Tax credits and deductions change the amount of a person’s tax bill or refund. People should understand which credits and deductions they can claim and the records they need to show their eligibility.

Tax credits

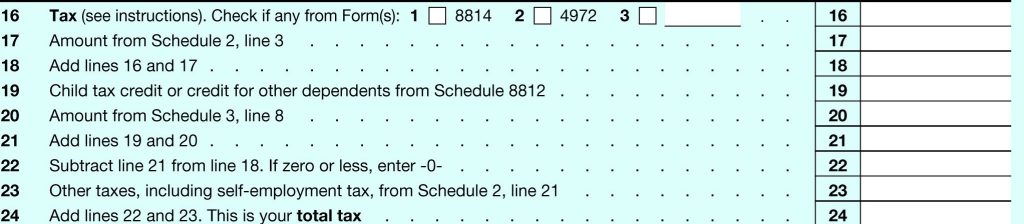

A tax credit reduces the income tax bill dollar-for-dollar that a taxpayer owes based on their tax return.

Notice in the image above, Line 16 represents the amount of tax owed. Lines 17 – 23 represent various tax credits that can be subtracted from the amount owed on Line 16. After all the applicable credits are subtracted your reduced tax liability is entered on Line 24.

Some tax credits, such as the Earned Income Tax Credit, are refundable. If a person’s tax bill is less than the amount of a refundable credit, they can get the difference back in their refund.

To claim a tax credit, people should:

- Keep records to show their eligibility for the tax credits they claim.

- Check now to see if they qualify to claim any credits next year on their tax return.

Deductions

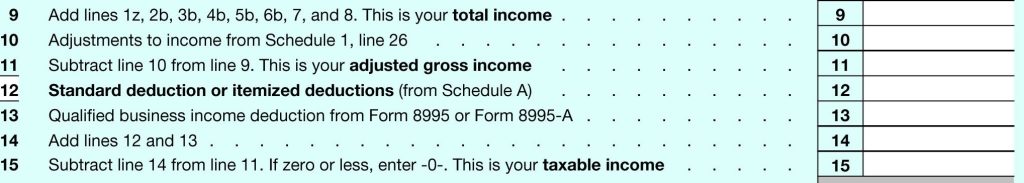

Deductions can reduce the amount of a taxpayer’s income before they calculate the tax they owe.

Notice in the image above. Line 9 represents a person’s total income. Lines 10 & 12 represent deductions that reduce that total income.

Most people take the standard deduction. The standard deduction changes each year for inflation. The amount of the standard deduction depends on a taxpayer’s filing status, age whether they’re blind, and whether the taxpayer is claimed as a dependent by someone else.

Some people must itemize their deductions, and some people may choose to do so because it reduces their taxable income more than the standard deduction. Generally, if a taxpayer’s itemized deductions are larger than their standard deduction, it makes sense for them to itemize.

Non-refundable vs Refundable Credits

Tax credits fall into two categories. Refundable and non-refundable. Non-refundable credits allow someone to receive a tax credit up to the amount of their tax liability. For example, if someone qualified for a $1000 non-refundable tax credit but their tax liability was only $500. They would only be able to use $500 of that tax credit.

Non-refundable credits include:

- · Adoption credit

- · Foreign tax credit

- · Mortgage interest tax credit

- · Credit for the elderly and disabled

- · Electric vehicle credit

Refundable credits allow taxpayers to receive credit beyond the amount of their tax liability even if it results in them receiving a tax refund. For example, if someone qualified for a $1000 refundable credit and their tax liability was $500. They would use the full credit and receive a $500 tax refund.

Refundable credits include:

- · Child tax credit

- · The earned income tax credit

- · The child and dependent care credit

- · The saver’s credit

Interactive Tax Assistant

Find help with tax questions based on specific circumstances with the Interactive Tax Assistant. It can help a person decide if they’re eligible for many popular tax credits and deductions.

More information:

- Tax credits for individuals: What they mean and how they can help refunds

- Deductions for individuals: What they mean and the difference between standard and itemized deductions