IRS Where’s My Refund? Refund Status Messages

What does your tax refund status look like today?

Have you submitted your Income Tax Return to the IRS to be E-Filed? Now the waiting game begins to see if we get approved for a refund or not. We’re gonna show you a little bit of information about how the “Where’s My Refund” Refund Status bars work.

Once you File your Income Tax Return whether it be E-Filed or paper filed and mailed. Within 24 hours of the IRS receiving your return, they will update your Refund Status. As long as your tax return passes the initial test(Yourself and your Dependent’s Name, Address, Social Security Number, Tax Filing Status, etc.) and matches exactly what is on file with the IRS they will accept your return.

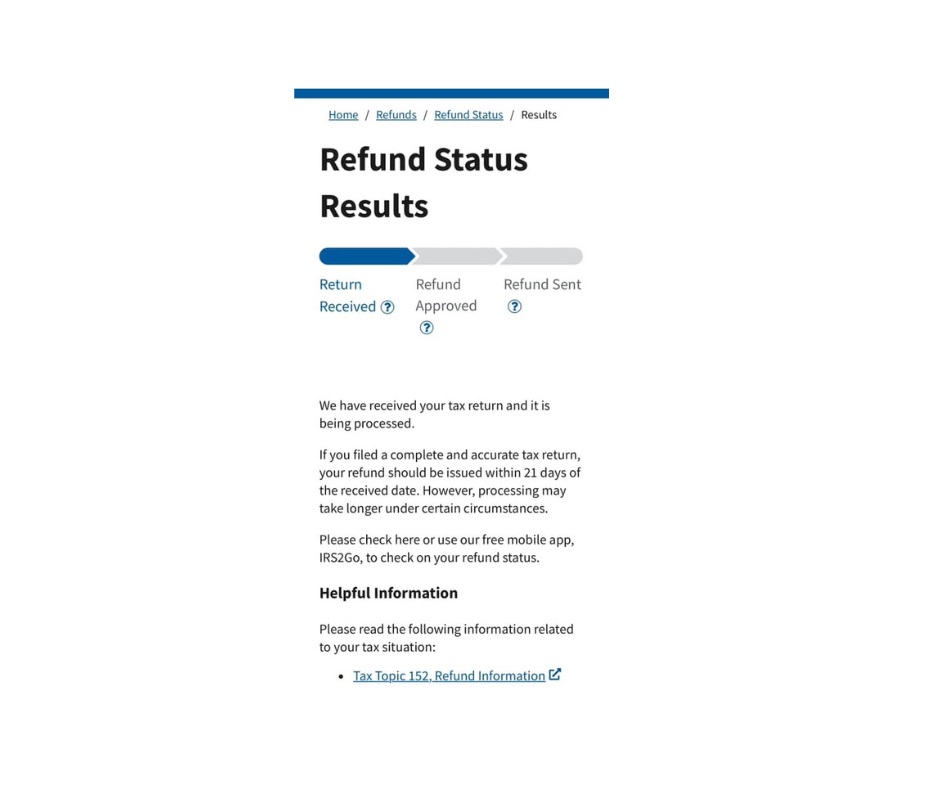

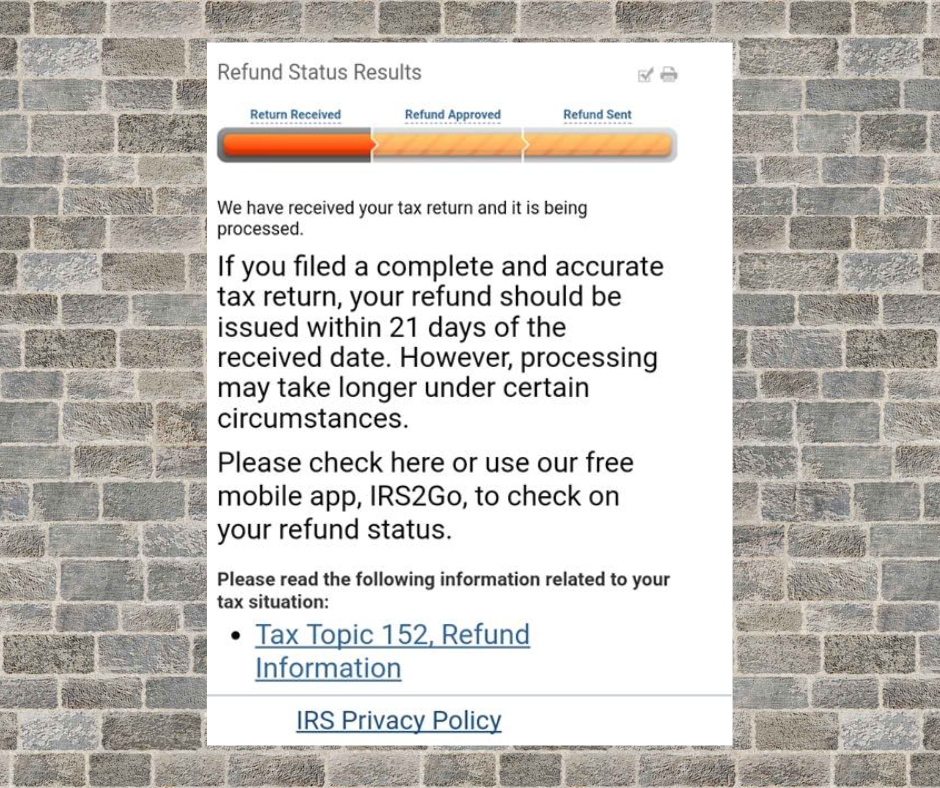

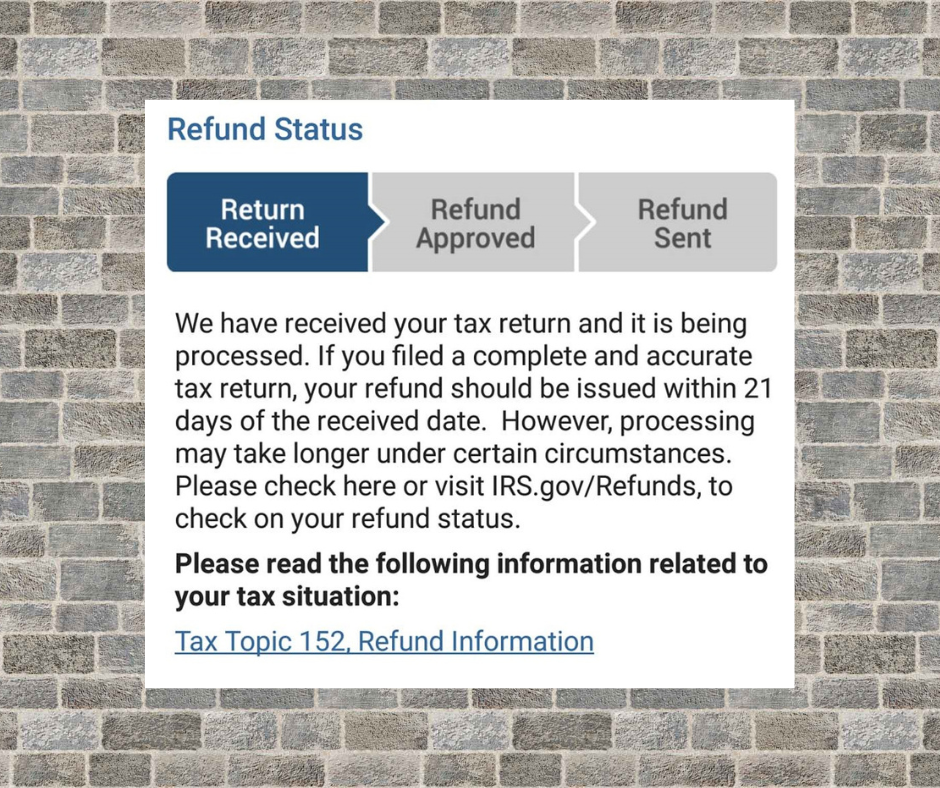

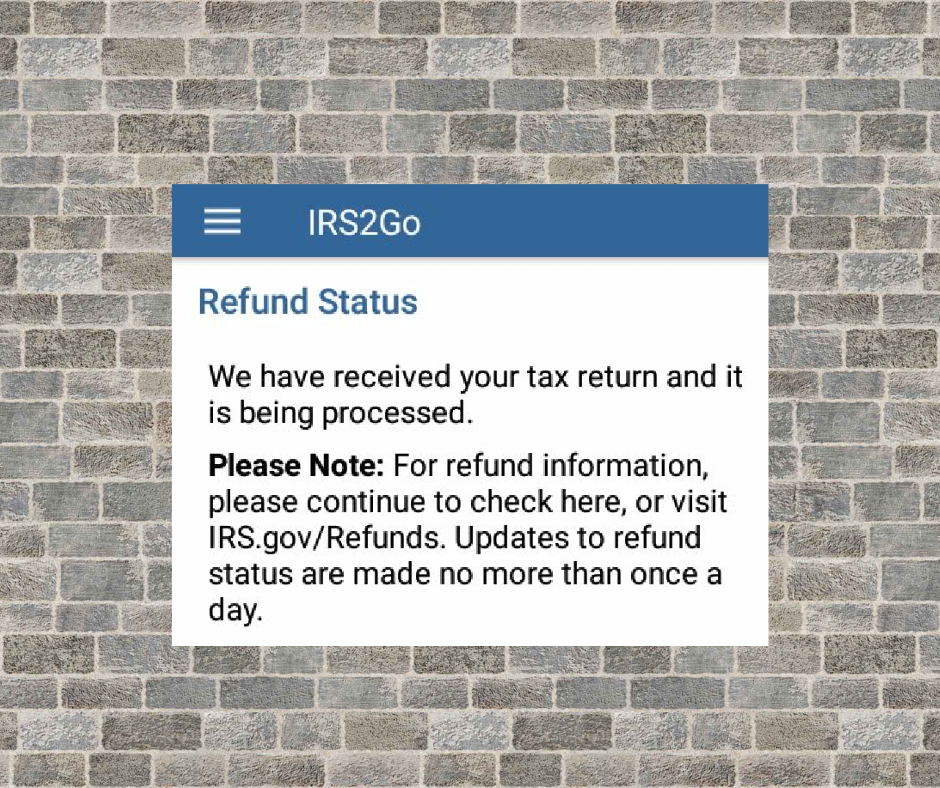

We have received your tax return and it is being processed

Once the IRS has accepted your income tax return, this refund status message is what you’ll typically see when you check the “Where’s My Refund” tool.

New Refund Status Results on Where’s My Refund? in 2024

“We have received your tax return and it is being processed”refund status message is a good sign and indicates the tax return is being processed and your tax return is still on track to a refund date.

