When the IRS processes an amended tax return, they verify all income, credits, and supporting documents. If anything does not match IRS records or eligibility rules, they may adjust the refund amount.

Common Reasons Refunds Get Reduced

| Reason | Why It Happens |

|---|---|

| IRS disallowed a credit | Lack of dependency eligibility or documentation |

| Income mismatch from employer data | Higher taxable income discovered |

| Math corrections by the IRS | Calculation errors on the amendment |

| Erroneous filing status | Married filing jointly vs separately issues |

| Earned Income Credit adjustments | W-2 proof or residency requirements |

| Child Tax Credit adjustments | Age, SSN, or residency rules not met |

Why Refunds May Increase Instead

Sometimes the IRS:

- Finds additional credits that were missed

- Removes incorrectly added income

- Corrects withholding or tax tables

Positive adjustments are also possible, especially if the original return was incorrect.

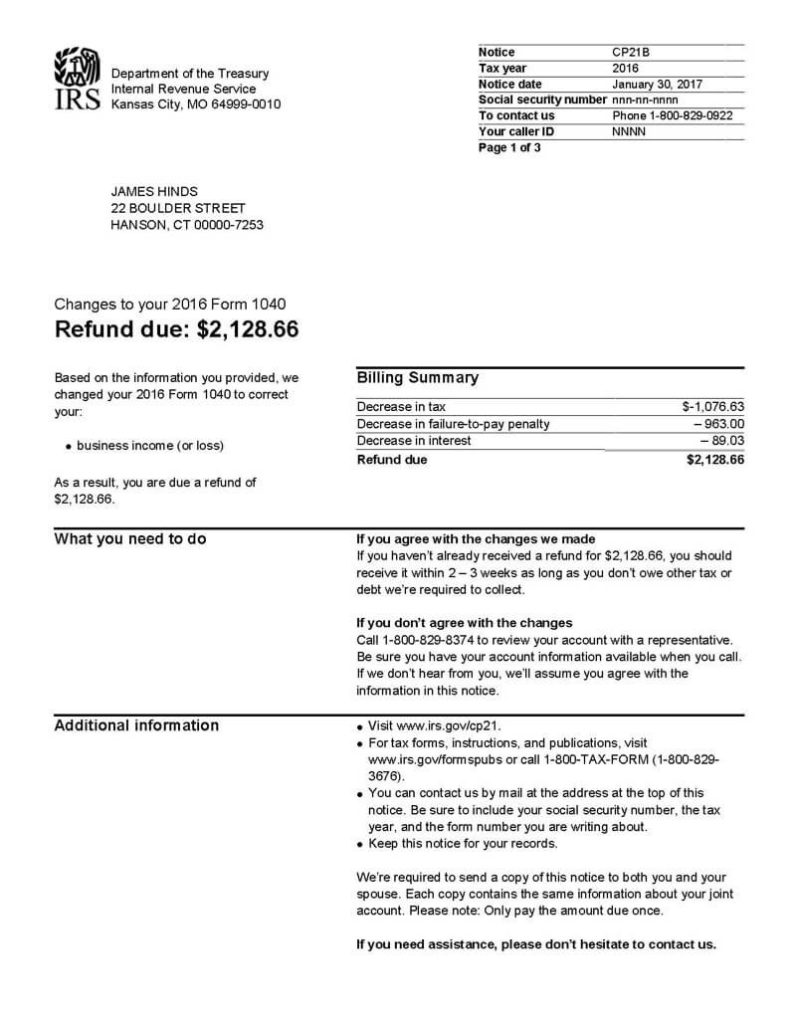

What Notice Will Explain the Change

Almost all amended refund changes are reported using:

- CP21B Notice (Refund Increase or Decrease)

- CP21C Notice (Balance Due)

This notice will include:

- Original refund amount requested

- New corrected refund amount

- Explanation of each change

If You Disagree With the Changes

You may:

- Submit documentation supporting your original figures

- Request an IRS reconsideration

- Contact the phone number listed on the notice

Time restrictions apply, so always read the deadlines provided.

Summary

The IRS verifies all numbers in an amended return. Any differences found during review may increase or reduce the refund amount. An official notice will be mailed explaining the adjustment.

If You Found The Information Here Was Useful Please Consider Sharing This Page!