IRS Daily and Weekly Account Processing

What is the difference between IRS Daily and Weekly Accounts?

The difference is when your tax return is processed, and when updates are made and posted to your account.

Daily Accounts:

Daily Tax Accounts:

Certain individual tax returns undergo daily processing without requiring any additional actions to the taxpayer’s account on the master file. These returns are typically straightforward, with no credits involved.

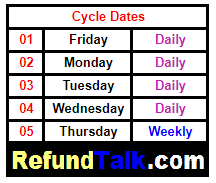

- If your cycle code ends with 01, 02, 03, or 04, your account is subject to daily processing, with updates typically posted on Tuesday and Wednesday mornings.

- Daily Account tax returns are processed Friday(01), Monday(02), Tuesday(03), Wednesday(04)

- Direct deposit updates for daily accounts are reflected on tax transcripts every Tuesday morning.

- Direct deposit updates for daily accounts are reflected on Where’s My Refund? tools every Wednesday morning.

Weekly Tax Accounts:

Taxpayer accounts are typically processed weekly, with the majority of taxpayers receiving tax refunds. In cases involving a tax refund, accounts are often processed on a weekly basis.

- If your cycle code ends with 05, your account follows a weekly processing schedule, with updates typically posted on Friday and Saturday mornings.

- Weekly Account tax returns are processed only on Thursdays(05)

- Direct deposit updates for weekly accounts are reflected on tax transcripts every Friday morning.

- Direct deposit updates for weekly accounts are reflected on Where’s My Refund? tools every Saturday morning.

Tax returns needing additional verification for accuracy are processed weekly to provide the IRS ample time for thorough review and correction before posting to the Master File. The IRS has integrated specific measures into its software planning to pinpoint tax return transactions and taxpayer accounts necessitating extra scrutiny pre-processing. Approximately 148 million taxpayer accounts have been identified by the IRS with characteristics triggering weekly processing, termed as “disqualifiers.”

- Entity: Entity disqualifiers relate to transactions or characteristics that are in the entity portion of a tax account. Examples include accounts marked as identity theft, accounts in bankruptcy litigation, and accounts with an IRS processing center zip code.

- Tax Module – Freeze: Tax Module Freeze disqualifiers relate to conditions present on the individual tax periods within a tax account. Examples include tax periods with a claim pending, with an offer-in-compromise, or marked uncollectible.

- Tax Module – Transactions: Tax Module Transaction disqualifiers relate to codes or transactions present on the individual tax periods within a tax account. Examples include tax periods with certain penalty transactions or underreported issues.

- Incoming Transactions: Incoming transaction disqualifiers relate to conditions posted to tax periods during the prior tax Filing Season. Examples include changes to the tax account or adjustments made to the tax return as a result of actions taken at the time the tax return is processed.

How to determine if your tax return follows daily or weekly processing:

