If you’ve looked at your IRS Tax Account Transcript, you may have noticed a term called the “As Of” date. It might seem confusing at first, but it’s actually very simple—and knowing what it means can help you understand your tax account better.

What Does the “As Of” Date Mean?

The “As Of” date is the date your penalties and interest are calculated to determine if you owe the IRS or are due a refund. It’s a future-oriented calculation, giving you time to pay any balance by check or online if needed.

In other words, it’s the IRS’s way of showing your account status as of a specific date, including interest, penalties, or balances due.

Why Do I See the “As Of” Date?

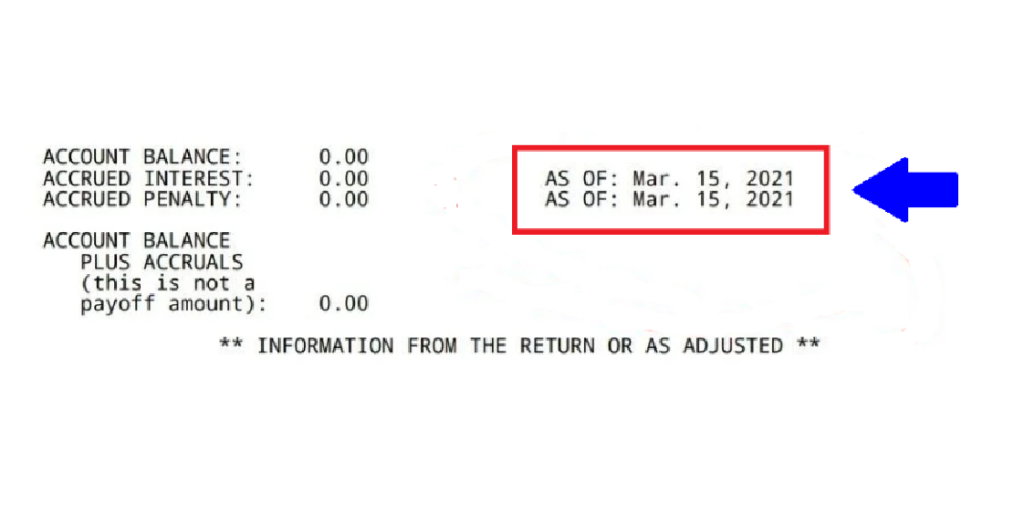

You’ll see the “As Of” date at the top of your Record of Account Transcript. This date tells you:

- Whether you have a balance due

- How penalties and interest are calculated

- That the IRS has accounted for possible future payments

This future date ensures taxpayers have enough time to mail payments or pay online before the account officially updates.

Why Does the “As Of” Date Keep Changing?

The IRS system updates the “As Of” date automatically whenever your tax account is viewed or updated. Changes in your account, such as additional payments, adjustments, or notices, can move this date forward or backward.

Think of it like a “living” snapshot of your account—it reflects the most current calculations at the time you access it.

How Do I Find My Tax Transcript “As Of” Date?

To check your “As Of” date online:

- Go to the IRS Get Transcripts page.

- Create an online account if you don’t have one.

- Sign in and click View Tax Records.

- Click the GET TRANSCRIPT ONLINE button to access your Record of Account Transcript.

- Look at the top of your transcript to see the “As Of” date.

Can the “As Of” Date Tell Me When My Refund Will Arrive?

No. The “As Of” date does not indicate your tax refund date. Instead, you need to watch your transcript for transaction codes under the EXPLANATION OF TRANSACTIONS section.

The key code to watch for is:

- 846 – Refund Issued: This code means your refund has been processed and sent to your bank. The date next to this code is when the IRS directly deposits your refund.

By checking your transcript regularly, you can track your refund status accurately.

Quick Summary

- “As Of” date = When penalties and interest are calculated.

- Purpose = Shows balances and refunds as of a future date.

- Changes = Updates automatically based on account activity.

- Refund info = Look for 846 Refund Issued code, not the “As Of” date.

Knowing your “As Of” date helps you stay on top of your tax account, understand balances, and track penalties, interest, and refunds with confidence.