Your Tax Return Is Still Being Processed — Refund Date Will Be Provided When Available

Stop Panicking: What This Message Actually Means

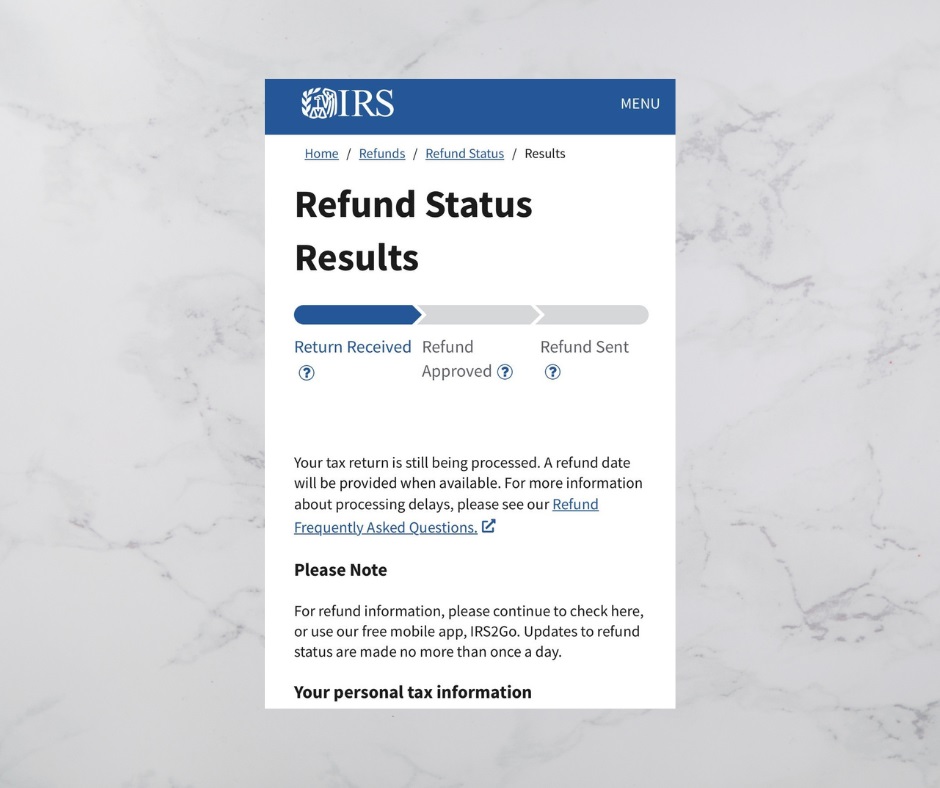

Seeing your federal tax refund status stuck on “Your tax return is still being processed — Refund date will be provided when available” can trigger immediate anxiety. However, this is one of the most common administrative messages the IRS uses, and in most cases, it is not a red flag.

This message simply signals two key facts:

- Received and Logged: The IRS has successfully received your tax return and officially entered it into its processing system (the “Master File”).

- Pending Approval: Your refund has not yet been approved and a specific direct deposit or mailing date has not been scheduled.

In short: Your return is in the queue and under active review, but the final checks are not yet complete.

Why Your Return Hasn’t Cleared the System Yet

While the IRS aims to issue most refunds in less than 21 days for e-filed returns, this specific status indicates your return has encountered a necessary administrative checkpoint that requires more than a simple automated pass-through.

The following reasons are the most common causes for a return to display this “still being processed” message:

1. Legislative Holds (The PATH Act)

If you claimed the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC), your refund is subject to the Protecting Americans from Tax Hikes (PATH) Act.

- The Delay: By law, the IRS cannot issue refunds claiming these credits before mid-February. Even if your refund is approved early, the official date will not be provided until after this date.

2. Administrative or Data Verification

The IRS is performing routine checks to ensure your information is accurate and matches third-party records (like W-2s and 1099s).

- Common Checks: Verification of claimed refundable credits, cross-referencing Social Security Numbers (SSNs), and reconciling income figures.

- The Fix: If everything matches, the return will move forward without you needing to do anything.

3. Errors and Incomplete Information

If the IRS identifies a simple mathematical error or missing information (a common cause for this message), it will attempt to correct it internally.

- The Fix: If the correction changes your refund amount, the new amount will be updated when the status changes to “Refund Approved.”

4. Identity Verification (The TPP Hold)

In a smaller percentage of cases, this message can precede a full identity check under the Taxpayer Protection Program (TPP).

- The Sign: The IRS will typically follow up with an official letter in the mail (such as Letter 5071C) if you are required to verify your identity.

How Long Should You Expect to Wait?

The duration of this “still being processed” status can vary widely based on your filing method and the reason for the delay.

| Filing Method | Typical Wait Time (After Acceptance) | Status Duration if Delayed |

| E-Filed Return | 10–21 Days | Can extend to 30–45 days or longer if a manual review is required. |

| Paper Return | 4–8 Weeks | Can extend beyond 12 weeks due to the manual processing of physical documents. |

| Returns with EITC/ACTC | Until Mid-to-Late February | Subject to the PATH Act hold, regardless of filing date. |

Your Action Plan: What to Do While You Wait

Patience is key, but you should also be prepared to act if the delay extends or if the IRS contacts you.

1. Monitor Daily (But Only Once)

The IRS updates the “Where’s My Refund?” (WMR) tool only once every 24 hours (usually overnight). Checking more often will not give you new information and can increase frustration. Check the WMR tool or the IRS2Go app once a day.

2. Watch Your Mailbox Closely

If the IRS needs information to clear your status, they will send a letter via the U.S. mail. They will almost never contact you by phone, email, or text regarding your refund status.

- Action: If you receive a letter, respond immediately and precisely according to the instructions to avoid further delay.

3. Know When to Call

The IRS specifically asks taxpayers not to call about their refund until:

- 21 days or more have passed since you e-filed your return.

- 6 weeks or more have passed since you mailed your paper return.

- The WMR tool tells you to contact the IRS.

The message “Your tax return is still being processed — Refund date will be provided when available” is the IRS’s way of saying: “We have it, we are working on it, but the final steps are not done.”

Be patient, check your mail regularly for verification requests, and use the official IRS tools for updates. A status change to “Refund Approved” is the final confirmation that your deposit date has been scheduled.