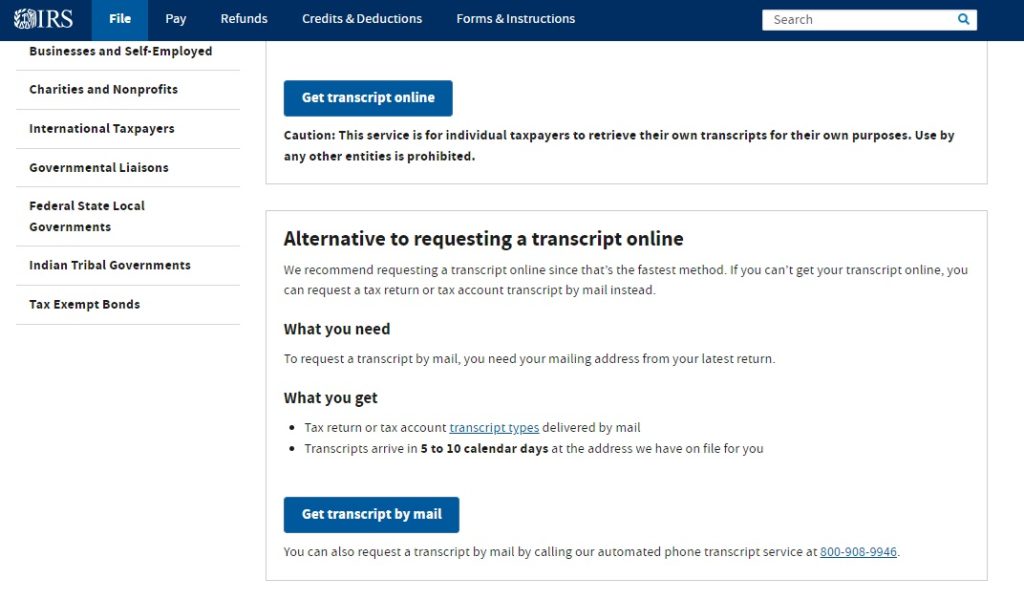

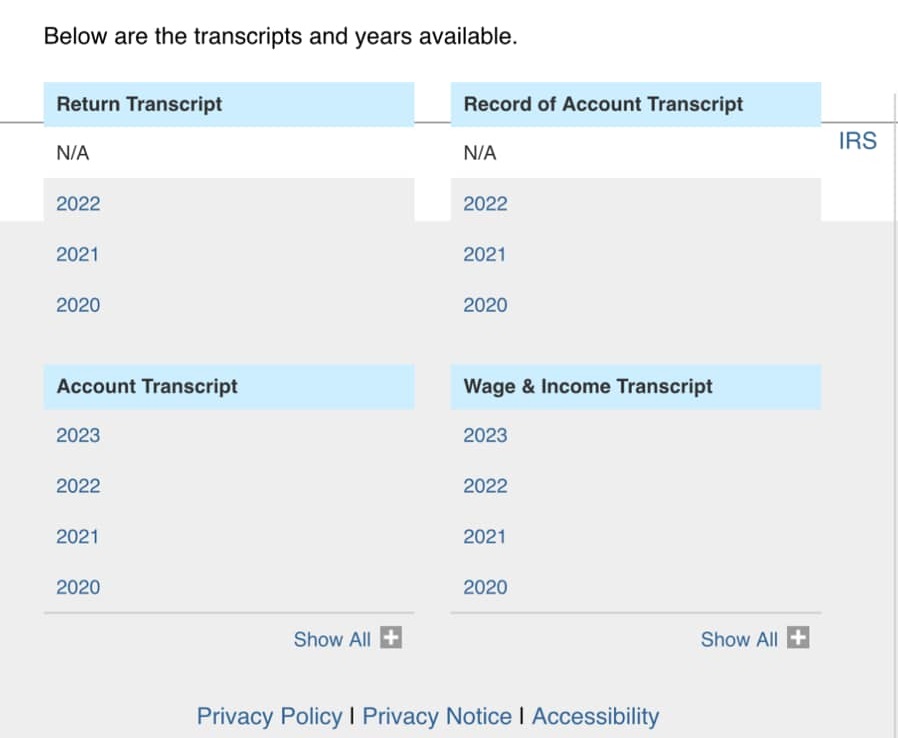

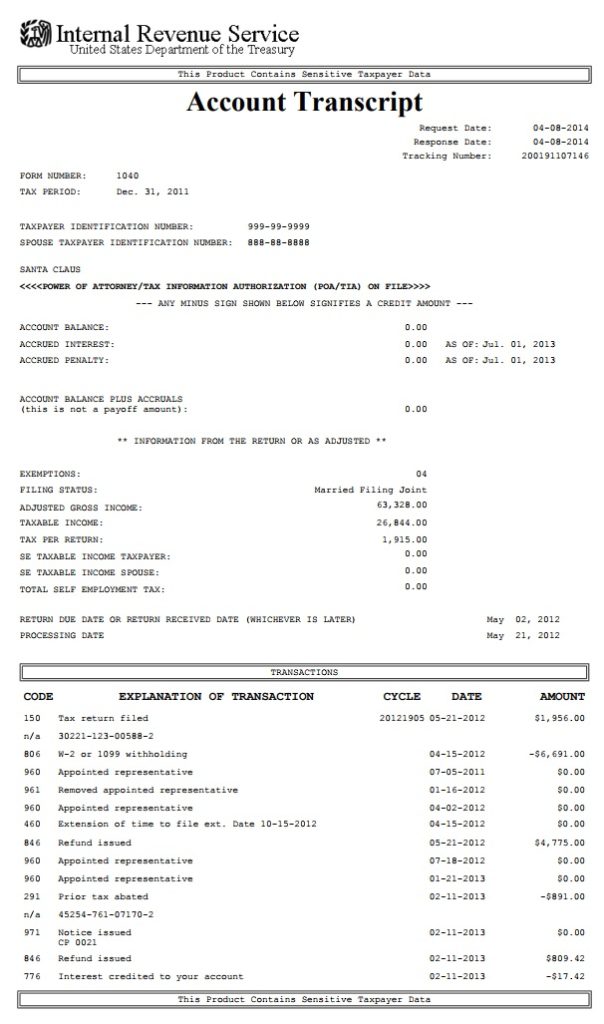

1. To locate your cycle code, it’s essential to have access to your current year’s Account Transcript.

2. Obtain a Copy of your Account Transcripts (If you need help you can visit our Transcript Resources Page)

3. Click on the most recent tax year and your Account Transcript will appear in a new window.

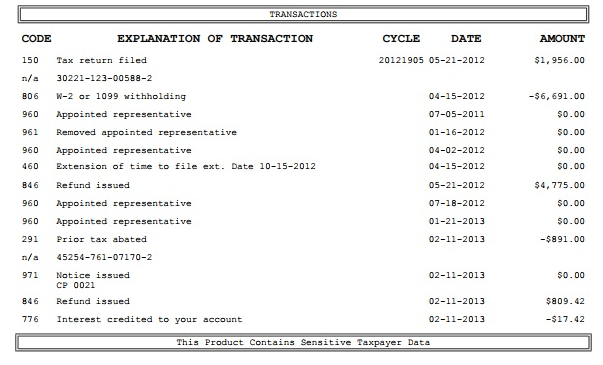

