The real schedule behind the 21-day refund timeline

Many taxpayers believe refunds are processed randomly or individually — but the IRS follows a structured, computer-driven weekly processing rhythm that determines EXACTLY when your refund moves, when your transcript updates, and when the IRS releases funds.

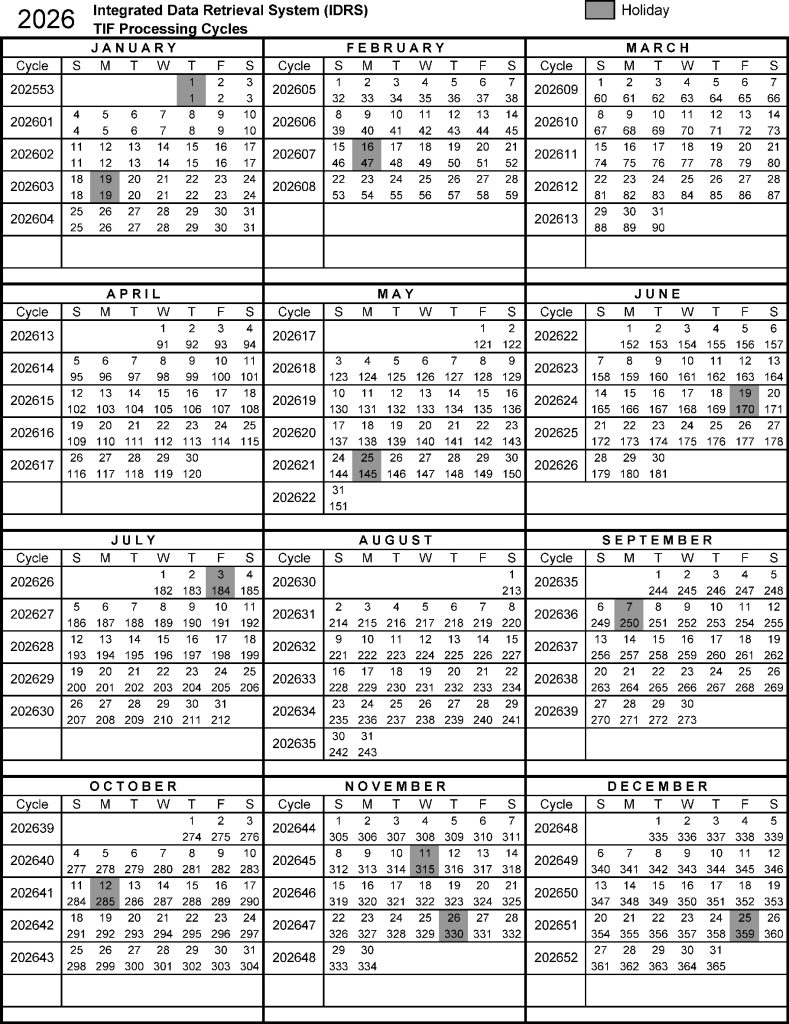

This calendar — the 2026 IDRS TIF Processing Cycles schedule — is the operational timetable of the IRS processing system. If you know how to interpret it, refund timing becomes predictable rather than mysterious.

What This Calendar Actually Represents

This is the 2026 IRS IDRS (Integrated Data Retrieval System) Tax Information File Processing Calendar. It’s the digital heartbeat of the IRS — the system that:

- receives tax returns

- posts tax codes

- applies payments and credits

- issues refunds

- triggers notices

- updates transcripts

150+ million returns move through this system annually — on the same timing model.

How the IRS Processing Week Really Works

The IRS does not process returns continuously — it runs on weekly cycles:

- Each cycle is numbered

- Each cycle runs Sunday through Saturday

- Processing actions occur Monday–Friday

- Transcript postings typically occur Thursday night / Friday morning

This explains the classic refund pattern:

- WMR updates overnight

- Weekly transcript changes on Fridays

- Refund deposits the following banking cycle

This is why the IRS quotes 21 days — which equals 3 full cycles.

