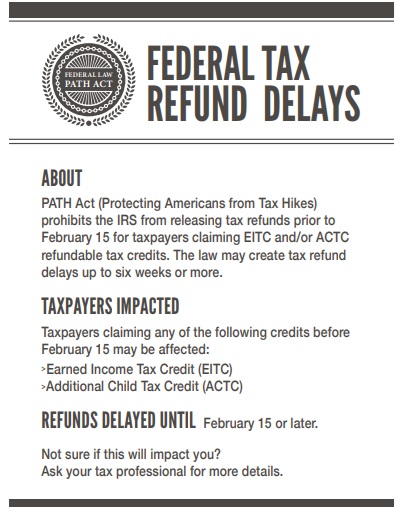

Waiting for your tax refund and wondering why it’s taking so long? The Protecting Americans from Tax Hikes (PATH) Act, passed in 2015, could be the reason. Designed to combat refund fraud, this federal law delays refunds for taxpayers claiming Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) until mid-February. In this engaging guide, we’ll break down what the PATH Act means, key dates, how it impacts your refund, and tips to stay ahead. Let’s dive into everything you need to know for a stress-free tax season!

What Is the PATH Act?

The PATH Act is a federal law aimed at stopping tax refund fraud, which once cost the government over $100 million annually. Here’s the gist:

- Fraud Prevention: It targets fraudulent claims tied to EITC and ACTC, two refundable credits often exploited.

- Mandatory Refund Hold: The IRS must hold entire refunds for returns claiming these credits until at least February 15 (or the next business day if it’s a weekend/holiday).

- Verification Time: The delay gives the IRS time to verify returns, reducing identity theft and erroneous payments.

Key PATH Act Dates

Mark these dates for the 2025 tax season:

- E-File Season Start: January 27, 2025—when the IRS begins accepting electronic returns.

- PATH Act Hold Lifts: February 17, 2025 (since February 15 is a Saturday), allowing EITC/ACTC refund processing to begin.

- Earliest Refunds: Expected around February 19, 2025, with most arriving by February 28, 2025.

- Mailed Checks: Can take 4–6 weeks after funding due to postal delays.

How Does the PATH Act Affect Your Refund?

If you claim EITC or ACTC, here’s what to expect:

- Refund Hold: Your entire refund is held until mid-February, even if you file early in January.

- Processing Timeline: After the hold lifts on February 17, 2025, refunds typically process within 21 days, though IRS backlogs or reviews may extend this.

- Status Updates: Starting February 17, check the “Where’s My Refund?” tool or IRS2Go app for real-time updates.

- Direct Deposit vs. Checks: Direct deposits arrive faster; mailed checks can add weeks.

- Non-EITC/ACTC Refunds: Returns without these credits process normally, often within 21 days of e-filing.

Impact of the PATH Act on Taxpayers

| Aspect | Details |

|---|---|

| Applies to | Taxpayers claiming EITC or ACTC |

| Hold Period | Until at least February 15 (February 17, 2025, for 2025 tax year) |

| Refund Issuance Begins | After hold lifts, starting February 17, 2025 |

| Typical Refund Timing | Most refunds by end of February, but some may take longer |

| Refund Method | Direct deposits faster; mailed checks take longer |

| Other Credits | Non-EITC/ACTC refunds process without delay |

Tips to Navigate PATH Act Delays

Don’t let the PATH Act catch you off guard! Here’s how to stay prepared:

- File Early: Submit your return in January to beat fraudulent filings, even with the hold.

- Use E-Filing and Direct Deposit: E-file through trusted software and choose direct deposit for faster refunds.

- Track Your Refund: Monitor updates starting February 17, via the “Where’s My Refund?” tool or IRS2Go app.

- Double-Check Your Return: Ensure accuracy (e.g., correct SSN, bank info) to avoid extra delays from errors.

- Respond to IRS Notices: If the IRS requests verification, reply promptly to keep processing on track.

- Avoid Scams: Only trust communications from IRS.gov or official mail—never unsolicited emails or calls.

- Consult a Pro: If delays persist or you need help, contact a tax professional or the Taxpayer Advocate Service.

Why the PATH Act Matters

The PATH Act protects taxpayers by curbing fraud, but it delays EITC and ACTC refunds for millions until mid- to late February. Understanding the hold period and timelines helps you plan finances and avoid surprises. By filing early, using IRS tools, and staying proactive, you can navigate these delays with confidence.

The PATH Act ensures safer tax refunds by delaying EITC and ACTC payments until February 17, 2025, for the 2025 tax season. While this can mean waiting longer, filing early and tracking your status keeps you in control. Expect most refunds by late February, and use direct deposit to speed things up. Get ready for a smoother 2025 tax season!