4. Look for the Transactions Sections on your Account Transcript

5. Locate your Cycle in the Transactions section of the Account Transcript

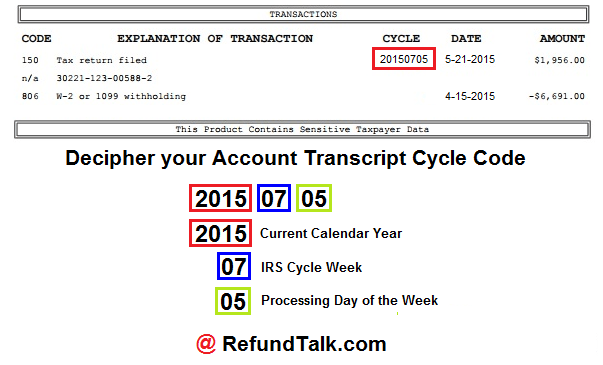

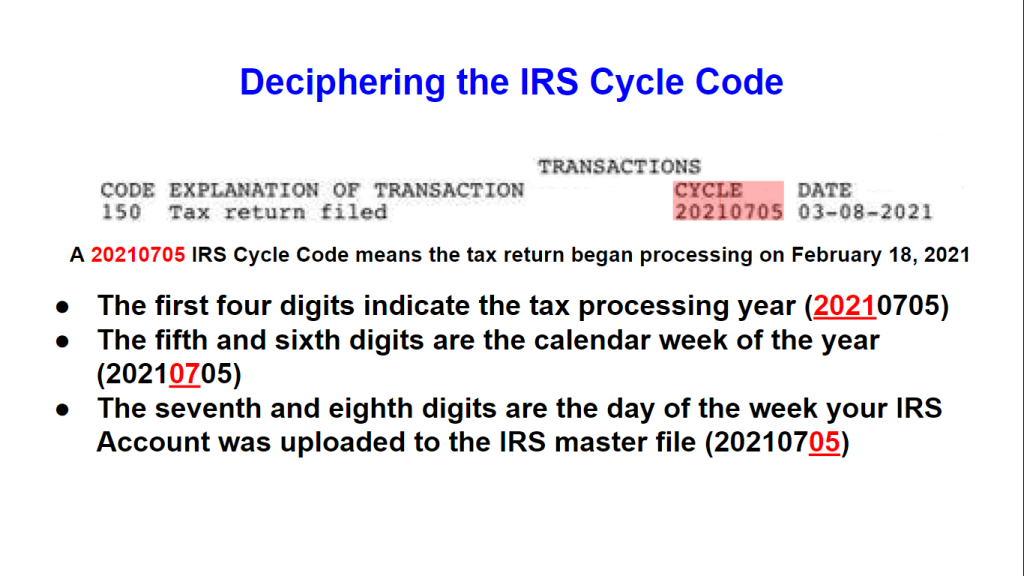

As highlighted in red above Cycle #20150705 is the day your return was posted to the IMF (Individual Master File) and began processing.

*The Processing Day of the Week the last two digits of your cycle code will determine if you are a Daily or Weekly Account.

