The mess of education-related tax breaks available to taxpayers will become a bit easier to navigate in the coming years if the Consolidated Appropriations Act of 2021 is signed into law. The year-end act, which provides for regular government funding, coronavirus-related relief, and various other congressional priorities, would clean up a temporary education-related tax break that has caused confusion for many taxpayers.

The year-end act would eliminate the temporary deduction for tuition and fees for tax years after 2020 in favor of expanding the income limits for the Lifetime Learning Credit, a permanent tax credit already available to taxpayers for many of the same expenses. The Joint Committee on Taxation estimates the change would reduce federal tax revenue by $5.9 billion from 2021 through 2030.

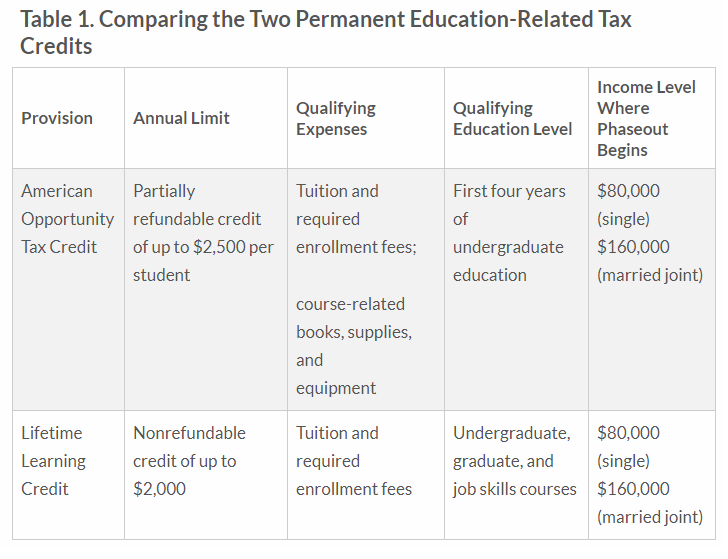

When filing their taxes, students had to choose between the temporary tuition and fees deduction or one of two permanent credits, the Lifetime Learning Credit or the American Opportunity Tax Credit.

The deduction did not require taxpayers to itemize (it was an above-the-line deduction) and allowed taxpayers to deduct up to $4,000 of qualified expenses for undergraduate or graduate education. It could not be used in combination with either of the credits or if income exceeded $80,000 for single filers or $160,000 for joint filers. The deduction was part of a collection of tax breaks known as “tax extenders” that routinely expired and then were reauthorized. This created confusion. Sometimes it looked the deduction would not be available, only to change at the last minute.

The overlap between the deduction and the credits also caused confusion for families trying to decide which was best to take. Research indicates they didn’t always choose optimally, sometimes leaving hundreds of dollars on the table. Part of that stemmed from the way in which deductions differ from credits. Though a $2,000 tax credit might sound smaller than a $4,000 deduction, the credit would reduce tax liability by a greater amount than the deduction. The benefit of a deduction depends on the tax rate a taxpayer’s faces. For example, at a 10 percent tax rate, a $4,000 deduction reduces tax liability by $400. At a 12 percent tax rate, the same deduction reduces tax liability by $480. Tax credits don’t depend on tax rates, but instead directly reduce tax liability.

In exchange for eliminating the temporary tuition and fees deduction, the year-end act would increase the income limits of the Lifetime Learning Credit. The credit provides a maximum annual amount up to $2,000 per tax return, calculated as 20 percent of the first $10,000 of qualified expenses, and it is nonrefundable. Undergraduate, graduate, and job skills courses qualify. Instead of phasing out at income levels starting at $59,000 for single filers and $118,000 for joint filers, the phaseout will begin at $80,000 for single filers and $160,000 for joint filers. Higher phaseout limits will help hold the vast majority of taxpayers harmless from the elimination of the temporary tuition and fees deduction.

The other permanent credit, the American Opportunity Tax Credit, will remain the same. It provides a maximum annual amount of $2,500 per student, calculated as 100 percent of the first $2,000 in qualifying expenses and 25 percent of the next $2,000 in qualifying expenses for the first four years of undergraduate education. If the credit reduces a taxpayer’s liability to zero, then up to $1,000 may be refunded. The credit is subject to income limits: to claim the full credit, income must be below $80,000 for single taxpayers ($160,000 married filing jointly). Taxpayers cannot claim the credit if income exceeds $90,000 ($180,000 married filing jointly).

These two education-related tax credits are permanent parts of the tax code. Taxpayers will still have to make a choice about which credit best fits their situation. They cannot claim more than one education benefit for the same student and the same expenses.

Eliminating the tuition and fees deduction in favor of an expanded credit will help taxpayers make better choices about which provision to take. Further evaluation and consolidation of education-related provisions is still warranted. But this change is a good step toward a simpler tax code.