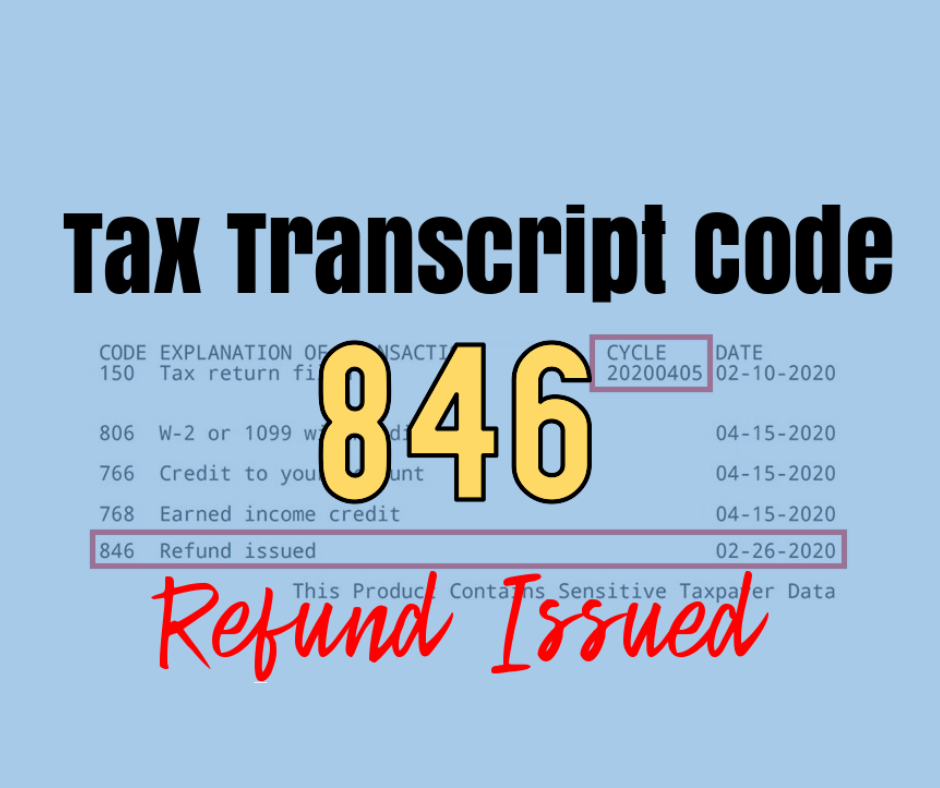

Waiting for your tax refund can sometimes feel like staring at a black box—uncertain and stressful. But if you know where to look, your IRS tax transcript can reveal exactly when your refund will land in your bank account. One key to this secret? IRS Transaction Code846.

What Is TC 846?

TC 846 is the IRS transaction code that means“Refund Issued.”When this code appears on your IRS account transcript, it signals that the IRS has approved your refund and scheduled it for payment either by direct deposit or paper check.

The date next to TC 846 is especially important—it’s the IRS’s official estimatedrefund deposit dateor mailing date.

Why Is TC 846 the Most Exciting Code on Your Transcript?

- It means your refund money is on its way!

- Seeing TC 846 means you’ve passed all IRS reviews and holds.

- You can plan your finances around this date with confidence.

- Unlike other messages like “still processing,” TC 846 is definitive proof your refund will be issued imminently.

How to Find TC 846 on Your IRS Transcript

- Get your IRS Tax Account Transcript via the IRS “Get Transcript” tool online.

- Look for the “Transaction” column on the transcript.

- Find the number846—this is your refund issuance event.

- Check the date listed next to it—that’s your expected refund deposit or mailing date.

What Happens After You See TC 846?

- Fordirect deposits, your bank usually posts the refund on the TC 846 date or within 1-2 business days thereafter.

- Forpaper checks, it may take a week or more after this date to arrive, depending on mail speed.

- Your refund is officially out of IRS hands; it’s now between your bank or postal service and you.

What if You Don’t See TC 846?

No TC 846 means your refund hasn’t been approved or scheduled yet. Possible reasons include:

- Your return is still being processed.

- Your refund is on hold for verification or related to refundable credits (EITC/ACTC).

- There might be identity verification, offset debts, or IRS review delays.

You should continue checking “Where’s My Refund?” or your transcript daily, and respond promptly to IRS notices.

Pro Tips for Refund Tracking Using TC Codes

- TC 766 signals a credit generated to your account—often the first sign of refund calculation.

- TC 570 or TC 971 indicate holds or reviews—expect delays.

- TC 826 means an offset (partial refund used to pay debt).

- TC 810/811 marks refunds frozen/unfrozen.

- By understanding TC 846 and related codes, you can decode your transcript like a pro.

Final Thoughts

Transaction Code 846 is yourbest friendin tax refund tracking. It’s the IRS’s green light saying, “Your refund is on its way!” Whether you’re budgeting for bills or planning a little treat, knowing this code can turn uncertainty into clarity.

So next time you pull up your IRS transcript, don’t be overwhelmed—just zero in on TC 846 and mark that date. Your refund journey moves forward from there!