What does N/A on my tax transcripts mean?

When checking your tax transcripts and if you see a N/A in place of the most recently filed tax transcripts. The N/A is letting you know that your transcripts for the current filed tax year are Not Available yet.

Why Transcripts Show N/A

When the IRS updates your account, they temporarily lock access to prevent inaccurate or outdated data from being viewed.

Common reasons for N/A status:

| Reason | What It Means | Good or Bad? |

|---|---|---|

| System update underway | Transcripts refreshing | Good |

| Return not yet posted to file | Too early in the season | Neutral |

| Review workflow in progress | Codes not ready to display | Good |

| Return moved to master file | New cycle processing | Good |

| Security lock for ID verification | IRS confirming identity | Needs attention |

9 times out of 10 → N/A = progress

1 out of 10 → possible ID verification

When N/A Appears for Early Filers

Early season (January–February):

- IRS hasn’t posted your return yet

- The first transcript population wave hasn’t occurred

N/A sticks around until:

- Your tax return posts

- Transaction codes appear

This is very normal.

N/A During Refund Review: A Good Signal

If you previously had codes like:

- 570 → Additional Action Pending

- 971 → Notice Issued

- 766/768 → Credits added

- 810 → Refund Freeze

and then transcripts go N/A…

That is commonly the FINAL STAGE before:

Code 846 — Refund Issued

Seen often with:

- PATH Act returns

- Returns with wage/income validation

- Amended or corrected filings

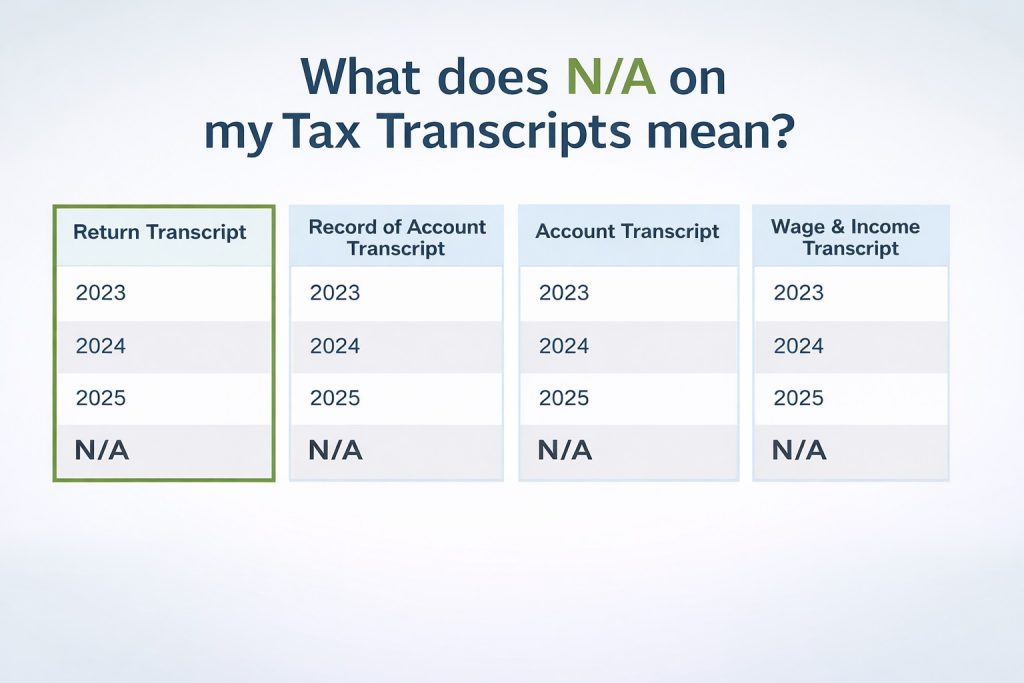

Which Transcript Types Can Show N/A?

| Transcript Type | Why It May Show N/A |

|---|---|

| Account Transcript | Under processing system update |

| Return Transcript | Return not fully posted |

| Record of Account | Codes being modified |

| Wage & Income | IRS still collecting employer data |

If only Wage & Income shows N/A → Filing too early

If all transcripts show N/A → System refresh likely underway

How Long Does N/A Last?

| Processing Type | Typical Duration |

|---|---|

| Early filing empty posting | 1–3 weeks |

| Review clearance update | 3–10 days |

| Code 846 pending | 24–72 hours |

| ID verification hold | Until action taken |

Shorter when N/A happens later in processing

Longer if N/A happens before codes appear

When Should You Worry?

Only if:

- N/A lasts longer than 4–6 weeks

- Transcript was visible before then disappeared and NEVER returned

- You receive an IRS notice requiring identity verification

If any of the above → call IRS:

800-829-1040

Quick Decoder Table

| Transcript Status | Meaning |

|---|---|

| Visible with codes | Actively processing |

| Ghost updates visible | Progress underway |

| N/A temporarily | System refresh / review movement |

| Long-term N/A | Possibly identity lock or posting error |

“Get Transcript” Can’t Find My Information

This is common early in the season. It usually means the IRS accepted your return but hasn’t started processing it yet.

Check the online portal weekly—most returns begin to appear within 7–10 days of filing.

If problems persist, you can call the IRS help desk at 1-800-876-1715 (Monday–Friday, 8:00 a.m.–8:00 p.m. ET).

Why Is My Transcript Blank or Showing Zeros?

That generally means your return is accepted but not yet posted to the IRS master file. Keep checking weekly; once posting occurs, line items and amounts will populate and transaction codes (like 570, 971, or 846) will begin to appear.

- If you continue to have problems, contact the IRS help desk at1-800-876-1715(Monday through Friday) 8 am – 8 pm (Eastern Standard Time).