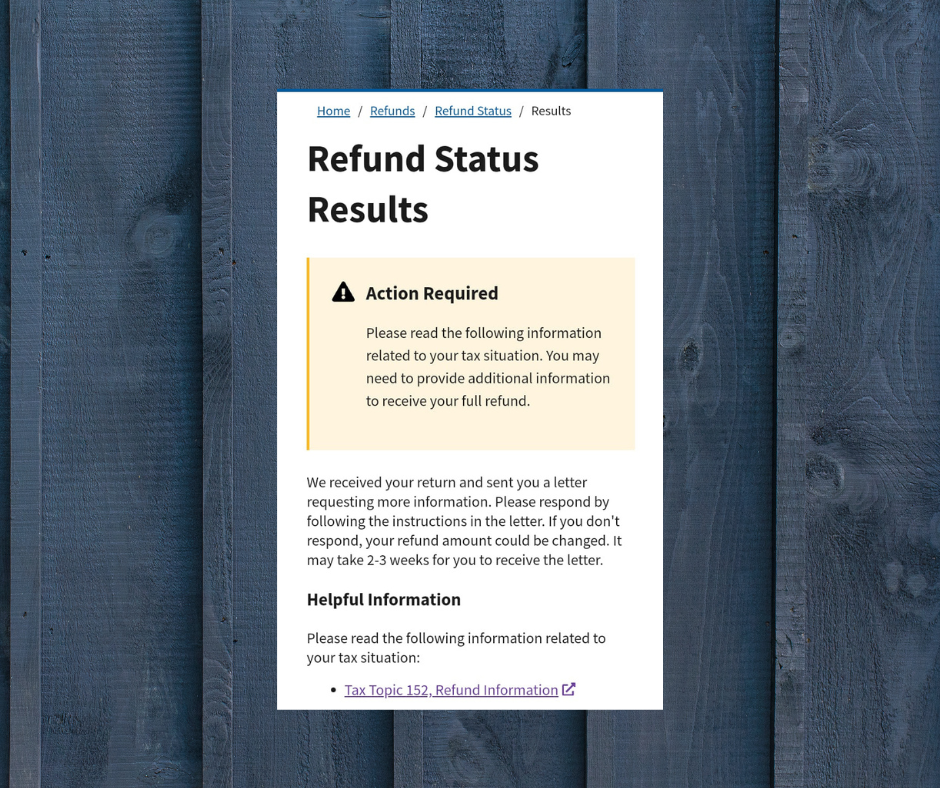

Seeing the “More Information” message on the IRS Where’s My Refund? tool? No need to panic! This just means the IRS needs a bit more info to verify your tax return before sending your refund. It’s a common step to prevent fraud and ensure your money lands safely in your pocket. Let’s make this super easy to understand and show you exactly what to do to get your refund rolling!

What Does the “More Information” Message Mean?

The IRS has put your refund on hold to double-check details like your income, withholding, tax credits, or deductions. This isn’t a sign you did anything wrong—it’s the IRS being extra careful to protect you and your refund. Here’s the scoop:

- You’ll get a letter (like CP05A, CP05B, or LTR 12C) asking for specific documents.

- Your refund won’t move until you send the requested info and the IRS verifies it.

- This is a routine check, often triggered by complex returns or fraud prevention measures.

How Does This Affect You?

- Refund Delay: Your refund is paused until the IRS reviews your response—expect weeks or more, depending on their workload.

- No Response? Big Problem: Ignoring the letter could lead to an adjusted or denied refund.

- Status Updates: The Where’s My Refund? tool will show this message until the IRS processes your documents.

8 Simple Steps to Fix the “More Information” Issue

Follow these steps to get your refund back on track:

- Read the IRS Letter Carefully

- Check which documents the IRS needs (e.g., W-2s, 1099s, pay stubs, bank statements) to verify your income, credits, or deductions.

- Gather Your Proof

- Collect clear, legible copies of the requested documents that match what you reported on your tax return.

- Include the Voucher

- Attach the bottom portion or voucher from the IRS letter to your response so they can match it to your case.

- Submit Your Docs

- Follow the letter’s instructions: mail to the listed address, fax, or use the IRS Document Upload Tool (if available).

- Keep Copies

- Save copies of everything you send and proof of delivery (e.g., tracking number or fax confirmation).

- Wait for Review

- The IRS will review your submission, which can take several weeks depending on their backlog.

- Track Your Status

- Check Where’s My Refund? or your IRS Online Account for updates after sending your documents.

- Contact the IRS if Needed

- No letter within 30 days or still stuck? Call the IRS at the number on your letter or 800-829-1040. Have your return ready!

Why Acting Fast Matters

Responding quickly to the “More Information” letter:

- Speeds Up Your Refund: The sooner you send the requested docs, the faster your refund arrives (typically within 6-9 weeks after review).

- Avoids Adjustments: Ignoring the letter could lead to the IRS reducing or denying your refund.

- Prevents Fraud: Verifying your info helps the IRS stop scammers from stealing your refund.

Pro Tips for a Smooth Fix

- Double-Check Docs: Ensure your documents match your return exactly—no discrepancies!

- Use Certified Mail: Track your submission to confirm the IRS received it.

- Sign Up for an IRS Account: Monitor your return and refund status in real-time with an IRS Online Account.

- Suspect Fraud?: If you didn’t file the return, report it via the IRS Identity Verification Service.

- Get Help: A tax professional can assist with complex issues or fraud concerns.

Don’t let the “More Information” message slow you down! Grab those documents, follow the IRS’s instructions, and your refund will be on its way. You’ve got this!