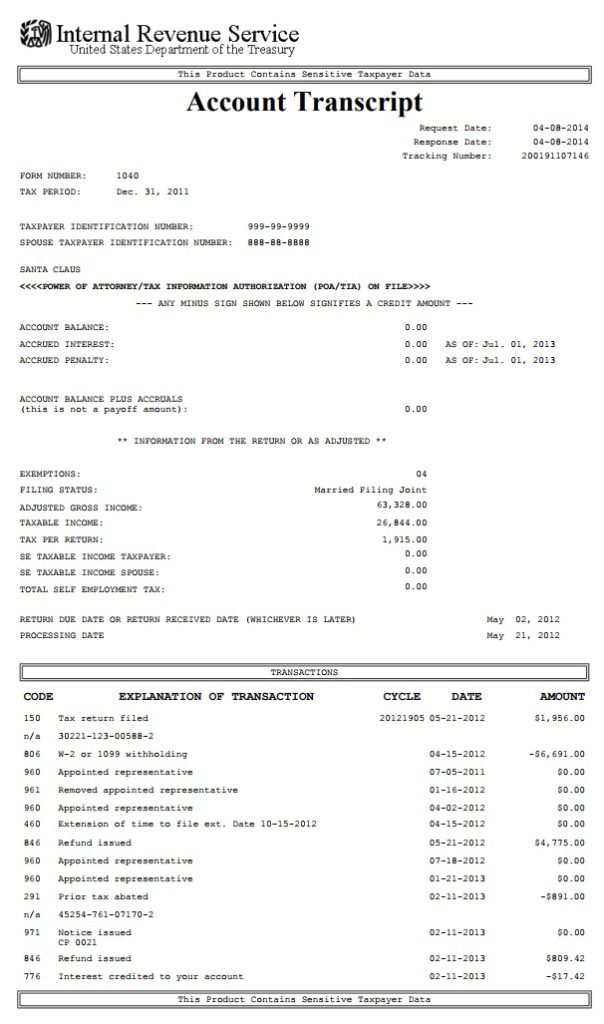

An IRS Account Transcript is an official record of your tax return activity, payments, and IRS actions for a specific tax year. It includes important transaction codes, dates, balances, account holds, offsets, and adjustment details that help you understand where your tax return stands in the IRS processing system.

If you are waiting on a tax refund, dealing with an audit, identity verification, an amended return, or an IRS notice, your Account Transcript is one of the most helpful tools available. Taxpayers use it to track progress, investigate delays, confirm payments, and understand the next steps in the process.

What Information Appears on an IRS Account Transcript?

An Account Transcript includes:

- Return Received Dates

Shows when the IRS officially received and started working on your return. - Transaction Codes (TCs)

Three-digit codes that represent actions taken on your account, such as:- TC 150 – Return filed

- TC 570 – Additional review or freeze on your refund

- TC 846 – Refund issued

- Account Balances & Adjustments

Whether you owe money or are receiving a refund. - Cycle and Processing Dates

Indicators of when your return is updated in the IRS system and when a refund may be released. - Offsets

If your tax refund is reduced to pay a past-due debt such as child support or student loans. - Hold & Review Flags

Alerts when certain returns require manual handling or additional verification.

Why Would You Need an Account Transcript?

Taxpayers commonly access this transcript to:

| Situation | How the Transcript Helps |

|---|---|

| Waiting on a refund | Shows processing progress and any delays |

| IRS sent a notice | Confirms what triggered the notice |

| Amended tax return | Helps identify adjustments and completion status |

| Applying for a loan or mortgage | Used as proof of tax filing |

| Identity verification cases | Shows verification and release dates |

It makes refund tracking much more reliable than checking the Where’s My Refund tool alone because updates appear here first.

How to Request Your Account Transcript

You can get a free copy online through Get Transcript Online at IRS.gov.

- Log in or create an IRS Online Account

- Select the tax year you want to review

- Download or print the PDF

You can also request transcripts by mail using Get Transcript by Mail, but processing usually takes 5–10 business days.

Key Things to Look For

- TC 150 – IRS has processed your filed return

- As-Of Date – IRS system date used to track progress

- Cycle Code – Indicates which day your account updates

- TC 846 – Refund is being issued

If you spot TC 570 or TC 971, it may mean your refund is paused for review — but not necessarily denied.

Summary

An IRS Account Transcript is one of the most valuable sources of information taxpayers can access. Whether you’re waiting on your refund, responding to a notice, or checking for errors, this transcript allows you to understand what’s happening behind the scenes at the IRS and what to expect next.