Tracking an amended tax refund is different from tracking a regular refund. There are fewer real-time updates and more manual processing involved, so understanding the correct tools is important.

There are only two official methods the IRS uses to show progress on amended returns.

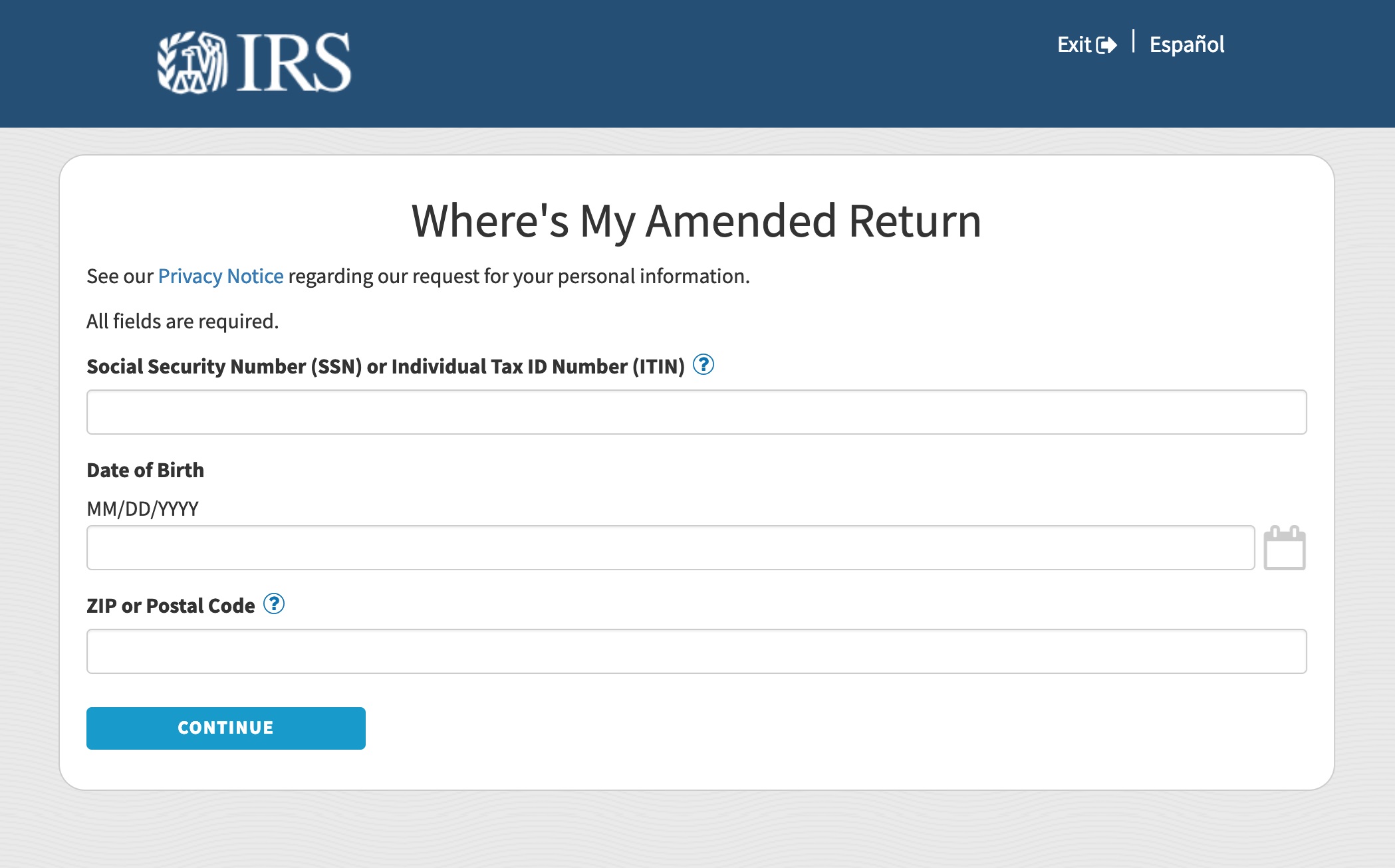

1. Where’s My Amended Return? (WMAR) Tool

Available at: irs.gov/amendedreturn

This online tool tracks:

- If the IRS has received your Form 1040-X

- If the amendment is still processing

- If processing is completed

It updates once per week.

No detailed payment information is displayed.

Status stages:

| Status | Meaning |

|---|---|

| Received | IRS has the return in the system |

| Adjusted | Changes completed; notice coming |

| Completed | Processing finished; payment steps follow |

The tool does not show:

- Refund amounts

- Deposit dates

- Holds or notices issued

- Offset information

2. IRS Account Transcript

Available after identity verification at: irs.gov/account

This provides the most accurate picture of refund movement.

It shows:

- Transaction codes

- Adjusted credits and balances

- Refund issuance

- Notices issued

- Internal processing dates

Useful transcript fields to monitor:

| Field | Why It Matters |

|---|---|

| As of Date | Shows if your account has reached a new checkpoint |

| Processing Date | Indicates when updates are expected |

| Cycle Code | Suggests weekly system posting timeline |

| Code 846 | Refund has been officially issued |

If a long delay occurs, the transcript often reveals the reason before the IRS website does.

When Will Tools Begin Showing Activity?

- WMAR typically updates within 3 weeks of receipt

- Transcripts may show no new codes for several months while waiting for assignment

- Most movement appears during the 10 to 20 week timeframe

Transcripts usually provide the first sign that a refund is nearing release.

When Tracking Tools Are Not Helpful

Delays may occur if:

- The amended return has not yet been digitized

- The IRS is waiting on employer income verification

- The case was routed to a special review unit

In these cases, contacting the IRS before 20 weeks often results in the same advice to continue waiting.

Summary

| Tool | Best For | Update Frequency |

|---|---|---|

| Where’s My Amended Return | Basic status stages | Weekly |

| Account Transcript | Detailed progress and payment information | Can update any time |

Using both tools together provides the clearest understanding of where your amended refund stands and when payment is likely to be issued.