Most taxpayers can get an early start on their federal tax returns as IRS Free File – an online tax preparation product available at no charge − opens today January 13, 2023, for the 2023 tax filing season.

Today is IRS (Internal Revenue Service) Free File Day, meaning that some providers will accept completed tax returns and hold them until they can officially be filed. that’s because the official start of tax season is Jan. 23 for individual tax return filers, the agency announced on Jan. 12 — a date which will allow “the IRS time to perform annual updates and readiness work that are critical to ensuring IRS systems run smoothly.”

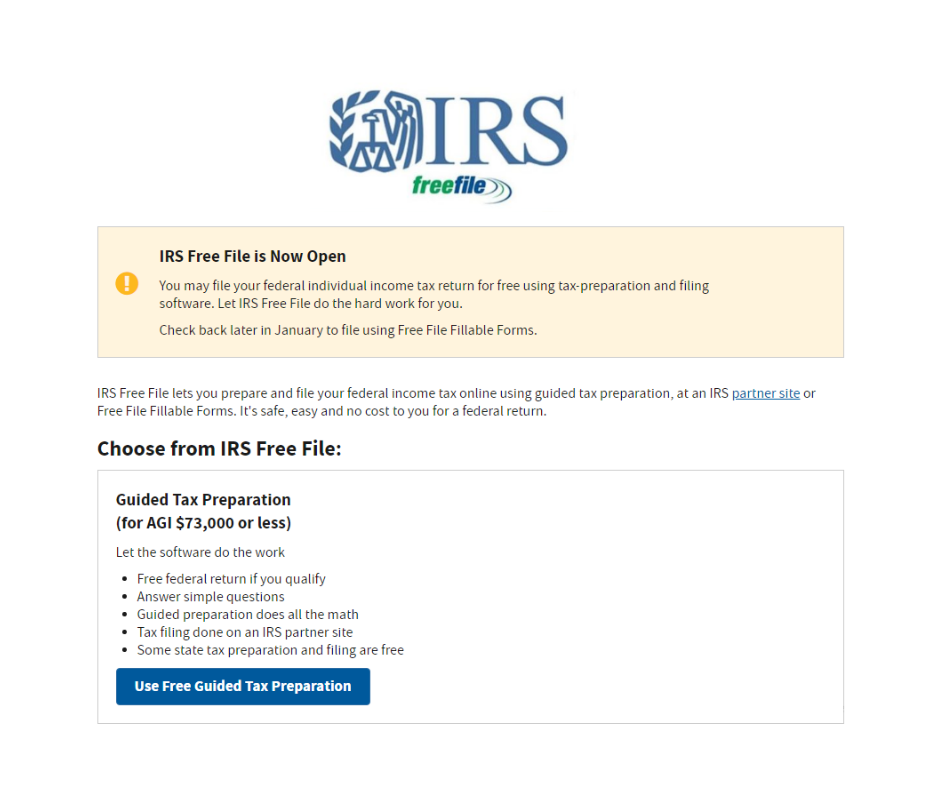

IRS Free File online products are available to any taxpayer or family who earned $73,000 or less in 2022.

Everyone can file electronically for free. Starting January 13, the IRS Free File program, available only through IRS.gov or the IRS2Go app, offers brand-name tax preparation software packages. Those who earned $73,000 or less in 2022, may qualify for Free File guided tax software. The software does all the work of finding deductions, credits and exemptions. Some of the Free File offers may include a free state tax return. Taxpayers comfortable filling out tax forms can use Free File Fillable Forms, the electronic federal tax forms paper version to file their tax returns online, regardless of income.

IRS Free File providers will accept completed tax returns and hold them until they can be filed electronically once the IRS begins processing returns. The Free File Fillable Forms, the electronic version of IRS paper forms, also will be available later when the filing season begins. This product is best for people comfortable preparing their own taxes and is safe and secure.

What Is IRS Free File?

The IRS Free File Program is a public-private partnership between the IRS and many tax preparation and filing software industry leaders who provide their brand-name products for free. It provides two ways for taxpayers to prepare and file their federal income tax online for free:

How IRS Free File Online works

Each IRS Free File provider sets its own eligibility rules for products based on age, income, and state residency. However, those who make $73,000 or less, will find at least one product that matches their needs, and usually more. Some providers also offer free state preparation. Active duty military can use any IRS Free File product if their income was $73,000 or less.

Here’s a step-by-step overview of how to find the right Free File product:

- Go to IRS.gov/freefile.

