Tax season can be a stressful time for many Americans, and receiving a notice from the Internal Revenue Service (IRS) with unfamiliar codes and jargon can be intimidating. One such code you might encounter is IRS Transcript Code 290, which indicates “Additional tax assessed.” In this blog post, we’ll break down what this code means, why you might receive it, and what steps you should take if you find it on your IRS transcript.

Understanding IRS Transcript Code 290

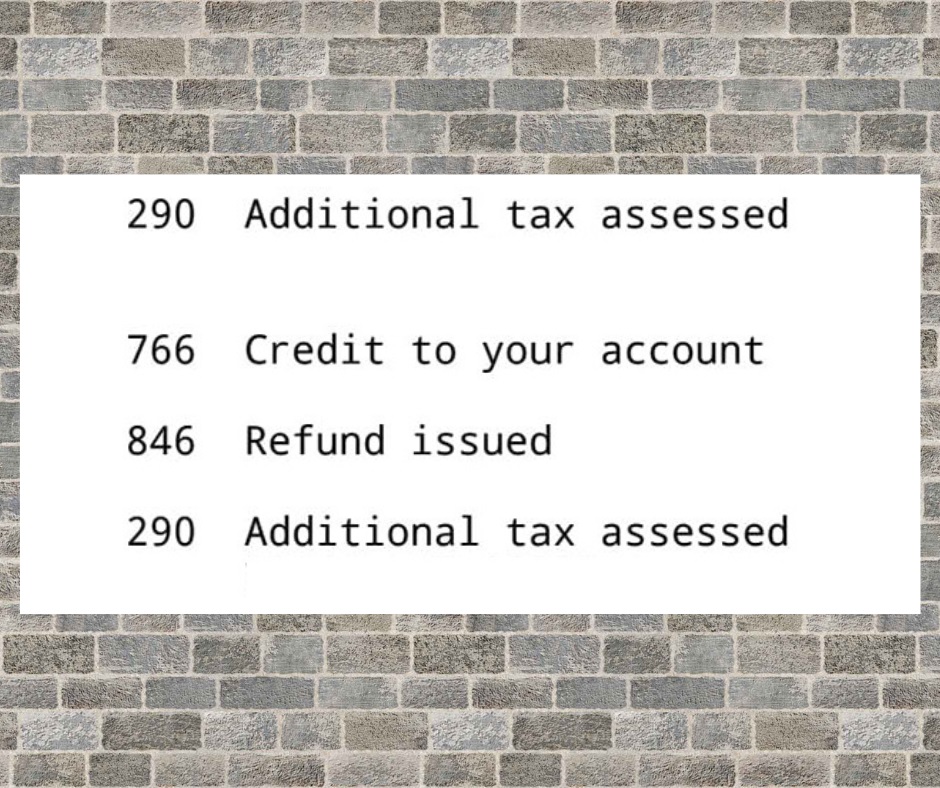

Before we dive into the specifics of Transcript Code 290, let’s briefly explain what IRS transcript codes are. These codes are a part of the IRS’s system for keeping track of your tax-related activities and transactions. They serve as shorthand references to various actions and events related to your tax return. Code 290, specifically, relates to the assessment of additional tax.

Transcript Code 290: Additional Tax Assessed

What does Transcript Code 290 mean?

Transcript Code 290 indicates that the IRS has reviewed your tax return and determined that you owe additional taxes beyond what you originally reported. This additional tax can result from various factors, such as unreported income, miscalculations, or changes in your tax situation that were not initially considered when you filed your return.

Common Reasons for Transcript Code 290:

- Unreported Income: You may have failed to report certain sources of income, like freelance earnings, rental income, or investment gains.

- Disallowed Deductions or Credits: The IRS might have disallowed deductions or credits you claimed on your return, leading to an increase in your tax liability.

- Changes in Filing Status: Your filing status can affect your tax liability. If you initially filed as “Single” but should have filed as “Head of Household” or another status, this could result in additional tax.

- Math Errors: Simple mathematical mistakes can lead to an incorrect tax calculation, prompting the IRS to assess additional tax.

What should you do if you receive Transcript Code 290?

Receiving Transcript Code 290 doesn’t mean you’re automatically in trouble or that you’re being accused of tax evasion. It’s merely an indication that there’s a discrepancy in your tax return, resulting in additional taxes owed. Here are the steps you should take:

- Review the Notice: Carefully read the notice from the IRS to understand why they assessed additional tax. The notice will provide details on the changes made to your return.

- Compare with Your Tax Return: Cross-reference the IRS’s findings with your original tax return to identify any discrepancies.

- Contact the IRS: If you believe there’s an error in the assessment or you have additional information to provide, contact the IRS promptly. You may need to submit supporting documentation to support your case.

- Payment Options: If you agree with the IRS’s assessment, you can pay the additional tax through various methods, such as a one-time payment or setting up a payment plan if you can’t pay in full.

- Seek Professional Help: If you’re unsure how to proceed or need assistance in dealing with Transcript Code 290, consider consulting a tax professional or accountant. They can help you navigate the process and ensure you meet all IRS requirements.

IRS Transcript Code 290, indicating “Additional tax assessed,” can be unnerving when you first encounter it. However, it’s essential to remember that receiving this code doesn’t necessarily imply wrongdoing. It’s an opportunity to rectify discrepancies in your tax return and fulfill your tax obligations accurately. By carefully reviewing the notice, communicating with the IRS, and seeking professional assistance if needed, you can navigate Transcript Code 290 and resolve any outstanding tax matters effectively. Remember, timely action can help you avoid further penalties and interest charges.