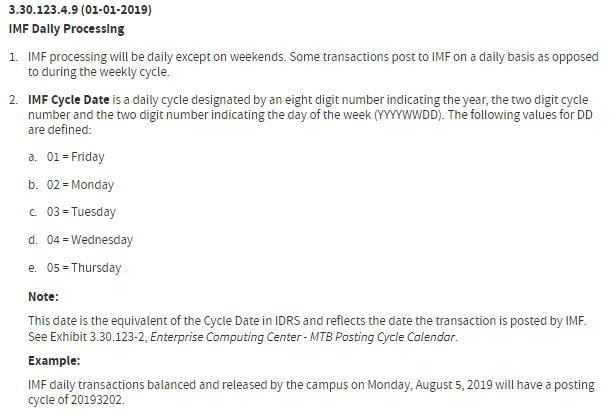

What is the Cycle Code?

An IRS Cycle Code serves as a distinct identifier assigned to every batch of tax returns processed by the Internal Revenue Service (IRS) within a specified timeframe. It aids in the efficient tracking and management of tax return processing. Typically, the cycle code comprises eight digits: the first four digits denote the processing year, the middle two digits represent the calendar week during which the return was received and processed, and the last two digits indicate the day of the week (ranging from 01 to 05) when the return underwent processing. Familiarizing yourself with the cycle code can offer valuable insights into the timeline of your tax return processing and the issuance of your refund.

Is my Cycle Code the same as last year?

No, Your cycle code will be different each year that you file a tax return.

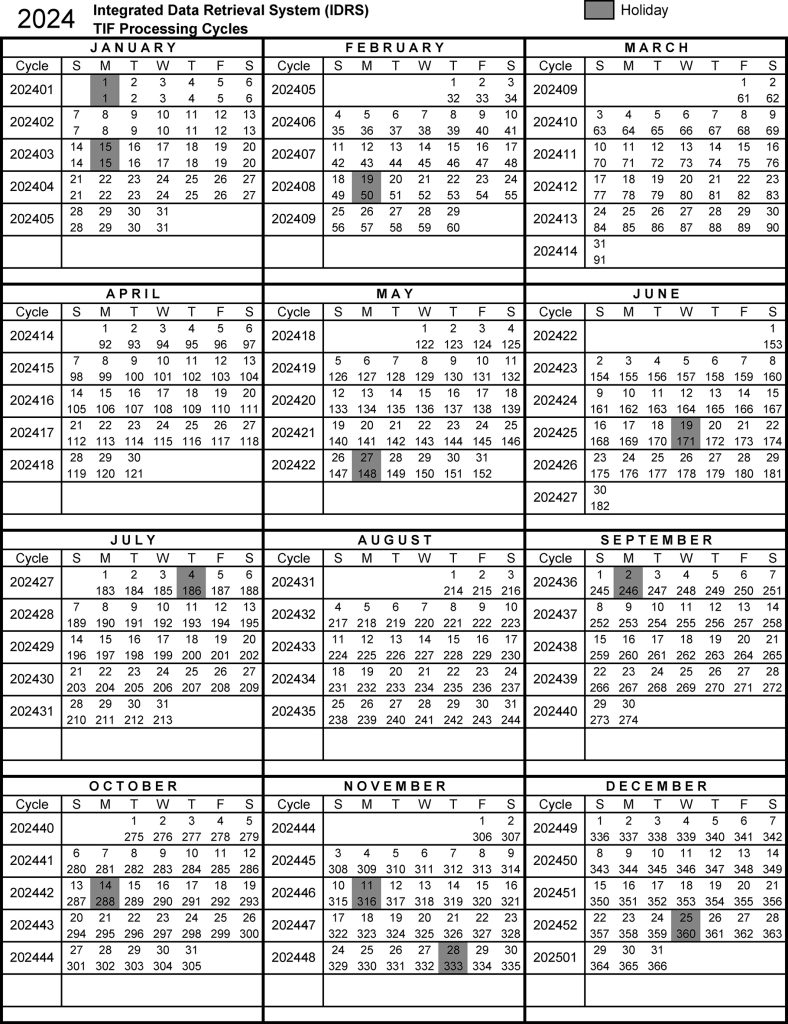

Use the charts below to help you translate your cycle code to a calendar date

Daily & Weekly Cycles with PATH

All tax returns will start out either to be daily or weekly accounts once you first get accepted into the Master File. If you are claiming Earned Income Credit or Additional Tax Credits and will be affected by the PATH LAW. All returns claiming the two mentioned credits above will be held under a C-Freeze. When your return is held under a C-Freeze this forces the tax return to update only on a weekly schedule. Everyone with the PATH message whether their cycle code ending in 01, 02, 03, 04, or 05 should see WMR updates on Saturdays. When a C-Freeze is on the account the computer forces the account to post updates on Where’s My Refund(WMR) on Saturdays.