Understanding the Cycle Numbers

Example:

20261405

It breaks down as:

- 2026 = Processing year

- 14 = The 14th processing week

- 05 = The 95th day of the year (cycle day alignment)

Your cycle code is a timestamp of when the IRS worked your return.

Why This Matters: The True 21-Day Refund Timeline

Week 1 — Cycle 1

Return received and accepted

Week 2 — Cycle 2

IRS runs checks, cross-matches W-2 and 1099 data, applies credits

Week 3 — Cycle 3

Refund scheduled and sent (TC 846)

The 21-day window is not an estimate —

It is built into IRS programming.

IRS Holiday Shutdown Dates for 2026

No processing occurs on:

- January 1 – New Year’s Day

- January 19 – MLK Day

- February 16 – Presidents Day

- May 25 – Memorial Day

- June 19 – Juneteenth

- July 3–4 – Independence Day

- September 7 – Labor Day

- October 12 – Columbus Day

- November 11 – Veterans Day

- November 26–27 – Thanksgiving

- December 25 – Christmas

If your return’s cycle intersects a federal holiday:

add at least 7 days to the processing timeline.

Real Processing Examples

Example 1 — Normal 21-day refund

Filed: January 27

Cycle movement: 202604 → 202605 → 202606

Refund: February 14

No holidays, smooth processing

Example 2 — Week containing Presidents Day

Filed: February 10

Refund delayed to: February 28

Cause: Feb 16 holiday break

Example 3 — Paper filer

Filed: March 1

Manually entered: March 20

Refund: April 10

Total time: 40+ days

Paper filing adds a pre-cycle delay because the return must be keyed into the system before the 3-cycle timer even begins.

How to Use This Calendar to Predict YOUR Refund

Step 1: Find the date you filed

Example: February 3

Step 2: Identify that cycle

February 3 = Cycle 202605

Step 3: Count 2–3 cycles forward

Cycle 202607 = Refund-issue week

Step 4: Check for holiday interference

Presidents Day inside that cycle = delay

Step 5: Expect TC 846 shortly thereafter

Bank deposit typically 1–3 business days later

You can estimate refund windows with striking accuracy once you know your cycle.

Pro Tips for Faster Refunds

- File early in January

- Avoid holiday weeks

- Always e-file

- Use direct deposit

- Report correct employer wage data

- Avoid math errors

- Respond quickly to any IRS letter

Processing mistakes do not slow the IRS — they restart your cycle from zero.

Why Refunds Sometimes Take Longer

Delays occur when returns require special handling due to:

- income mismatch

- missing forms

- dependent conflicts

- ID verification

- EITC/ACTC waiting period

- transcript coding issues

- amended return activity

- injured spouse allocation

- refund offset review

Each of these adds weeks to the process.

Your refund isn’t sitting in limbo —

It is moving through a precise, programmable processing calendar.

What you now understand:

- The IRS works on weekly processing cycles

- The 21-day rule is actually 3 cycle weeks

- Holidays pause all processing

- Paper returns always take longer

- Transcript cycle codes reveal timing

- Refund timing is not random — it is structured

Once you understand the IRS processing calendar, you can stop guessing and start predicting.

How to Check Your Real Refund Status

“Where’s My Refund?”

- Shows general status

- Updates once per day

IRS Transcript

- Shows cycle code

- Shows TC 150 / TC 570 / TC 846

- Shows actual processing milestones

IRS2Go App

- Same basic functionality as WMR

For real insight — your transcript is king.

Common Questions

Does the IRS process returns on weekends?

No — accounting occurs only on business days.

Do all refunds take 21 days?

Most do, unless additional verification is required.

Why did my cycle code not change this week?

You may be in a hold cycle — look for codes like TC 570.

Can anyone speed up a refund?

No — not even IRS phone support.

The system is automated.