals can no longer claim these credits.

Health coverage tax credit is not available.

The health coverage tax credit was not extended. The credit is not available after 2021.

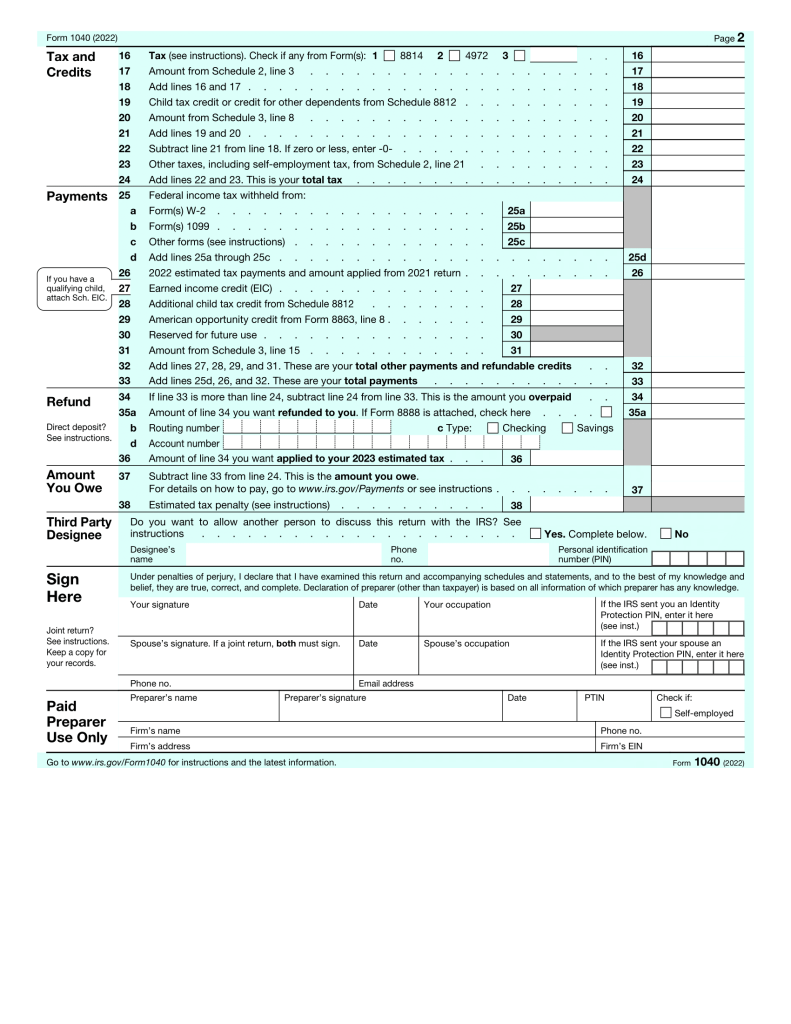

Credit for child and dependent care expenses.

The changes to the credit for child and dependent care expenses implemented by the American Rescue Plan Act of 2021 (ARP), were not extended. For 2022, the credit for the child and dependent care expenses is nonrefundable. The dollar limit on qualifying expenses is $3,000 for one qualifying person and $6,000 for two or more qualifying persons. The maximum credit amount allowed is 35% of your employment-related expenses. For more information, see the Instructions for Form 2441 and Pub. 503.

Child tax credit and additional child tax credit.

Many changes to the child tax credit (CTC) implemented by ARP were not extended. For 2022,

- The initial credit amount of the CTC is $2,000 for each qualifying child.

- The amount of CTC that can be claimed as a refundable credit is limited as it was in 2020, except the maximum additional child tax credit (ACTC) amount has increased to $1,500 for each qualifying child.

- A child must be under the age of 17 at the end of 2022 to be a qualifying child.

- Bona fide residents of Puerto Rico are no longer required to have three or more qualifying children to be eligible to claim the ACTC. Bona fide residents of Puerto Rico may be eligible to claim the ACTC if they have one or more qualifying children.

- For more information, see the Instructions for Schedule 8812 (Form 1040).

Changes to the earned income credit (EIC).

The enhancements for taxpayers without a qualifying child that applied for 2021 don’t apply for 2022. This means, to claim the EIC without a qualifying child in 2022 you must be at least age 25 but under age 65 at the end of 2022. If you are married and filing a joint return, either you or your spouse must be at least age 25 but under age 65 at the end of 2022. It doesn’t matter which spouse meets the age requirement, as long as one of the spouses does.

Reporting requirements for Form 1099-K.

Form 1099-K is issued by third-party settlement organizations and credit card companies to report payment transactions made to you for goods and services.

You must report all income on your tax return unless excluded by law, whether you received the income electronically or not, and whether you received a Form 1099-K or not. Box 1a and other amounts reported on Form 1099-K are additional pieces of information to help determine the correct amounts to report on your return.

If you received a Form 1099-K that shows payments you didn’t receive or is otherwise incorrect, contact the Form 1099-K issuer. Don’t contact the IRS; the IRS can’t correct an incorrect Form 1099-K. If you can’t get it corrected, or you sold a personal item at a loss, see the instructions for Schedule 1, lines 8z and 24z, later, for more reporting information.

All IRS information about Form 1099-K is available by going to IRS.gov/1099K.