Millions of U.S. taxpayers are eligible to have their federal income tax returns filed for free through the IRS Free File program. Depending on your adjusted gross income (AGI), you may be able to use the guided tax preparation services offered through an authorized IRS partner site and/or the fillable forms. To learn how to file your taxes for free, keep reading.

How Does Free File Work?

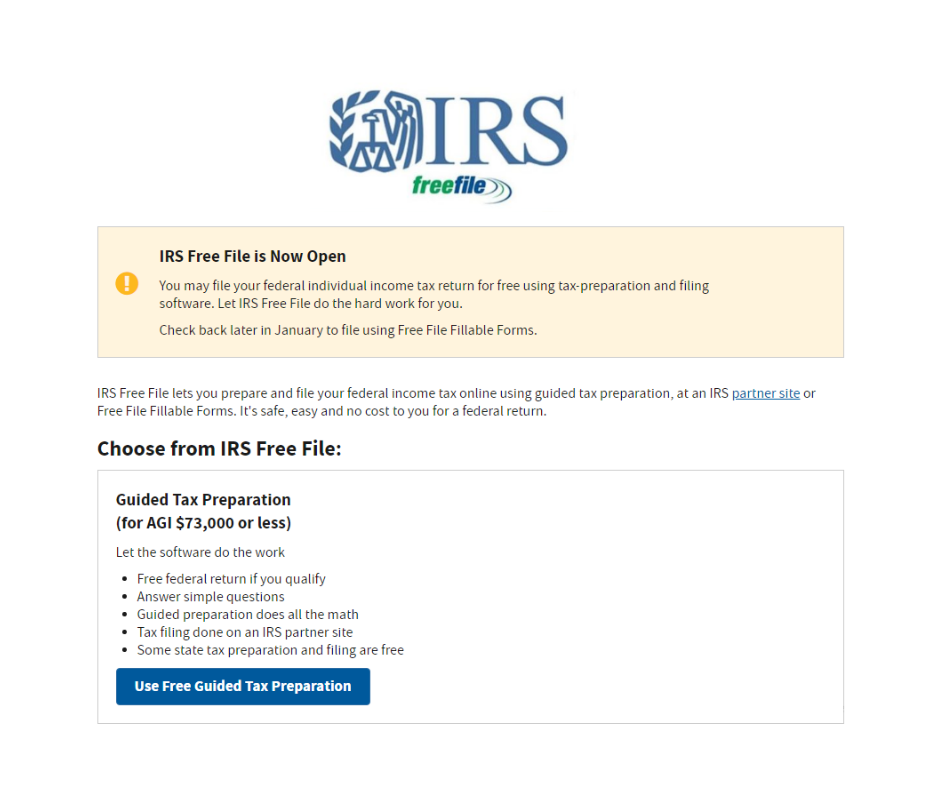

The IRS Free File program is a partnership between the IRS and the Free File Alliance. The Free File Alliance is a coalition of leading tax preparation software companies that provide their branded products for free to qualifying taxpayers. There are two ways taxpayers can file their federal tax returns for free through this program:

- Guided Tax Preparation – If your adjusted gross income (AGI) is $73,000 or less, you are eligible for free guided online tax preparation and filing services through one of the designated Free File partners.

- Free File Fillable Forms – Equivalent to an electronic version of Form 1040, this option is available to any taxpayer, regardless of income level. You must be able to prepare your tax return unassisted, but filing is free.

The IRS does not endorse any specific partner within the program. Taxpayers can review the available partners on IRS.gov and select one that best fits their needs. If qualified, they will then receive federal tax preparation and e-filing at no charge. Some partners may also provide state income tax filing for free.

How to File Your Taxes For Free

Although many well-known tax preparation companies participate in the Free File program, you cannot access the Free File program through their websites. You can only receive free tax preparation and filing assistance by starting at IRS.gov.

If your AGI is $73,000 or less:

- Go to https://apps.irs.gov/app/freeFile and select a Free File partner. You can browse all or narrow your choices by using the lookup tool.

- Next, create an account with the selected partner. If you’re a previous user, you can log into your existing account.

- Finally, gather the necessary information to prepare and file your federal taxes.

If your AGI is over $73,000:

- Read the IRS Free File Fillable Forms User’s Guide

- Make sure you are using one of the recommended browsers and have a high-speed internet connection before using the fillable forms.

- Turn off all pop-up blockers, tracking blockers, and auto-fill features.

- Create an account. You will need to do this every year.

With the Fillable Forms option, you will need to prepare your tax forms on your own. There are, however, free resources on IRS.gov to assist, including line-by-line instructions. Should your return get rejected, you can use the “Search Errors” tool to find a solution.

What You Need To File Your Taxes

Whether you use the Free File guided tax preparation or fillable forms, you’ll want to have the following information on hand before starting your federal income tax return.

- A copy of last year’s return (for AGI amount) – If you don’t have a copy, you can use the IRS Get Transcript self-help tool to get a tax transcript.

- Social Security numbers for yourself, spouse, and dependents (if applicable)

- W-2s

- 1099s (1099-INT, 1099-G, !099-DIV, and 1099-R)

- Other income and receipts (Social Security benefits, unemployment compensation, business receipts, etc.)

- Form 1095-A, Health Insurance Marketplace States (if applicable)

- Form 8962, Premium Tax Credit (if applicable)

- A valid email address – This is required to receive notification that your return was accepted.