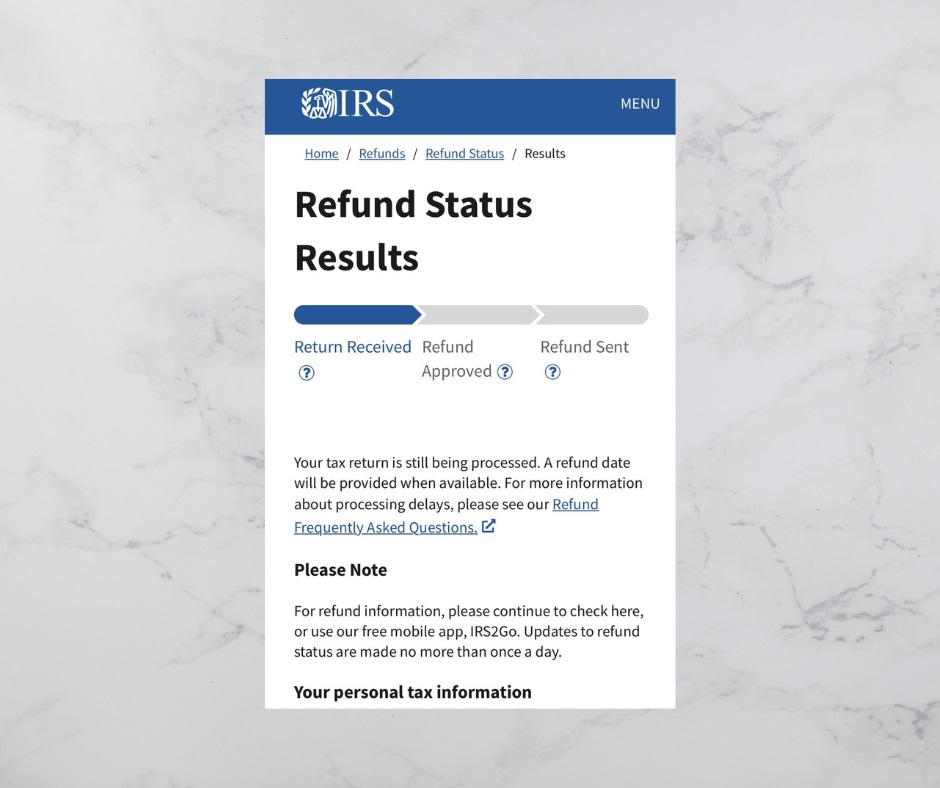

Tax season can feel like a waiting game, especially when the IRS message reads:“Your Tax Return Is Still Being Processed – A Refund Date Will Be Provided When Available.”If you’ve ever anxiously checked the status of your refund only to see this update, you’re not alone. Here’s an engaging breakdown of why this message appears, what it means for taxpayers, and how long you should expect to wait—plus tips to keep your stress (and confusion) to a minimum.

Why Am I Seeing “Your Tax Return Is Still Being Processed”?

This message means your return has made it through the initial IRS acceptance checks, but your refund hasn’t been approved for release yet. It’s a normal phase of IRS review—think of it as your return waiting in line for its turn.

Key causes for this status:

- Standard IRS Review:Most e-filed returns enter processing within 24-48 hours after you hit “submit.” The IRS checks for simple errors and matches your return to employer W-2 records.

- PATH Act Holds:If you claimed the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC), your refund is held until at least mid-February so the IRS can verify eligibility and prevent fraud.

- Paper Return Delays:Mailed returns can take 4–8 weeks just to be opened and scanned.

- Identity Verification:Sometimes the IRS needs you to verify your identity. This is routine if your Social Security number or personal details raise a red flag.

- Additional Reviews:Any discrepancies, complex deductions, or flagged credits might trigger a manual review.

How Long Does Processing Usually Take?

| Filing Method | Average Processing Time (after IRS acceptance) |

|---|---|

| E-file & Direct Deposit | Up to 21 days |

| Paper Return | 4–8 weeks |

| E-file & Paper Check | About 4 weeks |

| Mailed Return & Check | Up to 9 weeks |

Be aware: refunds claiming EITC/ACTC won’t be issued before mid-February—even if processed quickly—due to federal law (PATH Act).

What Can Cause Further Delays?

- Busy Filing Season:Late March–April filings run into peak IRS volume, stretching processing times further.

- Errors or Missing Info:Math mistakes or missing forms force the IRS to pause your return for manual review.

- Offsets for Past-Due Debts:If you owe child support, federal/state taxes, or student loans, your refund could be reduced—or redirected to pay those debts.

- IRS Backlogs:Paper returns, amended returns, and verification issues can lead to longer waits, especially during periods of heavy correspondence or government shutdowns.

What Should Taxpayers Do During the Wait?

- Check “Where’s My Refund?” Tool:Updates happen once every 24 hours. Patience pays—checking multiple times a day won’t speed things up.

- Read IRS Letters Promptly:If the IRS needs more info or identity verification, respond quickly to avoid further delays.

- Don’t Refile Unless Instructed:Filing another return won’t help unless IRS asks for it—and may actually slow things down.

- Contact IRS If Excessive Delay:E-filed returns usually process in 21 days. If it’s been longer, and you haven’t received notice, reach out to IRS customer service for help.

Final Timelines, Realistic Expectations

- Most direct deposit refunds:Sent within three weeks after e-filing.

- PATH Act credits:Expect your refund by early March if you filed early and are affected by the hold.

- Mailed checks:Becoming less common—expect even longer waits through 2025 as the IRS phases out paper refunds.

Bottom Line

Seeing “Your Tax Return Is Still Being Processed” is a routine part of tax season for millions. Understanding why the message appears—and what’s influencing your refund’s timeline—transforms stress into confidence. Track your status, respond promptly to requests, and remember: most refunds arrive sooner than you think, even when it feels like the wait will last forever.