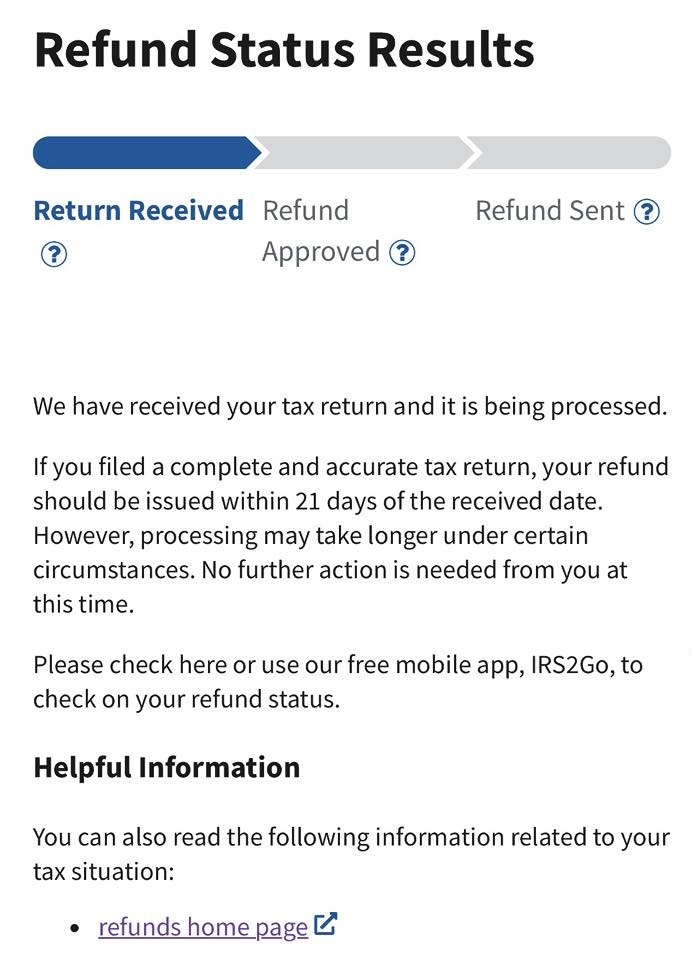

If you’ve recently filed your taxes and are eagerly awaiting your refund, you might have checked the IRS “Where’s My Refund?” tool and seen the status message:“We have received your tax return and it is being processed.”This status message is a key milestone in the tax refund process, and understanding it can help you manage your expectations as you track your refund. In this blog post, we’ll break down what this message means and what you can expect from the IRS processing timeline.

What Does “We Have Received Your Tax Return and It Is Being Processed” Mean?

When you see the message“We have received your tax return and it is being processed”, it’s a positive sign. This means the IRS has successfully received your tax return and is actively working on verifying the information. The processing phase includes reviewing your tax return for accuracy, ensuring there are no discrepancies or missing information, and calculating your refund if applicable.

This message confirms that your tax return is progressing through the system and is on track for refund issuance within the expected timeframe. However, it does not guarantee a specific refund date. The IRS may need additional time to process complex returns, verify identity, or resolve any issues.

Why Is This Message a Positive Sign?

The phrase“being processed”implies that the IRS is actively working on your return. It suggests that your tax return is moving forward through the system and has not been flagged for any major issues. If you’ve filed your taxes early, this message may help you feel confident that your refund is still on track.

However, this status does not mean your refund is guaranteed. The IRS will continue processing your return, and additional steps may be necessary before the final refund is issued.

The IRS Processing Timeline

While it’s hard to predict an exact refund date, understanding the IRS processing steps can help you manage expectations:

- Tax Return Receipt– The IRS confirms they’ve received your tax return, which is the stage at which you’ll see the“We have received your tax return and it is being processed”message.

- Processing– The IRS verifies the return, checks for discrepancies, and calculates your refund if eligible.

- Refund Issuance– Once the IRS has processed the return, the refund is issued to the taxpayer. This can happen via direct deposit or a paper check.

How Long Will “Being Processed” Last?

The amount of time your return stays in the“being processed”status depends on various factors:

- Return complexity– More complex returns may take longer to process.

- Volume of returns– The IRS typically processes millions of returns, so high volumes during peak filing periods can cause delays.

- Errors or additional checks– If the IRS identifies any discrepancies or needs additional information, your processing may take longer.

If the“being processed”status persists for an extended period, don’t panic. Simply continue monitoring the“Where’s My Refund?”tool for updates.

Using IRS Tools for More Information

If you’re looking for more details about your tax refund, you can use theGet Transcript toolon the IRS website. This tool allows you to access your tax transcripts, which may provide additional insights into your return’s processing status.

What Should You Do Next?

While your return is“being processed”, the best course of action is to be patient. Keep checking the IRS“Where’s My Refund?”tool for updates. Ensure that all your tax documents are in order in case the IRS requests additional information. If your refund remains in the“being processed”status for longer than usual, you may want to contact the IRS for further clarification.

Common Reasons for Processing Delays

While the“being processed”status is typically a positive sign, there are a few common reasons why processing might take longer than expected:

- Errors on your return– Incorrect information or missing forms could cause delays.

- Identity verification– The IRS may need to verify your identity, especially if there are discrepancies or if you recently changed your name.

- Tax offsets– If you owe any federal or state debts, the IRS may offset your refund.

- Complex returns– If you claimed multiple credits or had several income sources, your return may take longer to process.

Seeing“We have received your tax return and it is being processed”on the IRS“Where’s My Refund?”tool is generally a good sign. It means your return is moving through the IRS system and is on track for a timely refund. While this status doesn’t guarantee your refund date, it reassures you that your return is under review and in progress.

Remember to check back regularly using theWhere’s My Refund?tool and theGet Transcripttool for updates. If you have any questions or concerns, the IRS provides resources to help you navigate the process.

Frequently Asked Questions

- What does the “We have received your tax return and it is being processed” message mean?

This message indicates that the IRS has received your tax return and is currently working on it. Your return is moving through the IRS system, and the refund is being calculated. - Is this message a good or bad sign?

It’s generally a positive sign. It means your return is progressing through the system and is on track for refund issuance. - Does this mean my refund is guaranteed?

While this is a positive indicator, it doesn’t guarantee your refund. The IRS still needs to verify the information on your return and check for any discrepancies. - What should I do while my return is “being processed”?

Be patient and keep checking theWhere’s My Refund?tool for updates. Ensure your tax documents are accurate and available in case the IRS requests more information. - What if the status remains “being processed” for a long time?

If the status stays unchanged for an extended period, contact the IRS for further clarification, but only after allowing enough time for processing.