- Use the “Free File Online Look up” tool for help in finding the right product, or

- Review each offer by a provider by using the ‘Browse All Offers’ tool.

- Select a product.

- Follow links to the provider’s website to begin.

IRS Free File Services for the Military

Miltax online software will be available on January 23, 2023.

Members of the military and qualifying veterans can use MilTax, a Department of Defense program that generally offers free online tax preparation and e-filing software for federal returns and up to three state returns.

No computer? No problem. IRS Free File products support mobile phone access.

Free File providers also offer state tax return preparation, some for free and some for a fee. Again, use the “lookup” tool to find the right product. There are two products in Spanish. With Free File, you can even use any digital device, personal computer, tablet, or smartphone. Free File products are mobile-enabled so you can do your taxes on your smartphone or tablet and e-File with your hand-held device.

You should also know your protections under the IRS Free File program

- Get a free federal tax return – As long as you qualify for the Free File federal return offer, you must not be charged for the preparation and e-filing of a federal tax return.

- Be protected from unnecessary fees – Other than state tax preparation fees and a possible fee if you choose to continue with tax preparation when you don’t qualify for the federal return offer, you must not be offered or solicited marketing, promotional rebates, or any other form of selling activity on the Free File company’s website. Any state preparation or non-qualifying fees must be disclosed on the company’s Free File landing page.

- Be guided in your choices – If you find you don’t qualify for a specific company’s Free File offer after visiting their Free File website, you may return to the IRS.gov Free File website to seek another Free File online offer. Each Free File company will provide you information when you don’t qualify, with the option to select a link to bring you back to IRS.gov Free File site to select another company.

- Get help if you need it – If you need help when you are on the company’s Free File website and doing your taxes, you may refer to the company’s free customer service options.

- Be reminded of Free File – If you used Free File last year, you should receive an email from the same company product that you used, welcoming you back to Free File. The email should include a link to the company’s Free File online program and explain how to file with the program.

- Be protected from bank product fees – As part of Free File, you must not be offered any bank products such as Refund Anticipation Loans or Refund Anticipation Checks.

- Get help finding a free option for you – IRS offers a Free File online Look-up tool to help you find an offer that best meets your needs.

- Get important information on possible charges for state returns – Many Free File online products offer free state tax preparation. Some charge a state fee. Be sure to read each company’s information carefully.

Outlook for 2023

With the three previous tax seasons dramatically impacted by the pandemic, the IRS has taken additional steps for 2023 to improve service for taxpayers. As part of the August passage of the Inflation Reduction Act, the IRS has hired more than 5,000 new telephone assistors and added more in-person staff to help support taxpayers.

“This filing season is the first to benefit the IRS and our nation’s tax system from multi-year funding in the Inflation Reduction Act,” said Acting IRS Commissioner Doug O’Donnell. “With these new additional resources, taxpayers and tax professionals will see improvements in many areas of the agency this year. We’ve trained thousands of new employees to answer phones and help people. While much work remains after several difficult years, we expect people to experience improvements this tax season. That’s just the start as we work to add new long-term transformation efforts that will make things even smoother in future years. We are very excited to begin to deliver what taxpayers want and our employees know we could do with this funding.”

These steps took place as the IRS worked for months to prepare for the 2023 tax season. The Jan. 23 start date for individual tax return filers allows the IRS time to perform annual updates and readiness work that are critical to ensuring IRS systems run smoothly. This is the date IRS systems officially begin accepting tax returns. Many software providers and tax professionals are already accepting tax returns; they will transmit those returns to the IRS when the agency begins accepting tax returns on Jan. 23.

The IRS urges people to have all the information they need before they file a tax return. Filing a complete and accurate tax return can avoid extensive processing and refund delays as well as avoid the possibility of needing to file an amended tax return.

IRS Free File participants

“The IRS Free File Program is a public-private partnership between the IRS and many tax preparation and filing software industry companies who provide their online tax preparation and filing for free,” according to the IRS.

For 2023, these providers are participating in IRS Free File:

- 1040Now,

- ezTaxReturn.com,

- FreeTaxReturn.com,

- FileYourTaxes.com,

- On-Line Taxes (OLT.com),

- TaxAct,

- TaxHawk (FreeTaxUSA),

- TaxSlayer.

For 2022, the following providers have IRS Free File products in Spanish:

- ezTaxReturn.com,

- TaxSlayer

Intuit TurboTax dropped the IRS Free File program after July 2021

- Intuit TurboTax has elected not to renew its participation in the IRS Free File Program and will no longer be offering IRS Free File Program delivered by TurboTax.