The As of Date on your IRS Account Transcript is one of the strongest indicators of where your return really stands in the processing pipeline — but most taxpayers have no idea what it means.

This date helps the IRS:

- Schedule processing actions

- Trigger review updates

- Move returns through master file cycles

- Determine when refunds can be approved

When the As of Date changes, processing is actively progressing.

This guide breaks down exactly how to read it.

What is the As of Date?

Definition:

The date the IRS expects to take the next action on your account.

It is not:

- Your refund deposit date

- A cycle code

- A guarantee of movement that day

It is a status clock for processing and review.

If the IRS moves your As of Date forward, they are working on your return.

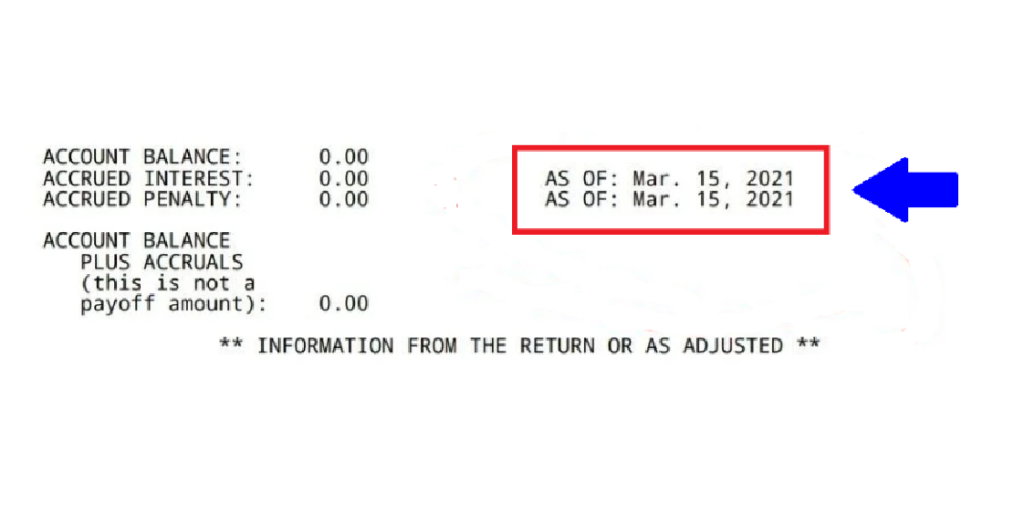

Where to Find the As of Date

IRS Account Transcript → Top section above transaction codes

Example:

As of Date: 03/10/2025

That means IRS planned movement on or before that date.

Why the As of Date Changes

There are three main reasons:

- Review completed → Return advancing

- IRS waiting for data → New target action date

- Cycle/week processing rescheduled

Even if no codes change, a new As of Date = GOOD NEWS.

As of Date vs Processing Date

| What It Means | As of Date | Processing Date |

|---|---|---|

| Internal Action Deadline | Yes | No |

| System Scheduling | Yes | Yes |

| Indicates Posting Cycle | No | Yes |

| Predicts Refund Release | Often | Sometimes |

Together they help forecast when 846 might drop.

Biggest Clue: The As of Date Leap

Small jumps (7–14 days)

→ Normal progression

→ Likely review finishing soon

Big jumps (30–60+ days)

→ IRS waiting on external data

→ Wage/Income mismatch or ID checks

Backwards jumps

→ Return moved to a new internal queue

→ Still a sign of activity

Any change is a signal of system attention, not abandonment.

Common As of Date Patterns

| Pattern | Meaning | Good or Bad? |

|---|---|---|

| Moves weekly | Standard weekly processing | Normal |

| Moves after a 570 code | Review in progress | Progress |

| Stops moving for 6+ weeks | Stalled file | Call IRS |

| Moves after notice 971 | Resolution underway | Good |

| Moves just before 846 | Refund approved | Best case |

Timeline Expectation Guide

When As of Date moves forward by:

| Days | What Typically Happens Next |

|---|---|

| 7–14 days | WMR updates + 846 incoming |

| 21–30 days | Extended review but moving |

| 45–60+ days | Identity or income validation delays |

What As of Date Tells You That WMR Won’t

| Scenario | WMR | Transcript As of Date |

|---|---|---|

| Refund freeze lifted | Still processing | Moves forward |

| Refund scheduled | Bars still missing | Moves near deposit |

| Internal review locked | Bars gone | Date frozen |

| Extended delay | Same status | Jumps way ahead |

As of Date is true behind-the-scenes timing.

When to Call IRS About As of Date

Only call if:

- No change 60 days

- Freeze codes remain (810, 570)

- Refund was reduced without explanation

- IRS requested documents & no confirmation

Otherwise: Continue monitoring — progress is happening.

Quick Summary Table

| What You See | Meaning |

|---|---|

| As of Date changed | IRS actively processing |

| Stayed the same 6–8 weeks | Major delay |

| As of Date lands on a Friday | Weekly batch movement |

| Moves into new month | Refund nearing approval |