An amended tax refund can absolutely be offset to pay certain past-due debts. Many taxpayers are surprised when the amended refund is taken even if the original refund was not.

Debts Eligible for Offset

Amended refunds can be used to pay:

- Federal tax debt

- State income tax debt

- Past-due child support

- Unemployment compensation overpayments

- Federally backed student loans (when collections active)

- Federal agency debts

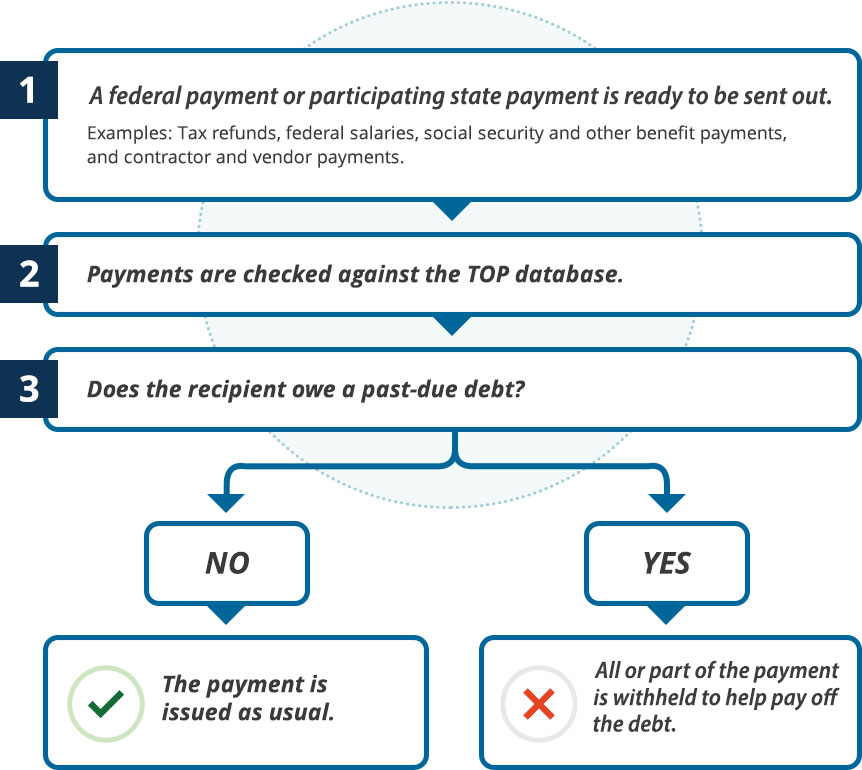

If the debt exists in the Treasury Offset Program, any additional refund amount generated by an amendment may be applied to that balance.

Why Offsets May Happen Even If the Original Refund Was Kept

Amended returns often include:

- Additional credits

- Dependency changes

- Corrected wages

These changes can result in a new refund amount, which is considered separate from the original refund. That new refund is subject to full offset review again.

How to Check If You Are at Risk of an Offset

You can confirm active debts at:

Treasury Offset Hotline: 1-800-304-3107

No personal account information is required. The system will state whether you have government debts that qualify for offset.

What to Expect If Offset Occurs

- A notice will be mailed explaining the amount taken

- Any remaining refund will still be issued

- The IRS does not handle disputes over the debt amount

Questions about the debt must be directed to the agency that claims the funds.

Summary

Amended refunds can be offset even if the original refund was not impacted. Any new refund amount created by Form 1040-X is subject to the IRS and Treasury review process for outstanding obligations.