When a tax return has already been filed, errors may be discovered later. Incorrect income, missing deductions, or changes to credits can all affect your refund or tax bill. Filing an amended tax return allows you to correct those issues and ensure your tax record is accurate with the IRS.

This guide explains when an amendment is required, how to amend properly, what deadlines apply, and what steps to take after filing.

When Should You Amend a Tax Return?

Not every mistake requires an amendment. The IRS automatically corrects basic math errors and may adjust certain clerical mistakes without your involvement.

You should file an amended return if you need to correct:

- Filing status (for example, single vs. married filing jointly)

- Dependents claimed

- Income reported (missing W-2s, 1099s, etc.)

- Credits such as Earned Income Credit or Child Tax Credit

- Deductions (standard vs. itemized, missed write-offs)

- Withholding or estimated payments

If the original return you filed was incomplete or inaccurate in any important way, amending is recommended.

How to Amend a Tax Return

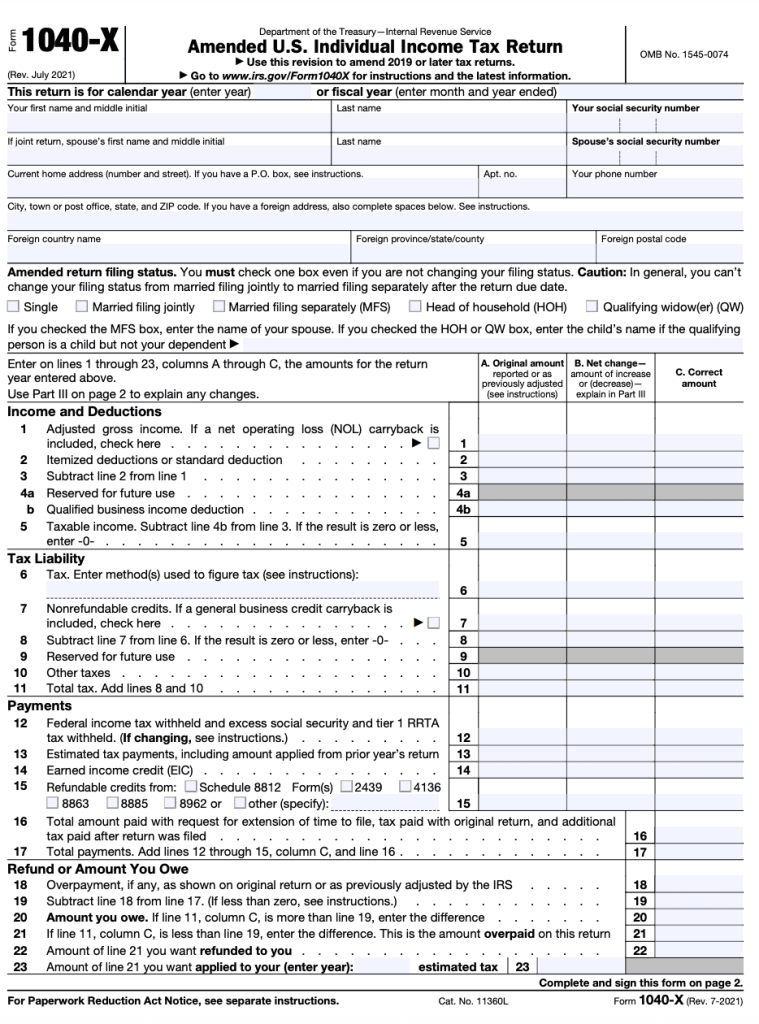

Amended returns are filed using Form 1040-X, Amended U.S. Individual Income Tax Return.

There are now two ways to file:

| Filing Method | Approved? | Notes |

|---|---|---|

| E-file (electronic) | Yes | Allowed for 2019 and later tax years |

| Paper form mailed to IRS | Yes | Slowest method due to manual processing |

When amending, include:

- A clear explanation of what you are changing and why

- Any corrected or additional forms (such as W-2s, 1099s, 2441, Schedule A, Schedule EIC)

Only amend after the original return has been fully processed. Amending too early may cause conflicting corrections.

What Happens if You Owe More Tax?

If corrections result in additional tax due:

- Pay the balance as soon as possible

- Interest and penalties grow over time if payment is late

- You can make an online payment when submitting the amendment

If you amend before the original payment deadline (typically April 15), and you pay on time, penalties are usually avoided.

Can You Get a Refund from an Amended Return?

Yes. Many people amend to claim:

- Additional credits

- Missed deductions

- Corrected withholding

Refunds from amended returns are sent separately and take much longer than standard refunds. Direct deposit is available only if the amendment was e-filed.

Deadline for Filing an Amended Return

To receive a refund from an amendment, you must file within:

- Three years from the date the original return was filed, or

- Two years from the date tax was paid

(Whichever is later)

If the original return was filed early, it is treated as filed on the due date (usually April 15).

There is no deadline for filing an amendment that results in a balance due, but penalties will increase the longer you wait.

What to Do After You File an Amended Return

Once Form 1040-X is filed, processing takes time.

- Electronic amendments generally take 8 to 16 weeks

- Paper amendments may take 16 to 30+ weeks

To track progress:

Where’s My Amended Return? (WMAR)

irs.gov/amendedreturn

It may take up to 3 weeks after filing to appear in the system. WMAR shows three phases of processing:

| Status | Meaning |

|---|---|

| Received | IRS has acknowledged the amendment |

| Adjusted | Changes have been finalized |

| Completed | Processing finished; refund or bill issued |

Do not contact the IRS before your amendment appears in WMAR unless instructed by a notice.

Summary

Filing an amended tax return ensures your tax information is accurate and prevents IRS issues in the future. Whether correcting income, credits, or dependents, Form 1040-X allows you to fix mistakes and claim money you are entitled to. Follow deadlines, choose e-file when possible, and allow time for the IRS to process the amended return.