It’s the date stamp for when your tax return activity was recorded on the IRS’s main computer (the Master File). Basically, it tells you what batch your return is in and when it’s scheduled for a weekly update.

Anatomy of the 8-Digit Code

Let’s break down the code format: YYYYWWDD (e.g., 20250805)

| Digits | Example | Meaning |

| YYYY | 2025 | Tax Year the transaction was processed. |

| WW | 08 | IRS Week of the year (01 to 52) the transaction posted. |

| DD | 05 | Day of the Week the transaction posted (Your Batch Day). |

The Crucial Last Two Digits (DD)

The last two digits tell you if you’re in a daily or weekly processing batch. This determines when your transcript updates and, often, when your refund status changes!

| Last Digits (DD) | Batch Type | Update Day (Generally) |

| 01, 02, 03, 04 | Daily Batch | Your transcript updates daily. |

| 05 | Weekly Batch | Your transcript updates once per week, usually on Friday or Saturday. |

Tip: Most individual taxpayers are in the Weekly Batch (ending in 05) during the main filing season. Once your return is in the weekly batch, you typically won’t see changes until your specific batch day each week.

Connecting it to Your Refund

The Cycle Code itself doesn’t mean your refund is issued. You need to look for another transaction code:

- TC 846 means Refund Issued. The date next to this code is your actual direct deposit or check mailing date!

- If you see a TC 570, it means a Hold is on your account. Don’t panic! It often just means a delay for review (like verifying a credit or income), but it pauses the processing cycle until the hold is resolved.

Bottom line: The Cycle Code tracks the IRS’s internal timeline. The TC 846 tracks your refund!

The Ultimate Guide to the IRS Cycle Code

This guide provides a clear, step-by-step breakdown of the IRS Cycle Code found on your tax account transcript.

1. What is the IRS Cycle Code?

The IRS Cycle Code is an 8-digit number that appears on your Tax Account Transcript under the “Cycle” column next to various transactions.

It is essentially a date stamp used by the IRS to track when a specific action or transaction related to your tax return was processed and officially posted to the IRS Master File (the agency’s main database). This code helps you understand the timing and batch your return is moving through.

2. Finding the Cycle Code on Your Transcript

To find your Cycle Code, you must request your Tax Account Transcript (not the Tax Return Transcript) from the IRS “Get Transcript” service.

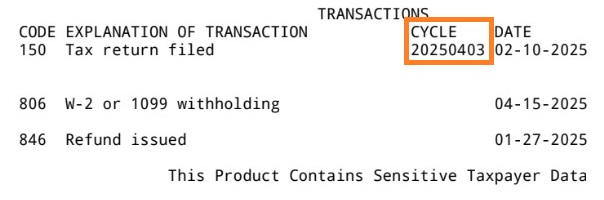

In the “Explanation of Transactions” section, you will see columns for:

- Transaction Code (TC): A 3-digit code identifying the action (e.g., 150 for ‘Return Filed’).

- Posting Date: The effective date of the transaction.

- Cycle: The 8-digit Cycle Code (e.g., 20250805).

- Amount: The dollar amount associated with the transaction.

3. Deciphering the 8-Digit Code Format

The Cycle Code follows a strict 8-digit format: YYYYWWDD.

| Position | Format | Meaning |

| 1-4 | YYYY | Year: The calendar year the transaction was posted (e.g., 2025). |

| 5-6 | WW | Week: The specific week of the filing season/calendar year (from 01 to 52) when the transaction posted. |

| 7-8 | DD | Day: The day of the week your account’s processing batch was updated. This is the most crucial part for predicting when your transcript will update. |

Example: A Cycle Code of 20250805 means:

- 2025: Processed in the year 2025.

- 08: Processed in the 8th week of the year.

- 05: Processed in the weekly batch update cycle.

4. Understanding the Processing Cycle (DD)

The last two digits (DD) determine if your tax account is on a daily or weekly processing schedule. This is the most relevant information for taxpayers who are anxiously awaiting updates.

A. Weekly Batch (Ends in 05)

Most individual taxpayers fall into the weekly batch, especially during the peak tax filing season.

- Code Ends in: 05

- Update Schedule: Your tax transcript is typically updated once a week, generally overnight on Friday or Saturday. If you check your transcript on a Tuesday, you may not see any changes until the next weekend.

B. Daily Batch (Ends in 01, 02, 03, or 04)

Accounts on a daily cycle are usually those with special or non-standard processing, though some standard returns may be routed this way.

- Code Ends in: 01, 02, 03, or 04

- Update Schedule: Your tax transcript may update daily, typically overnight from Monday through Thursday.

5. Cycle Code vs. Refund Status

It is important to remember that the Cycle Code only indicates processing activity. It does not automatically mean your refund is coming.

To confirm that your refund has been processed and a deposit date set, you must look for the Transaction Code (TC) 846.

- TC 846 (Refund Issued): When you see this code on your transcript, the date directly next to it is your actual scheduled direct deposit date.

- Cycle Code with TC 150: Seeing the Cycle Code next to TC 150 (Tax Return Filed) means the IRS has successfully entered your return into the Master File and the processing pipeline has officially started.