The Processing Date represents the date when the IRS expects to have your tax return and tax refund processed.

IRS Transcript Processing Date

What is a Tax Transcript Processing Date?

The processing date is a computer-generated date set by the IRS system. The Processing date is internally set to remind the IRS system to finish up your tax account and to either give a direct deposit date, post any additional code(s), or resequence the return (send it back through the system) when this happens the tax return will be pushed back to a future cycle week.

How do I find my Tax Transcript Processing Date?

To access your tax account transcript online, you need to visit the “Get Transcripts” page on the IRS website. From there, you’ll create your online account if you don’t have one already. Once signed in, you’ll click the link to View Tax Records and then click the GET TRANSCRIPT ONLINE button. From the dropdown menu, you’ll pick a reason for needing a transcript.

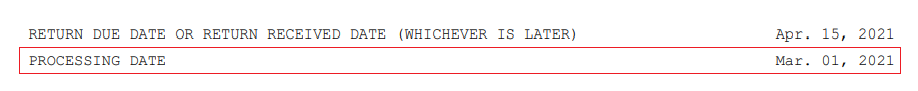

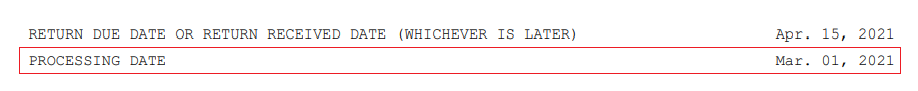

Where is my Tax Transcript Processing Date located?

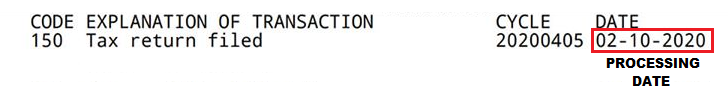

Once you have gained access to your tax record of account transcript, scroll down to the EXPLANATION OF TRANSACTION section of the document. There you’ll find a column labeled DATE that will provide your IRS Processing Date. Your processing date will be the first date printed in the DATE Column. The processing date will be located to the right of the cycle code as shown in the image below.

The processing date located on the record of the account transcript will begin the same as the date displayed next to the TC150 tax return filing date. This date could change depending on the different actions that take place in the tax account.

Processing Date highlighted in red -This computer-generated date shows the week that your 21 days are estimated to be up. This date will always be set for a future Monday date and be generated for 3 weeks out (7 days x 3 weeks = 21 days) from the cycle codes date.

Will my IRS Processing Date be the same as last year?

No, each time you file a new tax return or amended tax return your tax account will be assigned a new processing date. Your processing date can also update or change at different stages during the processing of your tax account.

Can my IRS Processing Date Change during the tax season?

Your processing date can update or change at any time during the tax season due to the resequencing of your tax return in the IRS master file. Resequencing could result in your tax return being sequenced through one or more processing cycles and could result in the tax refund being delayed past the original 21-day computer-generated estimated date.

IRS Transcript Transaction Processing Dates

What are all the other dates listed under the first processing date?

The area highlighted in blue in the image below is the transaction processing dates.

Transaction Processing Date

What are the Transaction Processing Dates?

The transcript transaction processing date column shows the effective date of a transaction on a tax account, and the date listed on the line across from the transaction represents the date the IRS processed or plans to process the transaction.

Can the Transaction Processing Dates Change?

TRANSACTION PROCESSING DATES DO NOT CHANGE. These are computer-generated dates for the tax record that documents the date the IRS processed the specific transaction. If transactions are added to your tax account the transactions will be documented and added to the list with new dates representing when the transaction will process.