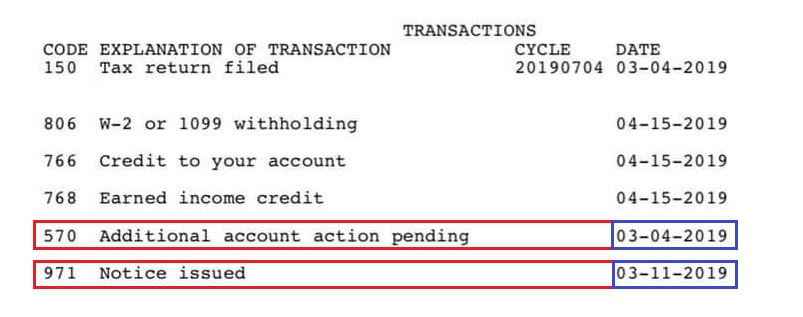

Code 570 and Code 971 are two of the most misunderstood IRS tax transcript update combinations. Many taxpayers panic when they appear together — especially if they were expecting Code 846 (refund issued). In reality, this sequence often represents normal refund verification and is a positive forward movement in processing.

This full guide will help you clearly understand what’s happening, what to expect next, and how long the process typically takes.

Understanding IRS Code 570: Additional Account Action Pending

Code 570 means the IRS placed a temporary hold on your refund while it verifies something in your return.

This does not mean you’re being audited.

Common triggers for Code 570:

- Earned Income Credit (EITC) or Child Tax Credit review

- Wage/income mismatch (W-2 or 1099 not received yet)

- Dependent claim conflict with another filer

- Recovery Rebate / stimulus credit miscalculation

- Identity verification checks

- Large adjustments or refundable credit changes

Important: There is no refund movement until Code 570 clears.

Next Step: Why Code 971 Appears

Code 971 — Notice Issued

This means the IRS has taken an action related to the 570 hold and has issued (or will issue) a notice explaining what’s being reviewed.

Key insight:

Code 971 appearing after Code 570 usually means the IRS completed its internal review and is preparing resolution.

Examples of 971 notice types:

| Notice Type | Usually Means |

|---|---|

| Math Error | Adjusting credits or income |

| Dependent Notice | Claim review needed |

| ID Verification | Additional identity proof required |

| Informational Review | Return was corrected & refund will continue |

You may or may not ever receive a physical letter — the notice is sometimes automated.

The Ideal Sequence to Watch For

A typical successful flow looks like this:

Code 570 → Code 971 → Code 846 (refund hold) (review complete) (refund issued)If your transcript shows 570 → 971, that is a good sign of forward progress.

How Long Does It Take After 971 Posts?

Average timelines:

| Timeline Stage | Typical Waiting Period |

|---|---|

| 570 appears | Initial review: 7–21 days |

| 971 posts | Second review: 2–6 weeks |

| 846 refund issued | Direct deposit posting |

Actual results vary by return type and complexity:

Faster resolution cases (no taxpayer response needed)

2–4 weeks after Code 971

Slower cases (IRS awaiting documents/information)

6–12+ weeks depending on staffing and volume

Will WMR Show Status Changes?

Often, yes — but later than transcripts.

Typical order of updates:

Transcript Update → WMR (bars return) → Deposit DateIf transcript has moved ahead, WMR may still show “still processing.”

When Should You Call the IRS?

Only if any of the below apply:

✔ You received a notice requiring documents

✔ 971 posts but no movement after 60 days

✔ There is a refund freeze code like 810 present

✔ Changes reduce refund and you need clarification

IRS phone number: 800-829-1040

Best time: Right when phones open (7:00 AM ET)

Signs That Refund Release Is Coming Soon

Watch for:

- As of Date moves forward

- Cycle code changes to a newer posting week

- Additional resolved codes 571 or 572

- Amount populates on transcript after being blank

When Code 846 posts → Refund approved

Summary

| Code | Meaning | Action Required |

|---|---|---|

| 570 | IRS placed a temporary hold | None — wait |

| 971 | Notice issued / internal action taken | Usually none |

| 846 | Refund issued | Celebrate & track deposit |

Most taxpayers do not need to send documents or call the IRS.