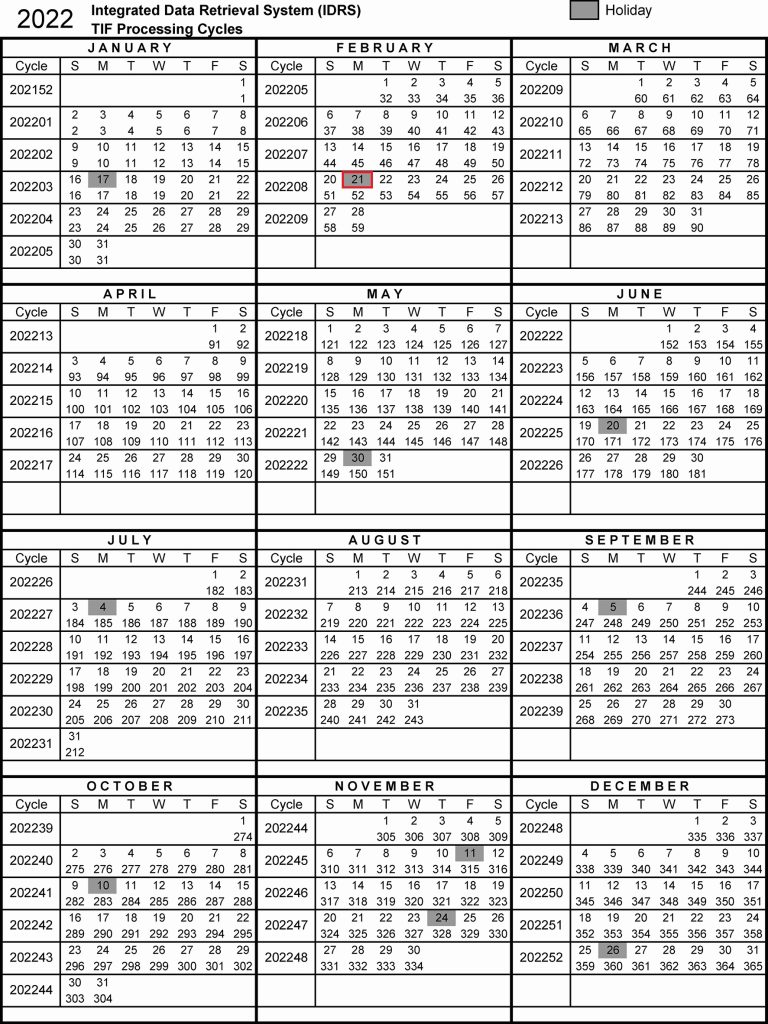

The Internal Revenue Service (IRS) recognized Presidents Day as a federal holiday and is therefore closed. In anticipation of the upcoming holiday, the IRS warned people who planned to call before and after the holiday that they could experience longer wait times. The organization added that Tuesday, February 22, the day after Presidents Day will be the busiest day of the year.

With a surge of tax returns expected the two weeks following the February 21 Presidents Day holiday, the Internal Revenue Service is offering taxpayers several tips and various time-saving resources to get them the help they need quickly and easily.

To help avoid this period of high telephone demand, the IRS encourages taxpayers and tax preparers to use online resources available at IRS.gov. And when it comes time to file, taxpayers are encouraged to file electronically and choose direct deposit for faster refunds. Filing electronically reduces tax return errors as the tax software does the calculations, flags common errors, and prompts taxpayers for missing information.

Here are a few featured tips to avoid the rush.

- Use IRS.gov to track refunds. The IRS issues more than nine out of 10 refunds in less than 21 days. IRS customer service representatives cannot answer refund questions until it has been 21 days or more since the taxpayer filed electronically, or six weeks since they mailed a paper return. But taxpayers can track their refund anytime by using the “Where’s My Refund?” tool on IRS.gov and the IRS2Go app. Taxpayers can also call the IRS refund hotline at 800-829-1954.

- Taxpayers claiming the Earned Income Tax Credit or the Additional Child Tax Credit can use the “Where’s My Refund?” tool to track refunds too. By law, the IRS cannot release refunds that include EITC or the ACTC before February 15. “Where’s My Refund?” on IRS.gov and the IRS2Go app will be updated with projected deposit dates for most early EITC/ACTC refund filers by February 19. IRS expects most EITC/ACTC related refunds to be available in taxpayer bank accounts or on debit cards by the first week of March, if they chose direct deposit and there are no other issues with their tax return.

- Use IRS.gov to find answers to tax questions. IRS offers a variety of online tools to help taxpayers answer common tax questions. For example, taxpayers can search the Interactive Tax Assistant, Tax Topics, Frequently Asked Questions, and Tax Trails to get faster answers.

- Let free tax software or free volunteer assistance do the work. Most taxpayers who want to prepare their own returns can file electronically for free with IRS Free File. Alternatively taxpayers who qualify can get free tax help from trained volunteers at community sites around the country.

- Turn to a trusted tax professional. To find more information about choosing a tax return preparer, including understanding the differences in credentials and qualifications, visit www.irs.gov/chooseataxpro.

- Make an appointment before visiting an IRS Taxpayer Assistance Centers. Anyone who needs face-to-face service should make an appointment before showing up. Most TAC visits can be avoided by using online tools available on IRS.gov.

- Call the employer first for that missing Form W-2. Those who have not received a Form W-2, Wage and Tax Statement, from one or more employers should first contact the issuer to inform them of the missing form. Those who do not get a response must still file on time and may need to use Form 4852, Substitute for Form W-2, Wage and Tax Statement (PDF), or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans and IRA’s Insurance Contracts (PDF).

- Use the IRS Services Guide (PDF) and the Let Us Help You page on IRS.gov to find additional ways to get help.

- Use the Tax Information for Members of the Military page on IRS.gov for details on tax benefits for military members and veterans, filing options and more.

You can also find answers and support in our tax community

Check out our Facebook community group to find answers and support to the majority of your tax season questions.