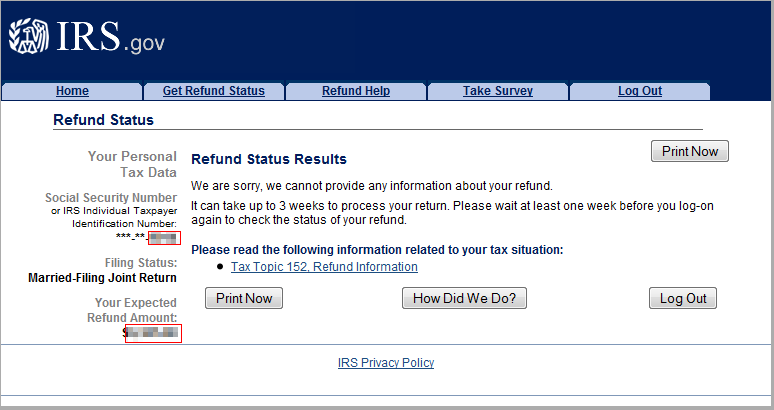

When you check your tax refund status at IRS.gov or on the IRS2GO app you may get a refund status from the IRS Where’s My Refund? site telling you “We are sorry, we cannot provide any information about your refund.”

There may be something wrong with the tax return you filed and the information on file in the IRS database. Once your tax return reached the IRS the tax return may not have met the initial acknowledgment tests or another problem was discovered. If you are seeing this message wait a few days or a week and check back.

Based on our research this refund status message can mean a couple of things.

- You may not have entered your refund status information correctly on WMR. Please make sure when you check your refund status you enter the information EXACTLY AS IT APPEARS ON YOUR TAX RETURN.

- Be sure you have waited at least 24 hours after acceptance before using the IRS WMR tool.

- Be sure you enter the correct SSN and Filing Status.

- Be sure you are using only the Federal Refund Amount. Do not include any state refund or any total refund that would include state and federal combined.

- Also, be sure you are using the Federal Refund Amount before any Tax Preparation fees are taken out (if you chose that option.)

- Look at your actual Federal return to get the Federal Refund Amount, i.e., your Form 1040, Line 35a.

- You can also try phoning the IRS refund hotline at 1-800-829-1954

Identity Verification Requirements

The system has frozen your return due to an Identity Verification Issue and the IRS will be sending an Identity Verification Notice by mail with more instructions.

What is the Initial Tax Return Acknowledgement Test?

- Incorrect name. Believe it or not, one of the most common errors when it comes to tax returns rejected has to do with naming. Specifically, people make errors entering and spelling their names, or their spouses’ names if the couple is filing jointly.

- Incorrect address. The house number, street spelling, road abbreviation, and zip code are all potential spots for error.

- Incorrect date of birth. Incorrectly entering the date of birth information will cause your tax return to be rejected.

- Incorrect direct deposit information. Direct deposit generally means you’ll get a tax refund sooner, but it could also get your tax returns rejected. Be sure to enter your bank’s routing number and account number correctly.

- Incorrect employer/employee information entry. This might include incorrectly entering an EIN from 1099, or it might include incorrectly entering an employee’s social security number or other information.

- The previous year’s AGI doesn’t match. You’re required to enter your previous year’s AGI when e-filing, and if it doesn’t match it will reject your return.

- The PIN doesn’t match. The pin number associated with your account EIN was entered incorrectly. Tax returns rejected for this reason are quite common.

- Dependent claims. This is, of course, one of the most common with individual tax returns, The taxpayer’s social security number has already been claimed on a return. This may be an entry error, or it may indicate fraudulent use of your social security number by someone else.

- Problems with a particular form. If you’re claiming the Earned Income Tax Credit, for example, there may be a problem with the particular forms related to that credit.

Try checking your refund status on the automated phone line.

If the mobile and web app is showing “We cannot provide any information about your return” try dialing 1-800-829-1954 to check your tax refund status.

Identity Verification

Go back and check the actual tax return for the correct information. Numerous failed refund status attempts with incorrect taxpayer information will cause the IRS to lock your account and the system will follow up with a letter to verify your identity.

Most of the time when you see the “we cannot provide any information about your return” message you will be required to verify yourself with the IRS. The IRS will issue a 5071C Notice in the mail with a code and a phone number wanting you to verify the information you submitted on your tax return. If you do not receive any letters or see any updates or changes to your refund status within 21 days you may want to try to call the IRS for assistance.

“We cannot provide any information about your return”

We have noted that some taxpayers may see the “we cannot provide any information about your return” message for up to 2-4 weeks before updating back to a normal processing screen. These are simple cases the IRS systems can correct without further information. But for the majority of filers stuck on this message, we have noted that the taxpayer will have to wait for an identity verification letter or may need to visit their local IRS branch to verify who they are.