If you check the “Where’s My Refund” Tool after you have filed your return and you are seeing this refund status message

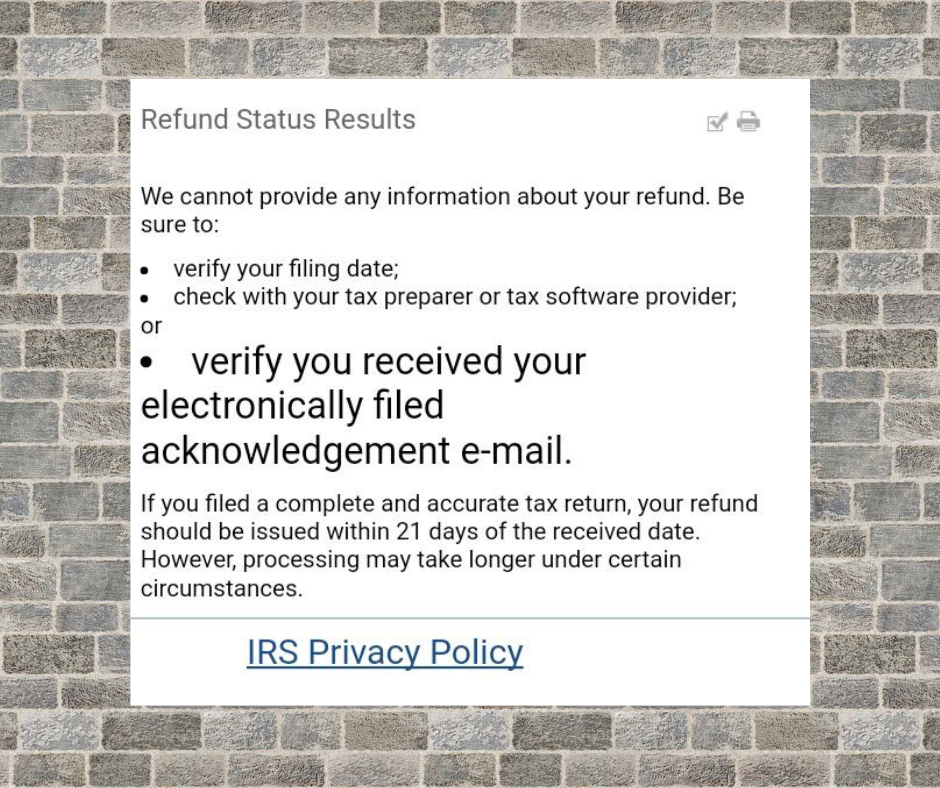

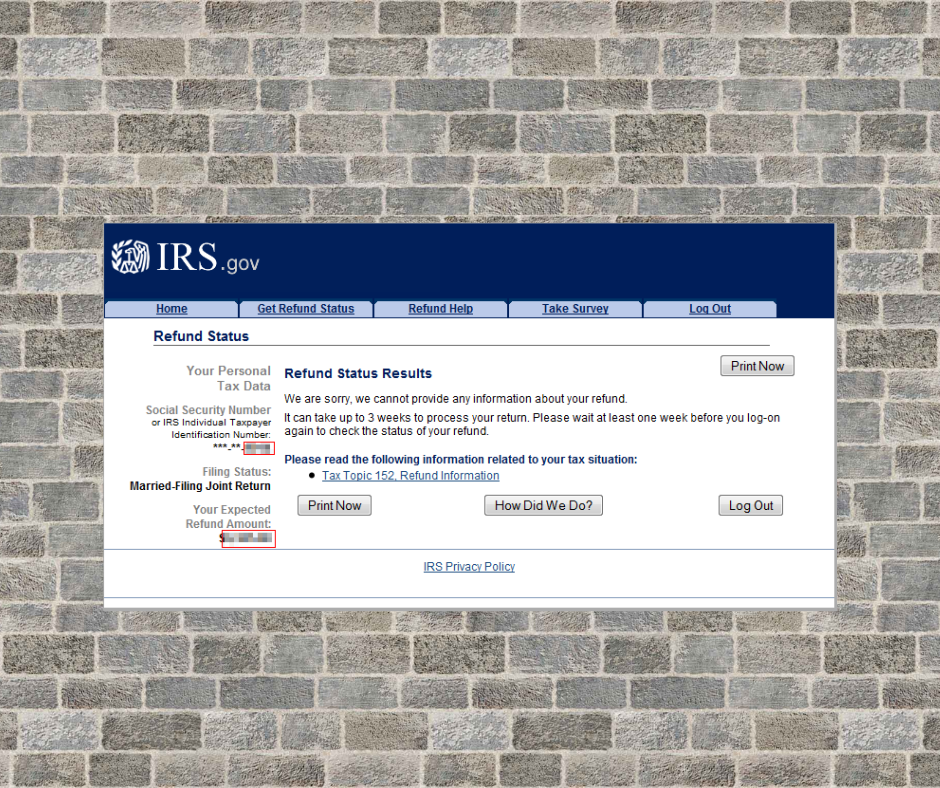

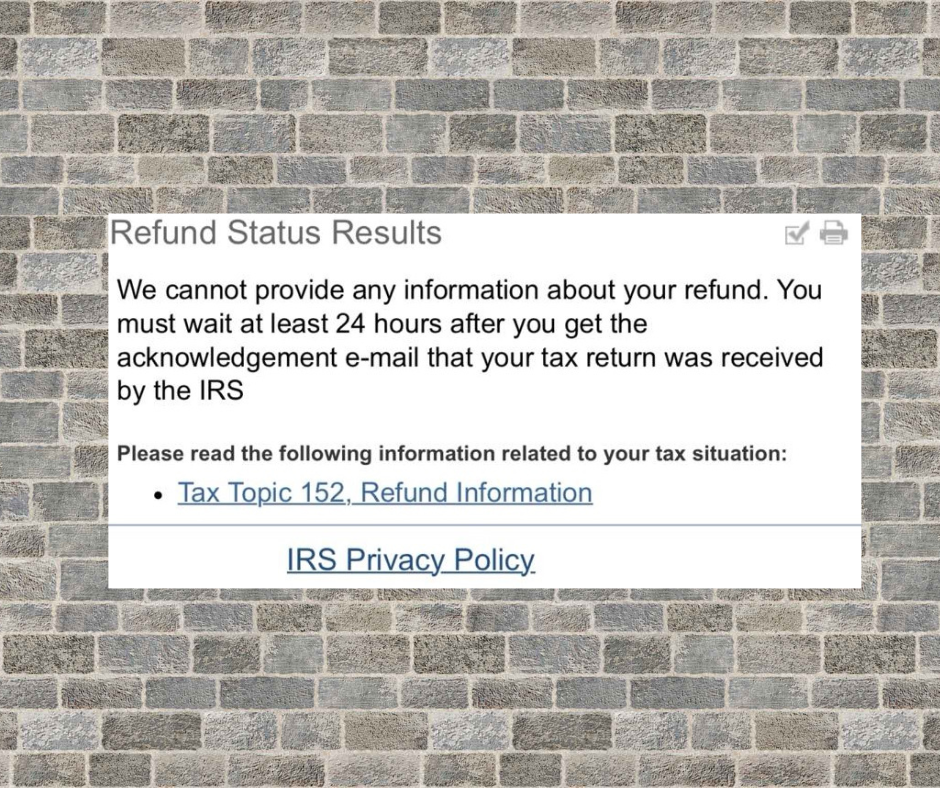

We cannot provide any information about your refund

Click Here for more information about ” We cannot provide any information about your tax refund.”

You may not have entered your refund status information correctly on WMR. Please make sure when you check your refund status you enter the information EXACTLY AS IT APPEARS ON YOUR TAX RETURN.

- Be sure you have waited at least 24 hours after acceptance before using the IRS WMR tool.

- Be sure you enter the correct SSN and Filing Status.

- Be sure you are using only the Federal Refund Amount. Do not include any state refund or any total refund that would include state and federal combined.

- Also, be sure you are using the Federal Refund Amount before any Tax Preparation fees are taken out (if you chose that option.)

- Look at your actual Federal return to get the Federal Refund Amount, i.e., your Form 1040, Line 35a.

- You can also try phoning the IRS refund hotline at 1-800-829-1954

I know I entered all my information correctly but the system still does not recognize my tax return.

Most of the time when you see we cannot provide any information about your return message you will be required to verify yourself with the IRS. The IRS will issue a 5071C Notice in the mail with a code and a phone number wanting you to verify the information you submitted on your tax return.

If you know you have entered all the information from your tax return correctly and you still see the “We cannot provide any information about your tax refund” status.

- Check your WMR status each week to see if the system corrects the issue with no further information.

- If you are stuck on this refund status with no change, you could be waiting for a letter requiring you to verify your identity and your tax return information with the IRS.

There may be something wrong with your tax return. Once your tax return reached the IRS the tax return may not have met the initial tests (See Below) or another problem was discovered. If you are seeing this message wait a few days and check back. If you do not receive any letters or see any updates or changes to your refund status within 21 days you may want to try to call the IRS for assistance.

