If you claimed the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) on your 2024 tax return, here’s what you need to know about your refund timeline!

The moment we’ve all been waiting for is almost here! 💰 If you’re claiming EITC/ACTC, you might think your refund will update immediately after the PATH Act hold lifts on February 15, 2025—but hold on! This year, updates will take an extra week due to IRS processing timelines.

📅 Key Refund Dates to Watch:

✅ February 21, 2025 (Friday): Many taxpayers will see Code 846 – Refund Issued appear on their IRS tax transcripts. 📄

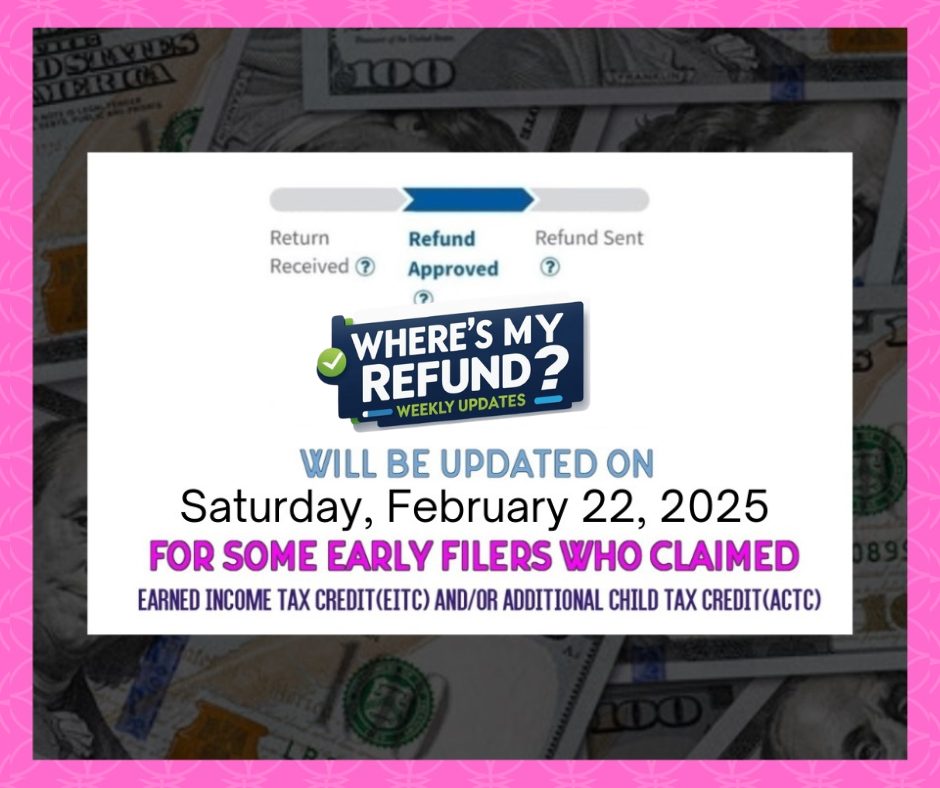

✅ February 22, 2025 (Saturday): The Where’s My Refund? (WMR) tool will update with direct deposit dates for early EITC/ACTC filers. 📲💻

✅ February 26, 2025 (Wednesday): The first wave of direct deposits is expected to hit bank accounts and prepaid cards! 💵🏦

💡 Some taxpayers may receive their refunds as early as February 22, but most will see deposits by February 26, 2025.

🔎 Why the Delay?

The Protecting Americans from Tax Hikes (PATH) Act requires the IRS to hold refunds that include the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) until mid-February to help prevent fraud and identity theft.

📌 The PATH Act hold lifts at 11:59:59 PM on February 15, but because of how the IRS processing cycle falls, EITC/ACTC filers WILL NOT be included in the usual early morning update on February 15. This year, because of how the calendar and tax law align, refunds will take an extra week to process. If you’re affected, you may still see a PATH Act message or “Being Processed” status before February 22, 2025 while the IRS finalizes your return.

📢 How to Track Your Refund:

🔹 Tax Transcripts – Check for updates on February 21 in your IRS account.

🔹 Where’s My Refund? (WMR) Tool – Updates will start February 22.

🔹 IRS2Go App – Get refund status updates on your phone.

📢 Remember: This will be the longest wait between February 15 and the first round of updates since 2020!

💭 What does this mean for you? If your return is error-free, your refund is still on track to arrive by late February to early March.

✨ Share this with fellow taxpayers & stay tuned for future updates! 💸💸