How the IRS really updates your return, and why the timing is not random

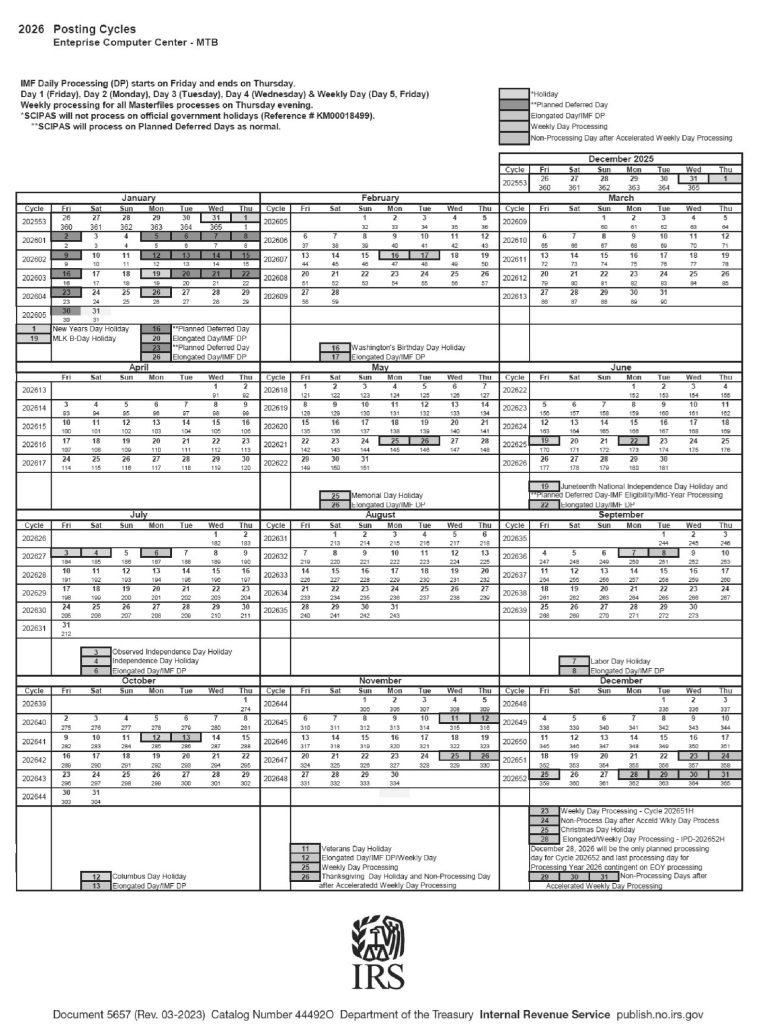

Every tax season, millions of filers anxiously hit refresh on “Where’s My Refund?” without understanding the system behind it. The truth is this: your return moves through the IRS on a precise schedule known as the IRS Master File Processing Calendar.

This calendar — specifically structured by weekly processing cycles — determines when your return updates, when codes post to your transcript, and when refunds get released.

Understanding it can turn refund stress into refund confidence.

What Is the IRS Processing Calendar?

The IRS Master File Schedule is essentially the government’s internal timetable for processing tax returns and updates.

Think of it as:

- a weekly operating schedule

- a systematic return-handling framework

- the engine behind cycle codes

- the reason refunds take a predictable timeline

This is not random.

It’s structured.

It’s automated.

And it follows a weekly rhythm.

The Most Important Rule

The IRS processes returns on a weekly cycle.

Here’s how it works structurally:

- Processing “Day 1” begins every Friday

- Internal processing continues through Thursday

- Major updates post Thursday night into Friday morning

This is why:

- many people see transcript updates on Friday

- many see WMR changes on Saturday

- many refunds hit banks the following week

That famous “21-day refund window”?

It’s actually 3 full weekly processing cycles.

How the Cycle Numbers Work on Your Transcript

Example:

20260805

Breakdown:

- 2026 – Processing year

- 08 – Processing week

- 05 – Weekly cycle day (Friday update batch)

The cycle code tells you exactly:

- when your return is in queue

- how fast it is moving

- when your update should appear

- when your refund should be issued

If you know your code — you know your timeline.

IRS Non-Processing Days: 2026 Holiday Closures

The IRS system pauses on federal holidays. That means no processing and no movement on:

- January 1 – New Year’s Day

- January 19 – MLK Day

- February 16 – Presidents Day

- May 25 – Memorial Day

- June 19 – Juneteenth

- July 3–4 – Independence Day

- September 7 – Labor Day

- October 12 – Columbus Day

- November 11 – Veterans Day

- November 26 – Thanksgiving

- December 25 – Christmas

If your return arrives near one of these dates:

expect at least a one-week delay.

The system can’t bypass holidays — the processing cycle simply skips forward.

What This Means for Your Refund Timing

E-filers with direct deposit

Fastest results:

- Accepted in Cycle 1

- Processed in Cycles 1, 2, and 3

- Refund released by the end of Cycle 3

- Deposit hits your bank 1–3 days later

Paper filers

Slowest path:

- Must be manually keyed into system

- That can take 4–8 weeks

- Only then do you enter the same weekly processing cycle

- And then your 3-cycle countdown begins

Electronic filing is not just faster —

it gets you into the processing pipeline sooner.

How to Use This Calendar for Refund Prediction

Step 1: Check your transcript

Look for your cycle code (e.g. 20260705).

Step 2: Identify your processing week

Example:

Cycle 202607 = the 7th processing week.

Step 3: Add 2–3 cycles

This is the average timeframe before:

- TC 150 (Return Filed)

- TC 806 (Withholding)

- TC 766 (Credits applied)

- TC 846 (Refund Issued)

post to your transcript.

Step 4: Adjust for holiday interruptions

If your cycle crosses a holiday —

add another week.

The IRS does not process refunds randomly or individually — they process them in weekly structured batches.

Knowing this schedule helps you:

- understand why nothing changes mid-week

- avoid obsessive refreshing

- correctly anticipate refund release timing

- see the “why” behind the standard 21-day quote

- interpret cycle codes accurately

Your refund is not lost, forgotten, or ignored.

It is traveling through a precise government processing rhythm.

Patience isn’t just recommended —

it’s built into the system.