What is the Initial Tax Return Acknowledgement Test?

- Incorrect name. Believe it or not, one of the most common errors when it comes to tax returns rejected has to do with naming. Specifically, people make errors entering and spelling their names, or their spouses’ names if the couple is filing jointly.

- Incorrect address. The house number, street spelling, road abbreviation, and zip code are all potential spots for error.

- Incorrect date of birth. Incorrectly entering the date of birth information will cause your tax return to be rejected.

- Incorrect direct deposit information. Direct deposit generally means you’ll get a tax refund sooner, but it could also get your tax returns rejected. Be sure to enter your bank’s routing number and account number correctly.

- Incorrect employer/employee information entry. This might include incorrectly entering an EIN from 1099, or it might include incorrectly entering an employee’s social security number or other information.

- The previous year’s AGI doesn’t match. You’re required to enter your previous year’s AGI when e-filing, and if it doesn’t match it will reject your return.

- The PIN doesn’t match. The pin number associated with your account EIN was entered incorrectly. Tax returns rejected for this reason are quite common.

- Dependent claims. This is, of course, one of the most common with individual tax returns, The taxpayer’s social security number has already been claimed on a return. This may be an entry error, or it may indicate fraudulent use of your social security number by someone else.

- Problems with a particular form. If you’re claiming the Earned Income Tax Credit, for example, there may be a problem with the particular forms related to that credit.

- Identity Verification. The IRS could issue a notice in the mail with a code and a phone number wanting you to verify the information you submitted on your tax return.

Click Here for more information about ” We cannot provide any information about your tax refund.”

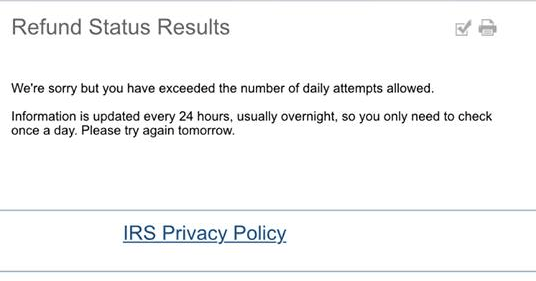

We’re sorry but you have exceeded the number of daily attempts allowed.

Exceeded the number of daily attempts

There is a limit on viewing WMR of only 3 attempts in a 24-hour time frame or you will be locked out and see this message.

