Sometimes the most challenging part of filing your taxes is simply knowing what to do with all the paperwork (or pdf-work? Is that a term?) that arrives in the mail (or your inbox). Similar names and unfamiliar structures don’t help, so today we’re going to break down three common tax forms that sound similar but are quite different.

Forms 1095-A, 1095-B, and 1095-C look very similar because each relates to your healthcare coverage. In past years, having bare minimum health insurance (officially referred to as “minimum essential coverage”) was a requirement. Taxpayers who didn’t have minimum essential coverage or an exemption were subject to penalties—now, however, the Tax Cuts and Jobs Act of 2017 has removed the penalty completely.

The paperwork hasn’t quite caught up to the change, though. You’ll still get one of these three forms, and each will be handled a bit differently. Let’s take a look at each and see what is reported and which helps you file your tax return.

How do I use Form 1095-A?

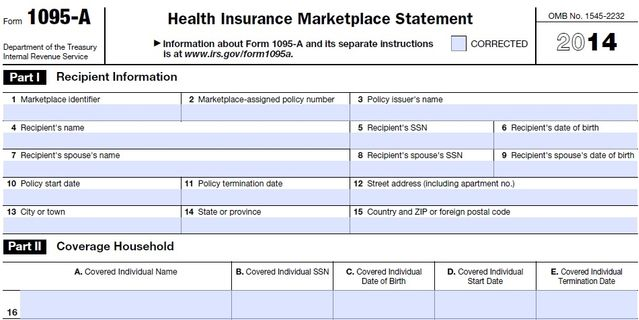

Form 1095-A is provided to the IRS and taxpayers by a Health Insurance Marketplace (HIM); it reports information on everyone covered by a qualified health plan purchased through a HIM. You will use the information on this form to either claim the Premium Tax Credit or reconcile the credit on your return if you received any advance credit payments during the year.

When you file your tax return, you’ll be asked about coverage through a HIM, and our walkthrough interview will help you report your 1095-A information on Form 8962 to calculate whether you’ll receive or reconcile your Premium Tax Credit. You’ll definitely want to keep this form handy for when you sit down to file.

What is Form 1095-B for?

Form 1095-B simply reports whether you had minimum essential health coverage in the past year, which would have been crucial information when health insurance was a requirement for all taxpayers. However, now that the penalty for not having minimum essential coverage has been removed, your 1095-B is basically just a list of details you no longer need when you file your taxes.

If you file your tax return, the walkthrough will simply ask if you had healthcare coverage. Any further details provided by your Form 1095-B are irrelevant, so don’t worry about finding a place on your tax return to report them.

Do I file Form 1095-C on my tax return?

Similar to Form 1095-B, your Form 1095-C includes healthcare coverage details for employer-provided health insurance. Since there is no longer a penalty for not having healthcare coverage, you don’t need the details provided by a 1095-C and there is nowhere on your tax return to report them. When you file your tax return, simply check the box to say that you had healthcare and keep your Form 1095-C for your records.

Here’s the bottom line: If you bought health coverage through a Marketplace, look for your 1095-A in January and keep it close by with your W-2 and other tax information. If you receive a 1095-B or -C, file them away; you won’t need to enter this information on your taxes.

Now that you know the purpose of these three healthcare information forms, filing your taxes is just a few confident clicks away.