Yes. Paper-filed amended returns almost always take longer than those submitted electronically. This is because paper returns require multiple extra steps before they can begin processing.

Why Paper Returns Move Slower

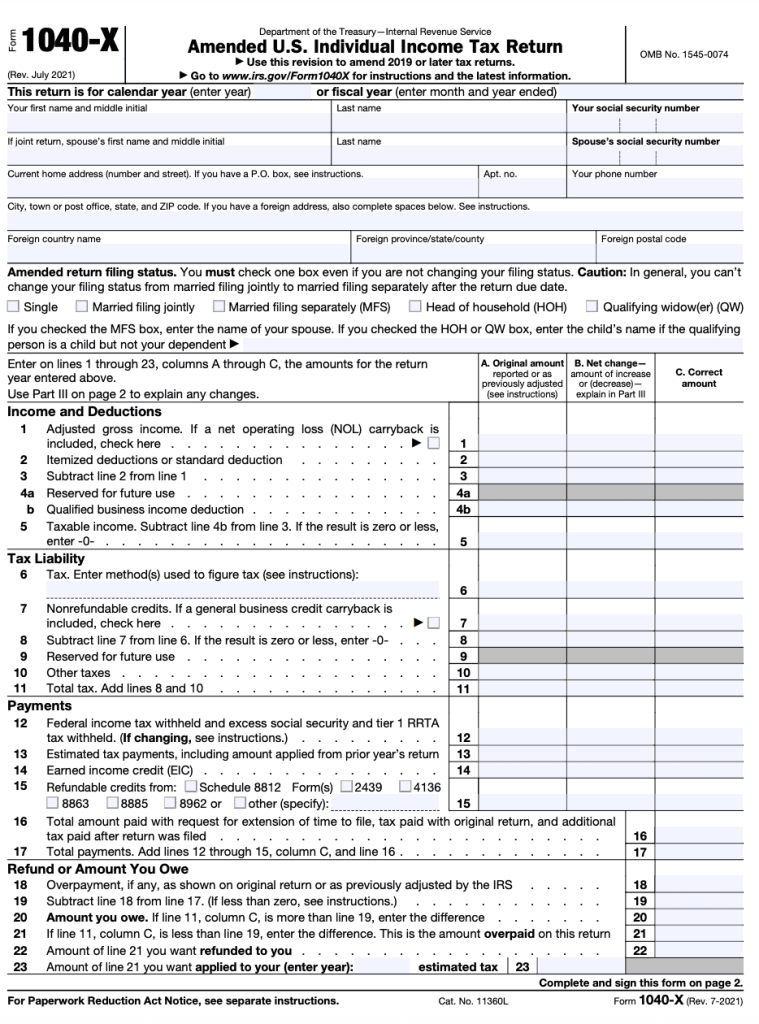

Paper Form 1040-X must go through:

- Mail delivery and security screening

- Physical storage in IRS facilities

- Manual data entry into the IRS system

- Assignment to an IRS caseworker

Processing does not officially begin until the return has been digitized and confirmed in the IRS workflow.

Time Comparison

| Filing Method | Average Processing Range |

|---|---|

| E-filed amendment | 8 to 16 weeks |

| Paper-filed amendment | 16 to 30+ weeks |

Mail delays, staffing shortages, and high seasonal volume can increase these time-frames considerably.

Issues That Can Cause Additional Delays

- Unreadable handwriting

- Missing signatures

- Pages or attachments separated in scanning

- Incorrect mailing address

- Additional IRS review required

Even a small error can add weeks or months.

Should You Mail Supporting Documents?

If the IRS requires additional proof, they will request it. Sending documents unsolicited can slow processing because those submissions must be reviewed and matched manually.

Summary

Paper-filed amended returns take significantly longer due to mailing time and manual handling. Whenever possible, electronic filing is the faster and more reliable method for submitting Form 1040-X.