Taxpayers often find themselves perplexed by the cryptic codes and terminology used by the Internal Revenue Service (IRS). One such code that frequently appears is IRS transcript code 424, which signifies Examination Requests. In this blog post, we’ll break down the meaning of IRS Transcript Code 424, shed light on when it may appear, and discuss what actions taxpayers can take if they encounter it.

What is IRS Transcript Code 424?

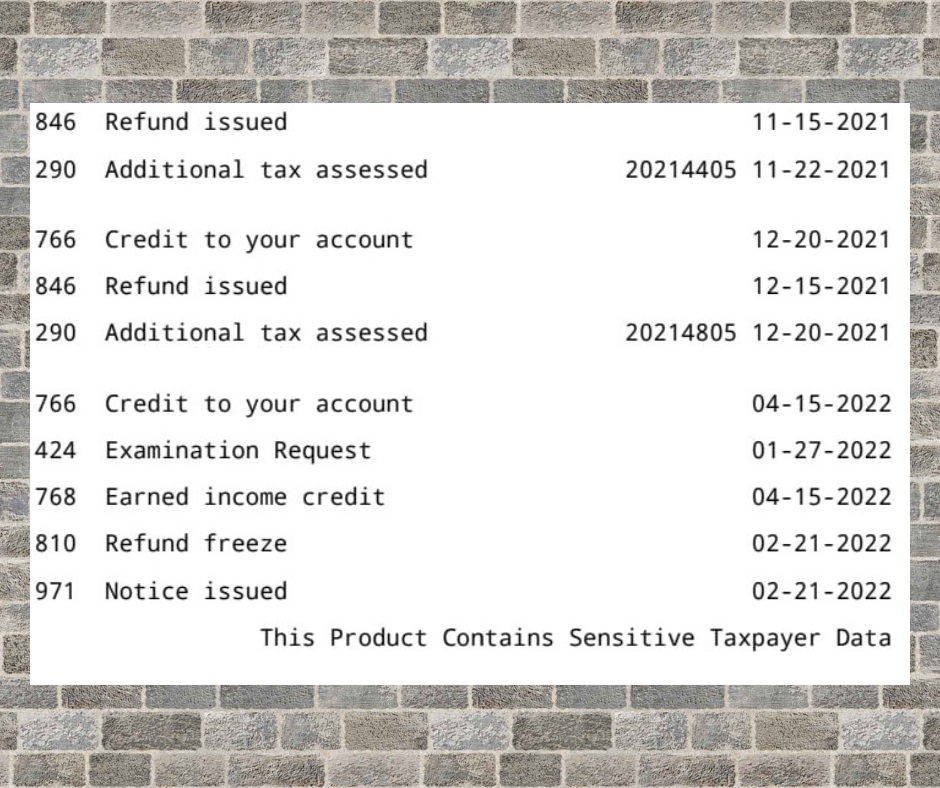

IRS Transcript Code 424 is a notation that appears on your tax transcript when there have been changes made to your tax return as a result of an IRS examination or audit. Essentially, it indicates that the IRS has reviewed your tax return and made modifications or adjustments to it.

Understanding the Examination Process

Before we delve deeper into the implications of Transcript Code 424, let’s briefly outline the examination process:

- Selection for Examination: The IRS selects returns for examination based on various criteria, including random selection, specific issues or deductions that raise red flags, or information matching discrepancies.

- Examination Phase: During this phase, the IRS examines your return more closely. They may request additional documentation or clarification on certain items.

- Adjustments: If the IRS finds discrepancies or errors, they will make adjustments to your return. These adjustments can involve changes to your reported income, deductions, credits, or other aspects of your tax return.

- Notification: After the examination, the IRS will send you a notice explaining the changes they’ve made to your return. This notice will also provide instructions on how to respond if you disagree with their findings.

Implications of IRS Transcript Code 424

When Transcript Code 424 appears on your tax transcript, it signifies that the IRS has completed its examination of your return and has made changes to it. Here’s what you need to know about the implications of this code:

- Possible Tax Owed: If the IRS made adjustments that resulted in a higher tax liability, you may owe additional taxes, along with any associated penalties and interest. The IRS will provide detailed information about the changes made and the amount you owe in the notice they send you.

- Refund Changes: On the flip side, if the IRS’s adjustments lead to a decrease in your tax liability, you may be entitled to a larger refund. The IRS will issue a refund for the additional amount you’re owed.

- Review the Notice: It’s crucial to review the notice you receive from the IRS carefully. It will explain the changes made, the reasons for those changes, and your options for disputing them if you disagree. If you believe the adjustments are incorrect, you can appeal the decision.

- Timely Response: Be sure to respond to the IRS notice promptly. Failure to do so could result in further penalties and interest accrual.

IRS Transcript Code 424 may initially appear to be confusing, but understanding its meaning and implications is essential for any taxpayer. It signals that the IRS has examined your tax return and made changes, which could impact your tax liability or refund. To navigate this process successfully, carefully review the IRS notice and consult a tax professional for guidance on how to respond if necessary.

Remember that maintaining accurate records, being prepared for potential audits, and seeking professional assistance when needed can help minimize the impact of IRS examination changes on your financial well-being.