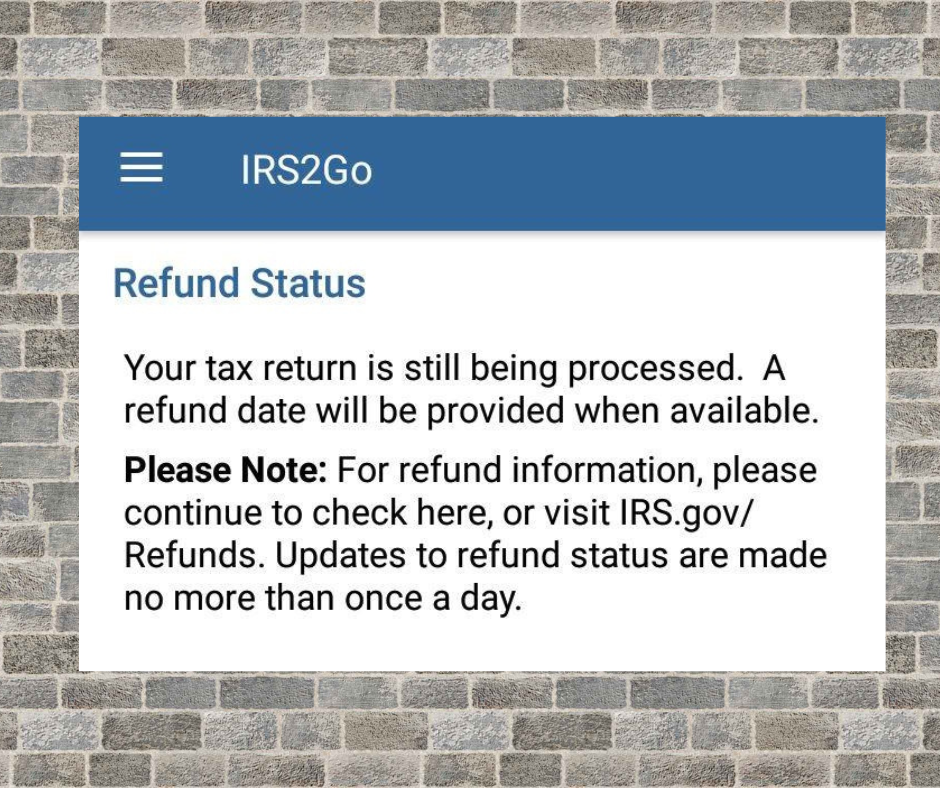

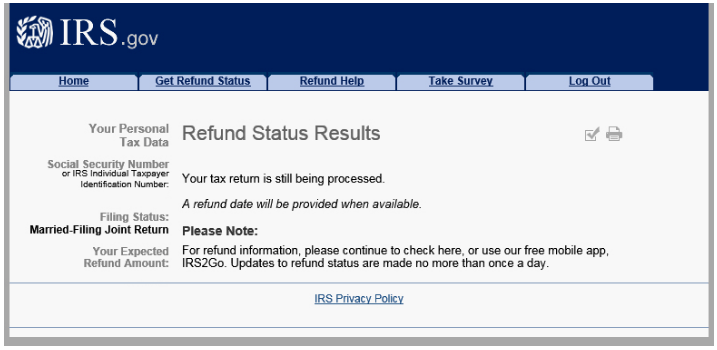

Your tax return is still being processed

There are multiple reasons you may see the Your tax return is still being processed refund status message. The IRS is saying they can not guarantee your refund within the 21-day time frame.

Some common reasons you might be seeing the still-being-processed tax refund status:

The IRS is holding your refund while it is verifying the accuracy of your return, including one or more of the following

- Identity Verification

- Income and Wage Verification

- Dependent Verification

- Review of the Tax Return

- Questionable Refundable Tax Credits

- And more!

The Where’s My Refund? The status message “your tax return is still being processed” is used by the IRS to inform taxpayers that the IRS is Still Processing their tax return, but the IRS systems may have potentially detected an issue that could delay the tax refund longer than the original 21-day processing timeframe.

But don’t panic when this happens. The IRS still has your return but things are essentially on hold until the IRS gets the additional information from you to continue processing your return. You will either get directions on WMR or IRS2Go or the IRS will contact you by mail. Follow the provided instructions and return any additional information ASAP to get your potential refund and reduce any further delays. Talk to your accountant, tax advocate, or tax professional if you are not clear on what the IRS is asking for or if you don’t get an update after 21 days.

Once your Income Tax Return has been accepted the next step is to get approval from the IRS.

There is no given time of how long it will take to get a refund from the Internal Revenue Service. The IRS states on its website that it tries to issue 9 out of 10 Income Tax Refunds within 21 Days. Every single person has a different situation. Your friend may get theirs a week before you. Your Cycle Code will determine what order your return is processed. This does not guarantee you a refund for any certain day.

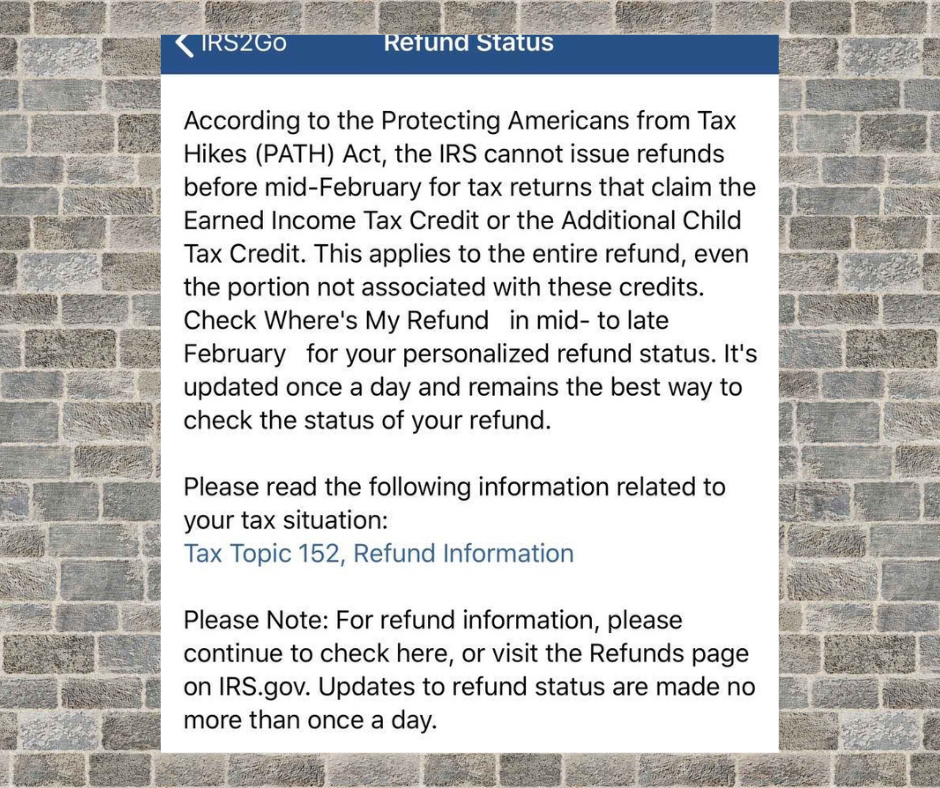

IRS PATH ACT Refund Status Message

Taxpayers Claiming Earned Income Tax Credits, Additional Child Tax Credits will see the Path Message until after Feb. 15.

