IRS Account Transcripts Transaction Codes

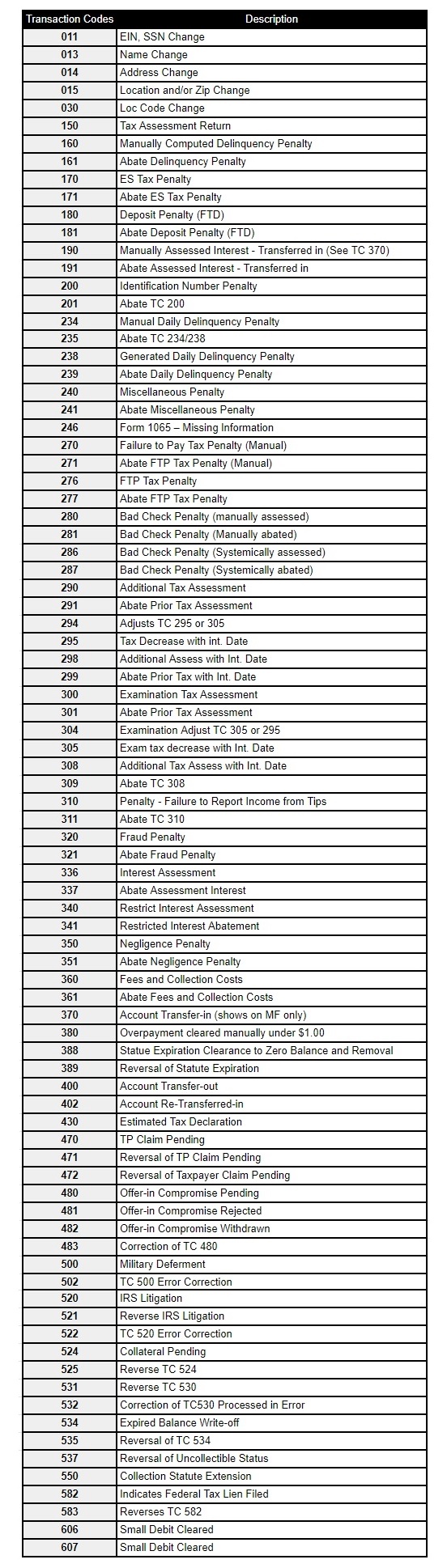

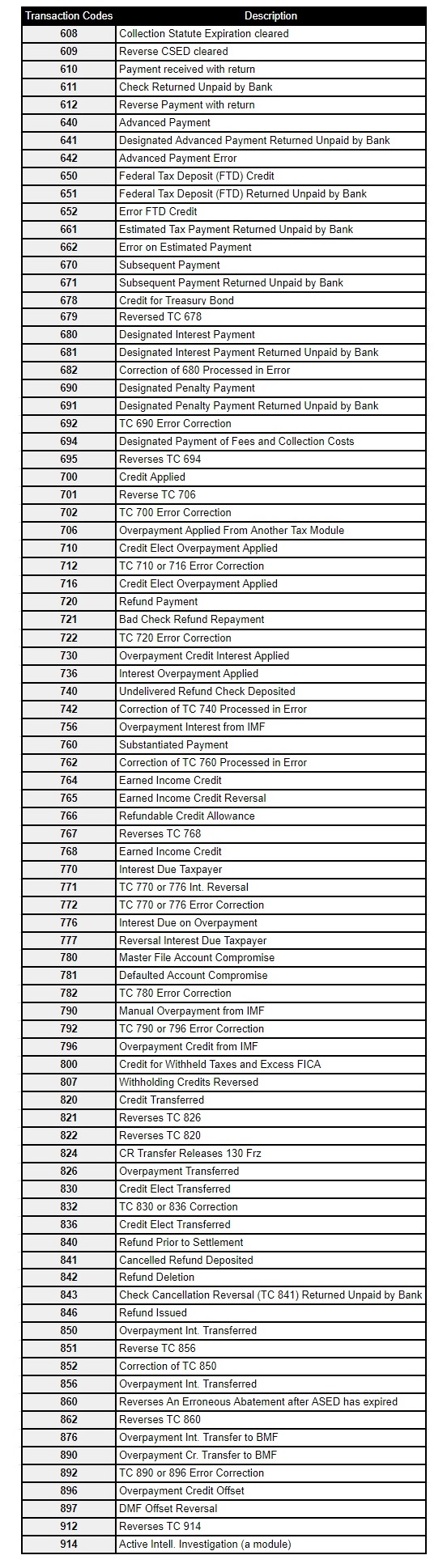

Transaction Codes (TC) can be found on your account transcript and consist of three digits. They are used to identify a transaction being processed and to maintain a history of actions posted to a taxpayer’s account on the Master File. Every transaction processed must contain a Transaction Code to maintain Accounting Controls of debits and credits, to cause the computer at Enterprise Computing Center to post the transaction on the Master File, to permit compilation of reports, and to identify the transaction when a transcript is extracted from the Master File.

Below are common Transaction Codes frequently found on your Account Transcript

Common Tax Transcript Transaction Codes

- TC 150 – tax return was filed – which means the return has started processing and posted to your account.

- TC 290 – Additional Tax Assessed

- TC 428 – Examination or Appeals Case Transfer

- TC 460 – Extension of Time for Filing

- TC 480 – Offer in Compromise Pending

- TC 494 – Notice of Deficiency

- TC 520 – IRS Litigation Instituted

- TC 530 – Indicates that an account is currently not collectible

- TC 570 – Additional Liability Pending or Credit Hold

- TC 571 – Reversal of TC 570 code releases the Freeze

- TC 582 – Lien Indicator

- TC 766– Credit to your Account

- TC 766 – Refundable Credit Allowance or IRS TOP Offset Reversal w/OTN

- TC 767– Reduced or removed credit to your account Generated Reversal of Refundable Credit Allowance or Rejected TOP Offset

- TC 768 – Earned Income Credit

- TC 776 – Interest Credited to your Account

- TC 806 – Reflects any credit the taxpayer is given for tax withheld, as shown on the tax return and the taxpayer’s information statements such as Forms W-2 and 1099 attached to the taxpayer’s tax return

- TC 810 – Refund Freeze

- TC 811 – Refund Release

- TC 820 – Refund used to offset prior IRS Debt

- TC 836 – Refund you chose to apply for next year’s taxes.

- TC 840 – Manual Refund

- TC 846 – Refund Issued or approved

- TC 898 – Refund used to offset FMS Debt

- TC 922 – Review of unreported income

- TC 971 – Misc. Transaction

- TC 971 – Notice Issued

- TC 976 – If a duplicate return is filed, TC 976 is attached to your account to indicate more than one return has been posted. Duplicate filings are a strong indication that identity theft may have occurred, and you should contact the IRS to conduct a further investigation into the issue. Your account will be marked TC 971 when identity theft is suspected either by IRS or by your report to the agency.

- TC 977 – Amended Return Filed

Here, you can access a comprehensive list of all IRS Transaction Codes

IRS-Transcript-Codes-PDF

Also, check out our Transcript Resource Page Here for more info!