When it comes to tracking your tax refund, the IRS “Where’s My Refund?” tool is incredibly useful—but sometimes you want more detailed insight. That’s where your IRS tax transcript comes in. Understanding and decoding your tax transcript can give you an advance peek at your refund status, including an estimated refund date—and knowing what to look for can help ease the anxiety of waiting. This guide breaks down how to decode your IRS tax transcript for your refund date in plain language anyone can understand.

What Is an IRS Tax Transcript?

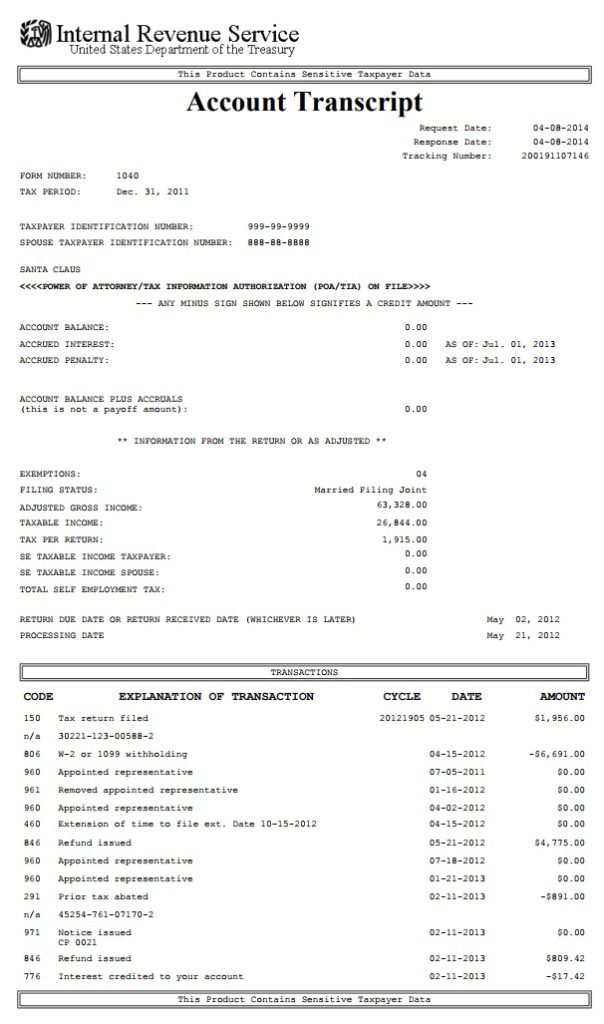

An IRS tax transcript is a record summarizing all actions related to your tax account for a given year. It shows when the IRS received and processed your tax return, payments, credits, adjustments, and refunds. Think of it as your personal tax report card reflecting IRS activity on your account.

How to Get Your IRS Transcript

You can request your transcript quickly and securely using the IRS online “Get Transcript” tool. Once logged in, choose the “Tax Account Transcript” which details all relevant transaction codes and dates.

Key Transcript Codes to Watch for Refund Tracking

The secret to decoding your refund lies in understanding a few important IRS codes:

- Code 150:This means your tax return has been received and processed.

- Code 766:Represents a credit being applied to your account—often signaling your refund amount.

- Code 846:This is the most important—when you see Code 846 on your transcript, it means your refund has been approved and scheduled for payment. The date next to it is the estimated refund date.

You may see Code 766 before 846—but 846 is the definitive word that your refund is officially on the way.

How to Read Your Refund Date on the Transcript

Look for Code 846 in the transaction section of your transcript. The date listed next to this code is when the IRS expects to issue your refund. Generally, you will receive the refund in your bank account the next business day if you chose direct deposit—or within a week or two by mail if you opted for a paper check.

Why Is Your Refund Date Important?

Knowing your refund date helps you plan ahead financially and reduces the stress of uncertainty. While the date is an estimate and can be affected by factors like IRS processing delays or tax credit holds (PATH Act), it’s the most reliable prediction available besides official IRS tools.

Other Things to Watch Out For on Your Transcript

- Code 570 or Code 420:Indicates additional IRS review or audit, which could delay your refund.

- Code 610:Refund applied to outstanding debts, which means your refund may be reduced or applied toward unpaid balances.

- Tax Year, Cycle Codes:Help pinpoint when your return was initially processed, offering context to your refund timeline.

What to Do If Your Transcript Shows No Refund Date

If you don’t see Code 846 or any refund scheduling code, it means your refund isn’t approved yet. This can happen if:

- You claimed refundable credits subject to PATH Act holds (EITC or ACTC).

- Your return is still under review or verification.

- There are pending issues or IRS backlog.

Check your IRS “Where’s My Refund?” daily and respond promptly to any IRS correspondence to keep things moving.

Final Thoughts

Decoding your IRS tax transcript demystifies your tax refund’s journey and empowers you with detailed information about your refund date. Use your transcript as a complement to the IRS online tools for the clearest picture.

Understanding key transaction codes like 846 gives you confidence about when you’ll see that refund hit your account, helping you stay informed and prepared during tax season.

With this ultimate guide, the mystery of “when will I get my refund?” becomes clear—and you hold the key to unlocking your IRS tax transcript’s story.