Taxpayers who claim the Earned Income Tax Credit or the Additional Child Tax Credit may experience a refund hold. According to the Protecting Americans from Tax Hikes (PATH) Act, the IRS cannot issue these refunds before mid-February. The IRS expects the earliest EITC/ACTC-related refunds to be available in taxpayer bank accounts or debit cards starting the first week of March if these taxpayers chose direct deposit and there are no other issues with their tax return.

Does the Path Message mean I am Approved for a Tax Refund?

NO, Once February 15th arrives you will return back to your bars and wait for further updates or more information.

Note: The PATH Hold will come to an end on Feb. 15th at 11:59 pm and everyone held by the path message should update to this message.

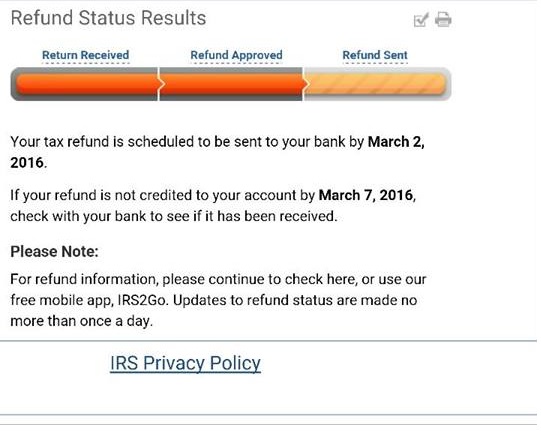

If your Income Tax Return was approved for a Refund this is what you will see

And the Final Step to Claiming your Income Tax Refund is Refund Sent

If you get this message you should feel good. Based on experience not very many tax filers ever get to see this message. The “Where’s My Refund” Tool never seems to make it past 2 bars before taxpayers are checking their bank for their Income Tax Refund.

Let’s say that something did not look correct on your Tax Return and you lose your “Where’s My Refund” Refund Status Bars.

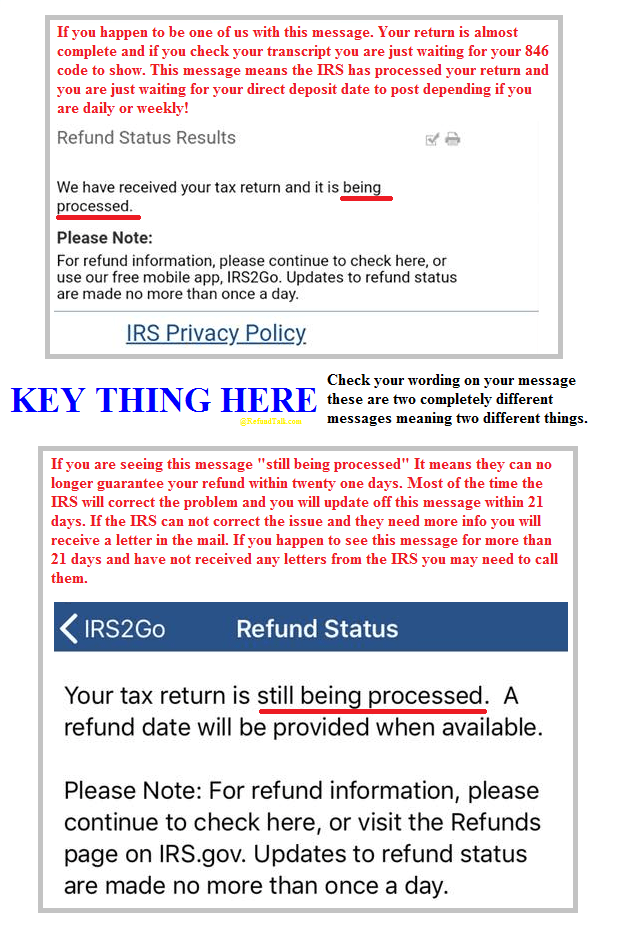

The “being processed” message we receive after the PATH HOLD and the “Still being processed” are two completely different statuses.

Click Here for more information about “Being Processed” and “Still Being Processed” message.

If the tax return has some simple errors that can possibly be corrected with the IRS Error Resolution Department you may see the message above. If the error is something more advanced that needs more attention you may see the messages below while you wait for a letter or somebody to correct your tax return.

If you see this message there is a good chance your Tax Return may be under review. This does not mean you are not getting a refund. This is simply telling you that your Refund got pulled out for a Quality Check. For some reason, the system pulled your Tax Return to be looked at for further review.

