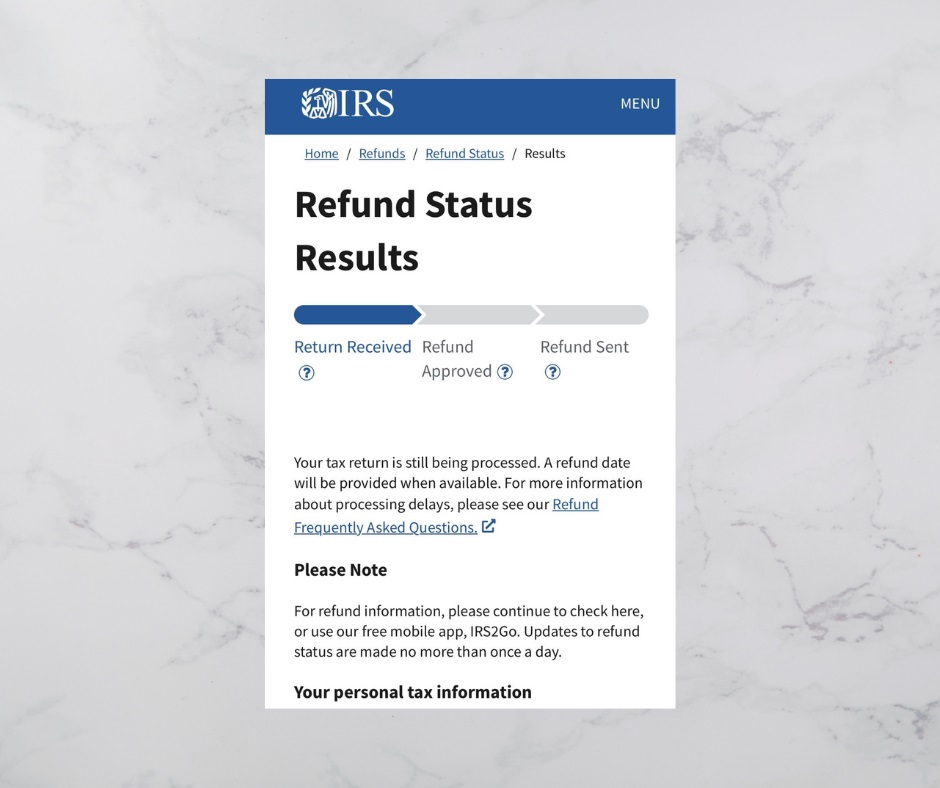

If you’ve checked the IRS “Where’s My Refund?” tool and see the status message stating, “Your tax return is still being processed. A refund date will be provided when available,” you might wonder what this means and if any action is needed. This message is common, especially during peak tax season, and typically indicates that the IRS is working on your return.

Here’s everything you need to know about this status message, why it appears, and what steps (if any) you need to take.

What Is the “Still Being Processed” Refund Status?

The “Still Being Processed” message appears during the initial stages of reviewing your tax return. It means:

- The IRS has received your return, whether you e-filed or submitted it on paper.

- The agency is actively processing your return but hasn’t yet finalized it.

- A specific refund issue date has not been determined or assigned.

This message corresponds to the “Return Received” stage in the “Where’s My Refund?” tool.

Why Might You See This Message?

There are several reasons your return might still be processing. Some are routine, while others might require further attention. Here are the most common reasons:

1. Standard Processing Times

- E-Filed Returns: Most electronically filed returns process within 21 days. If it’s been less than three weeks, this message may simply mean your return is in the queue for standard review.

- Paper Returns: Mailed returns can take six weeks or more to process due to the additional time required for manual handling.

2. Refundable Credits

- If you claimed certain tax credits, such as the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC), your refund may be delayed. Federal law requires the IRS to hold refunds involving these credits until mid-to-late February to allow time for fraud prevention.

3. Errors or Missing Information

- Common issues like typos, missing Social Security Numbers, or discrepancies between your tax return and IRS records can slow processing. The IRS may need to correct the error or request additional documentation.

4. Verification Processes

- The IRS uses fraud prevention systems to identify potentially suspicious returns. If your return is flagged for review, you may see this message while the agency confirms your identity, income, or deductions.

5. Identity Theft Concerns

- If your return is flagged for potential identity theft, the IRS may request that you verify your identity before processing your refund.

What Should You Do If You See This Message?

Most of the time, there’s no need to take immediate action. However, here are a few steps to ensure your return is on track:

1. Wait for Updates

- The IRS updates the “Where’s My Refund?” tool once daily, usually overnight. Check back periodically, but keep in mind that updates may not happen every day.

- Avoid calling the IRS if it has been less than 21 days for e-filed returns or six weeks for paper returns.

2. Look Out for IRS Notices or Letters

- If the IRS requires additional information or action from you, they will send a notice or letter to the address listed on your tax return. Be sure to read any correspondence carefully and respond promptly.

3. Confirm Your Information

- Double-check that the information on your return is accurate, including your Social Security Number, filing status, and refund amount.

4. Verify Your Identity

- If you’re asked to verify your identity, follow the instructions provided in the IRS letter. This may involve using the online IRS Identity Verification Service or calling a specific phone number.

5. Be Patient

- Processing times can vary depending on factors like the complexity of your return, IRS workload, and current staffing levels. Most taxpayers will see their status change to “Refund Approved” soon.

Possible Next Steps from the IRS

If the IRS needs more information from you, they may:

- Send a Notice: A letter like Letter 4883C or 5071C may request identity verification.

- Request Documentation: You may be asked to provide proof of income, dependents, or other details on your return.

- Provide an Update: Your status will change to “Refund Approved” or “Refund Sent” once processing is complete.

While the message “Your tax return is still being processed” can be frustrating, it is often a routine part of the IRS’s workflow.

- Understanding the reasons for the delay and taking appropriate steps can help you navigate this process with confidence.

- Most importantly, stay patient and monitor the status of your return regularly.

- Delays can occur for various reasons, including normal processing times, additional reviews, or errors on the return.

- Be patient, check the Where’s My Refund? tool daily, and watch for correspondence from the IRS.

- If you’re required to verify information, respond promptly to avoid further delays.

- If needed, seek assistance from a tax professional to address any concerns or correspondence from the IRS.

Have You Experienced This Refund Status?

Have you seen the “Your tax return is still being processed” message in the past? If so, what steps did you take, and how was the issue resolved? Sharing your experience could help others who are navigating this frustrating process. Drop a comment below or join the conversation on our social media pages!