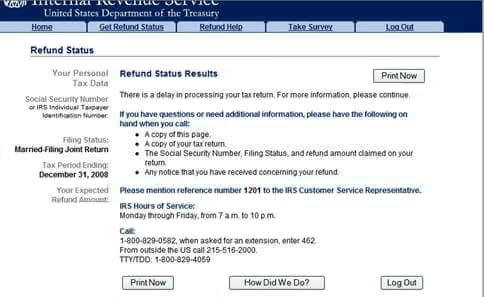

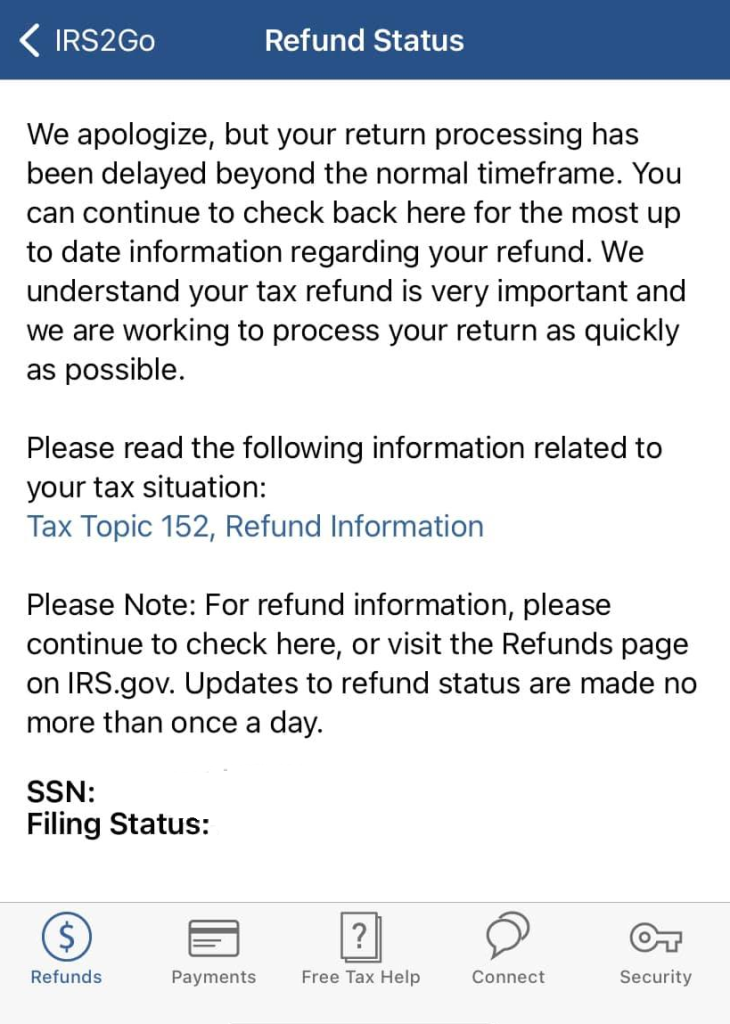

We apologize, but your tax return processing has been delayed beyond the normal timeframe

If you are seeing this refund status “We apologize, but your tax return processing has been delayed beyond the normal timeframe” it means the IRS can no longer guarantee your refund within the 21-day time frame.

Why It Is Under Review

When the IRS officially places your return under review, you will receive a CP05 notice, and the processing of your refund will be delayed until the review is complete. According to the IRS website, a number of distinct factors can trigger the review, including the need to verify the following entries on your return:

- Income is not overstated or understated.

- Tax withholding amounts are correct.

- You have the right to claim the tax credits on your return.

- Social Security benefits withholding amounts are correct.

- Household help is accurately reported.

- Schedule C income is not overstated or understated.

To confirm the accuracy of the contents, the IRS may contact third parties.

Why is my Tax Return Under Review?

There is no hard and fast way to determine why your return was selected for a review. According to IRS.gov, “returns [are selected] for examination using various methods which include random sampling, computerized screening, and comparison of information received by the IRS such as Forms W-2 and 1099.” If your return is selected for a review, it doesn’t necessarily indicate or suggest you made a mistake or deliberately misreported your information.

Upon receiving the CP05 notice, the IRS recommends you take the following steps if you have additional questions or concerns:

- Consult with your tax preparer to gain a better understanding of the notice.

- Call the toll-free number listed at the top of the notice to receive additional information.

- Call the Taxpayer Advocate Service (TAS) hotline at 1-877-777-4778 if you believe your return has been selected in error due to the inadequate screening of IRS systems.

- Authorize a professional tax preparer or accountant to communicate with the IRS on your behalf by submitting Form 2848 (Power of Attorney and Declaration of Representative).

How to Avoid Reviews

To possibly decrease your chances of being reviewed, be sure to report all information in the most truthful manner possible.

When the Review Is Complete

Once the review is complete, the IRS will make the necessary adjustments and issue your refund accordingly.

Time Frame

The IRS encourages taxpayers to wait at least 45 days from the day they receive the CP05 notice to follow up about the status if they haven’t yet received your refund. Use the number found on the notice to ensure you are routed to the correct department.

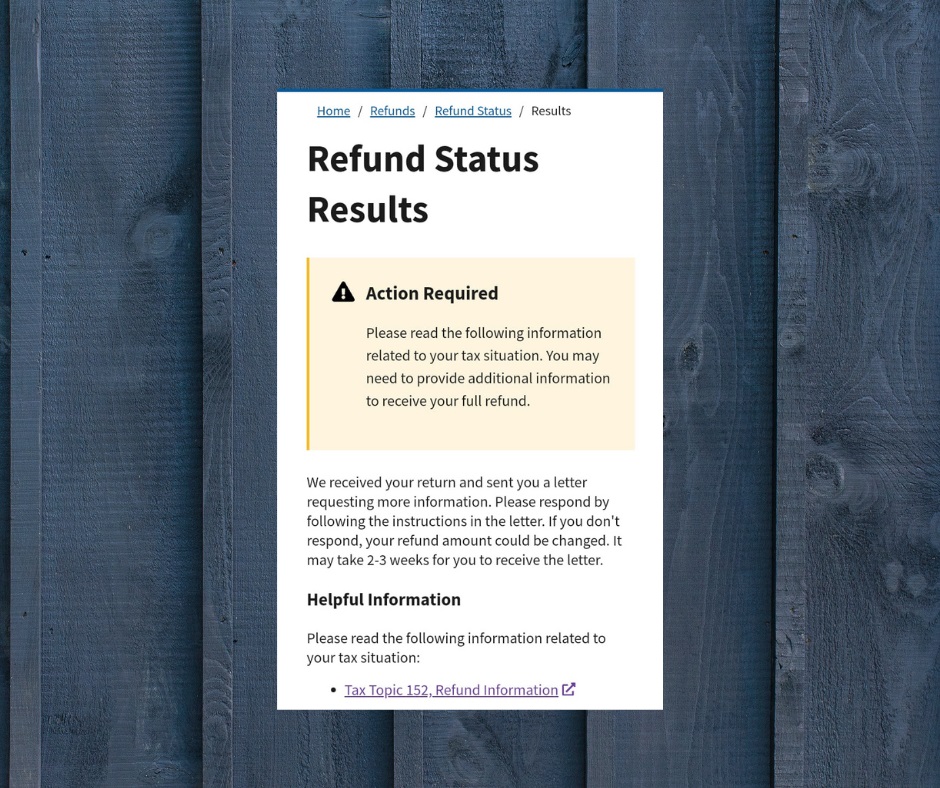

We received your return and sent you a letter requesting more information.

This IRS refund status message indicates that they have received your tax return but have identified the need for additional information. The IRS has sent you a letter outlining the specific details and instructions on how to provide the required information. It is crucial to respond promptly and follow the guidelines provided in the letter. Failure to respond may result in adjustments to your refund amount. The letter’s delivery may take 2-3 weeks, so it’s advisable to be vigilant for correspondence from the IRS and to act promptly upon receiving it.

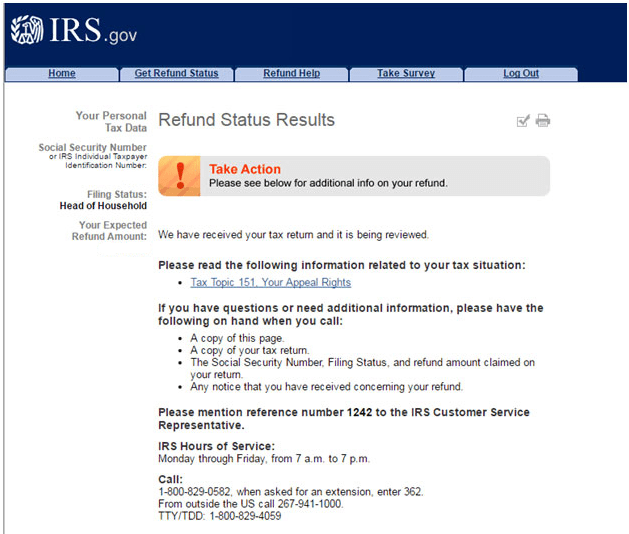

What does it mean when my refund status says to take action?

Most of the time when people see this “Take Action” refund status the first question they have is: “Am I being audited?”. Typically, the answer to this question is YES! And the IRS wants more information. When you encounter a “Take Action” refund status you need the help of a tax professional to guide you through the process.

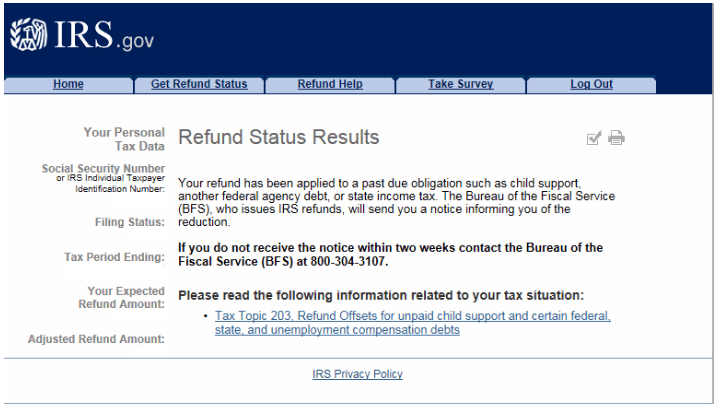

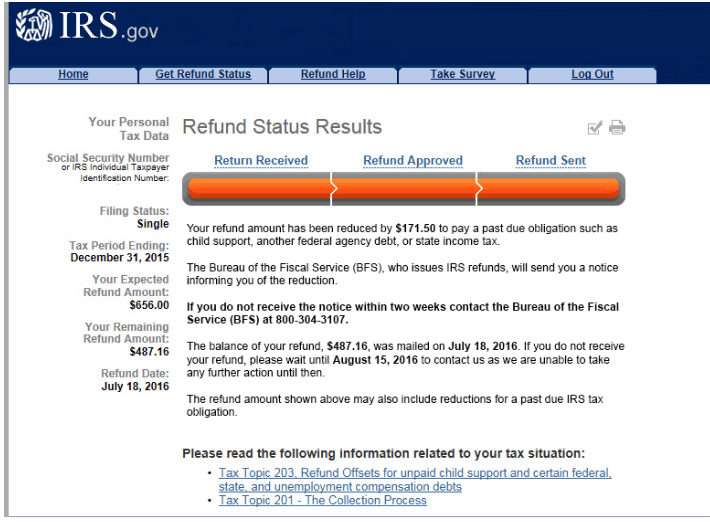

What does it mean when my refund status says applied to past due obligation?

If you check “Where’s My Refund?” and your tax refund status says “refund applied to pay past-due obligation such as child support, another federal agency debt, or state income tax”. Most commonly this is a result of the taxpayer or spouse having past-due child support obligations or student loan debt in default. You should receive a notice outlining the details.

Just because you owe a debt or have past due debts does not mean that you’re not entitled to a refund:

• In situations where a couple is married and one spouse owes a debt and the other spouse does not, this is referred to as an “Injured Spouse”.

• In a situation where a student loan is delinquent, this is referred to as being in “default”.

What does it mean when my refund status says it is reduced to pay a past-due obligation?

When you check “Where’s My Refund?” and your tax refund status says “Refund Reduced to Pay a Past Due Obligation. They are informing you all or a portion of your tax refund was used to pay a past-due debt.